New York’s residential market was something of a puzzle in 2017 — with exuberant buyers dropping eight-figure sums at 432 Park Avenue one minute, and price-conscious shoppers sitting on the sidelines the next.

But inevitably, brokers who found ways to fit buyers and sellers together got deals done and rose to the top of the heap on The Real Deal’s annual ranking of residential agents.

But this year’s top agents didn’t just eke out sales in a challenging environment. They did so against the backdrop of unprecedented pressure on brokerages to turn a profit and prove their value in a changing marketplace that includes digital competitors from StreetEasy and Zillow to Realtor.com and Redfin.

Related: These Manhattan agents have the highest dollar volume in listings

Those challenges came into full focus in April when Town Residential folded its resale and leasing divisions, saying it could no longer afford to compete for top agents. It’s also been on display at Keller Williams NYC, which is going through a major leadership shakeup, with layoffs and agent defections.

Across the board, top agents — key drivers of revenue for firms — have never wielded more leverage as brokerages struggle to stay in the black.

Like last year, we ranked agents by closed sales, but this year we made a significant change in calculating co-brokered deals to reflect the reality of split commissions. Rather than giving agents full credit if they shared a deal with another broker at their own firm, we divvied up their dollar volume. (For example, if two Douglas Elliman agents closed a $30 million deal together, we awarded each $15 million. Three Elliman agents who shared a deal each got $10 million worth of credit.)

As in years past, TRD’s ranking includes both new development and resale deals. It’s based only on sell-side transactions that closed in 2017.

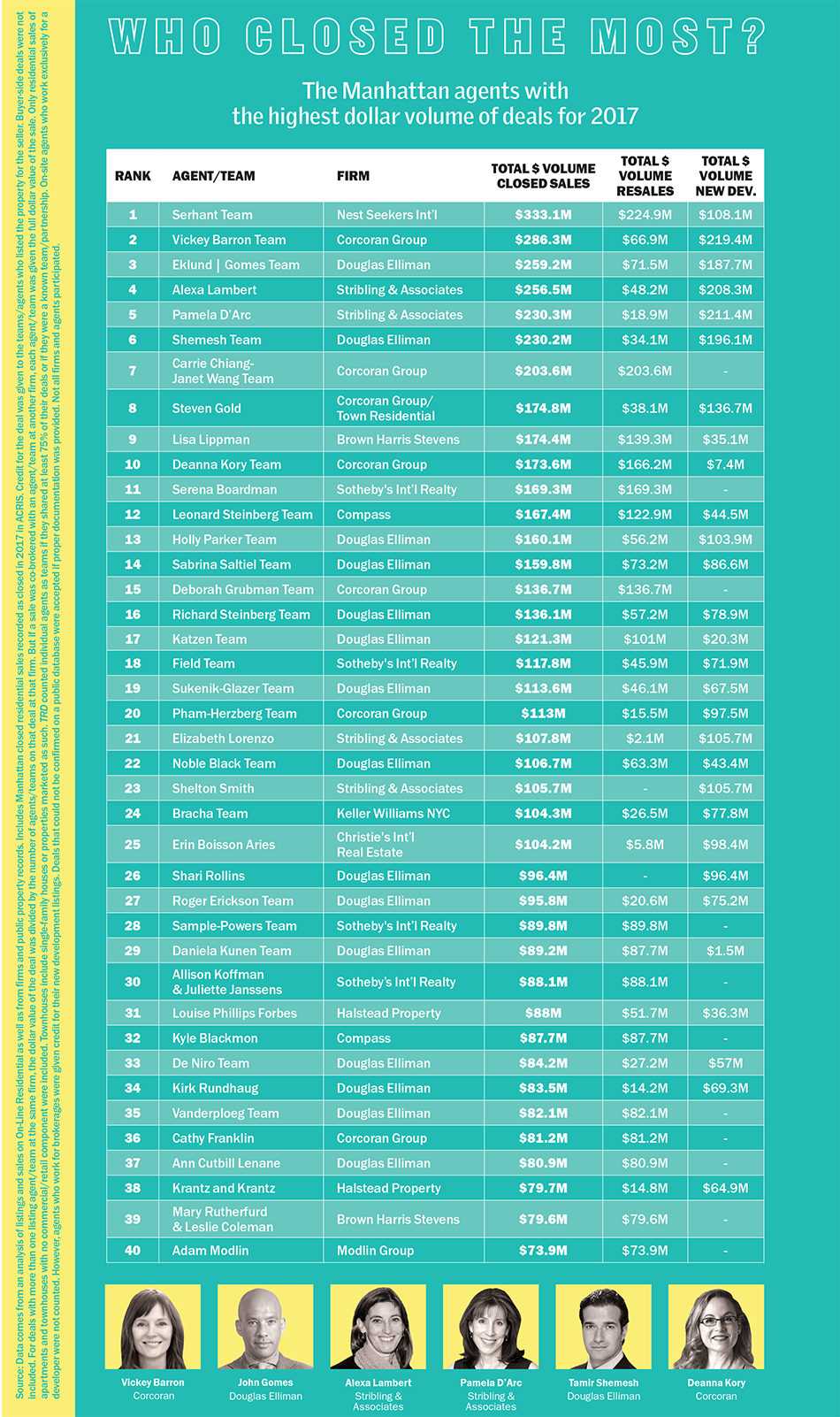

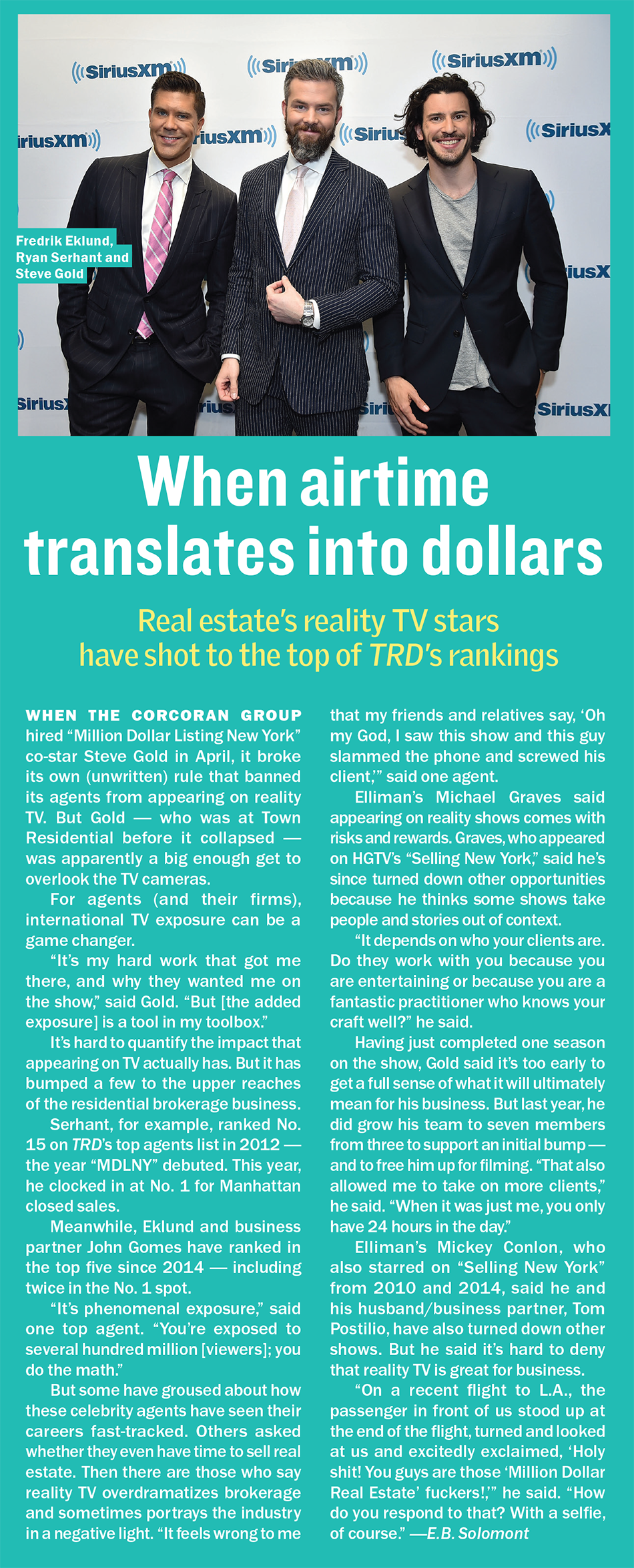

Nest Seekers International’s Ryan Serhant, a co-star on Bravo’s “Million Dollar Listing New York” — along with his 43-person team — clocked in at No. 1 with $333.1 million in closed Manhattan listings.

He was followed by the Corcoran Group’s Vickey Barron with $286.3 million in deals and Elliman’s Fredrik Eklund (also of “MDLNY” fame) and John Gomes, whose team closed $259.2 million.

Rounding out the top five were Stribling & Associates’ Alexa Lambert (with $256.5 million) and Pamela D’Arc (with $230.3 million), also of Stribling.

But even agents who racked up billions of dollars worth of deals described 2017 as manic and disorienting as discounts proliferated.

On the new development front, developers were hurting while buyers were swimming in a large surplus of inventory and were in little rush to commit, agents reported.

Elliman’s Holly Parker, who ranked No. 13 with $160.1 million in closed deals, said she analyzed the market like never before in 2017 to provide clients with real-time information. “Most of the time, we understand the market after they’ve closed, and that’s just too late,” she said.

In 2017, she said, each deal she closed felt like a marathon. “No one was happy,” she said. “Buyers thought they should have gotten a better deal, and sellers thought they sold out.”

Corcoran’s Barron said it was just flat-out harder to close deals — both because the market was harder to read and because competition was fierce.

“There’s no question that everyone is working harder to accomplish the same task that we did five years ago,” she said. “It’s extremely competitive.”

More deals, more discounts

Even if the market felt slow, 2017 transaction volume inched higher last year as buyers and sellers found middle ground. There were 12,266 residential sales in Manhattan for the year, according to appraisal firm Miller Samuel, up from 11,605 in 2016. But prices dropped somewhat, with $25 billion in deal volume in 2017, the same as 2016, according to the Real Estate Board of New York.

Still, brokers said fewer foreign buyers, coupled with anxiety over the federal tax reform bill, made closing deals take longer.

“The market is tough,” said Elliman’s Tamir Shemesh, who ranked No. 6 with $230.2 million in sales. “If someone tells you they’re doing wonderful, check their numbers.”

“The market is tough,” said Elliman’s Tamir Shemesh, who ranked No. 6 with $230.2 million in sales. “If someone tells you they’re doing wonderful, check their numbers.”

Steve Gold — a star of “MDLNY” who jumped to Corcoran after Town’s demise — said his numbers were bolstered by deals he negotiated in 2016, when the market was stronger, but which closed in 2017. Those deals included 21 closings at 212 Fifth Avenue, a condo conversion by Thor Equities, Madison Equities and Building and Land Technology. (Gold, who came in at No. 8 with $174.8 million in dollar volume, sold those units, which ranged in price from $3.9 million to $28.2 million, while he was at Town. The now-defunct firm was marketing the project until early 2017.)

“Some of those numbers are great, but the market compared to 2016 was different,” said Gold, describing even more competition on the new development side today.

Stribling’s D’Arc also benefited from deals struck in 2016 at World Wide Group and Rose Associates’ 252 East 57th Street, where she had more than 50 closings. “We started closings about a year ago, and people started moving in,” she said. “Once we had a building that people could touch, the sales really just took off.”

But Brown Harris Stevens’ Mary Rutherfurd — who together with BHS colleague Leslie Coleman sold $79.6 million and ranked No. 39 — said buyers have “no sense of urgency.”

“There are deals to be done,” Rutherfurd said, “but it’s when the sellers are realistic about pricing.”

In fact, two of Rutherfurd and Coleman’s biggest listings in 2017 closed after the sellers agreed to significant price cuts. One of them was among the city’s most expensive listings — the penthouse at the Pierre Hotel. It sold for $44 million in September, four years after hitting the market asking $125 million. In 2015, after failing to sell the 12,000-square-foot co-op for $63 million, owner Barbara Zweig pulled the triplex off the market for a redesign. BGC Partners’ Howard Lutnick was reportedly the buyer.

“We felt good about the price,” said Rutherfurd, who declined to comment further, citing a confidentiality agreement. “It was fair all around.”

The pair also closed on the sale of an Upper East Side mansion once owned by banker and philanthropist David Rockefeller. The final price was $20 million —$12.5 million less than the original asking price for the property, which hit the market last year after Rockefeller died at age 101. (Rutherfurd and Coleman co-listed the house with BHS colleague Paula Del Nunzio.)

Danny Davis, who also jumped to Corcoran in May after Town folded, said he prices units to sell in today’s market — not what the market could be, or what it was at its peak. “I’m frank, maybe to a fault,” said Davis, who did not make this year’s ranking. “I don’t want to waste my time and give people false hope on properties and prices that aren’t realistic in today’s market.”

One of those sales was a co-op at 34 Laight Street that first hit the market three years ago. Davis said he pitched for the listing back in 2015, when he advised the seller to list for $12 million. The seller, he said, hired brokers from Elliman and listed for $15 million, but came knocking on Davis’ door when the market turned and ended up selling for $10 million in an all-cash deal.

Resale resurgence

Like in past years, agents selling new condos racked up the highest dollar volumes.

But as new development legacy contracts — those signed when the market was roaring back in 2014 and 2015 — dried up, resale deals gave many agents a leg up.

Serhant, for example, closed $224.9 million in Manhattan resale deals and just $108.1 million in Manhattan sponsor sales in 2017.

But Serhant said TRD’s ranking doesn’t give the full picture because it only includes Manhattan. When Brooklyn is factored in, he said, his team did $800 million in closed sales, including $60 million at 550 Vanderbilt in Prospect Heights.

He said he capitalized on the market volatility in 2017. “When the market is straight up or straight down, one side of the transaction is difficult,” he said. “When the market is up and down and up and down, I can negotiate.”

Meanwhile, at No. 9, BHS’s Lisa Lippman closed $139.3 million resale deals out of her overall $174.4 million.

And at No.10, Corcoran’s Deanna Kory closed $166.2 million in resales out of her team’s $173.6 million total, including a $9 million unit at 235 West 71st Street.

Elliman’s Josh Rubin said the resale market has been more stable than the new development sector because it often revolves around local buyers who need to move or want to trade up.

“With new development, you’re dealing with investors from around the world. They can afford to wait if they feel that today’s market isn’t as promising,” said Rubin, who closed $73.3 million in deals but just missed the cutoff for the ranking. “There’s no need for them to drop to their knees and take what’s offered to them.”

Corcoran’s Barron — who closed $219.4 million in new development deals — also sold nearly $67 million worth of resales at Walker Tower. In one case, she sold a two-bedroom condo for $14.8 million after convincing the owner to trade up in the building. Barron said the seller wasn’t looking to sell, but when someone expressed interest in his two-bedroom, she wasn’t shy. “I ring bells,” she said. “I said, ‘I have a buyer, would you be willing to move?’”

Kory said she’s placed a greater emphasis on going after buyers, who are now in the driver’s seat.

“As the market has slowed — and it’s been slowing since 2015 — it used to be that having a listing was the thing to have,” she said. “Now a buyer is more important because anybody out there looking right now, they tend to be more real.”

Industry intrigue

Still, 2017 was a year of reckoning for many brokerages.

Upon shuttering most of his business, Town founder Andrew Heiberger said competition for agents and high commission payouts made it impossible to turn a profit.

Town’s unexpected closure also sent its rivals scrambling to pick up its top-producing agents. And in many cases, they dangled high commission splits and other perks to do so.

After the dust settled, Compass took at least 58 of Town’s 377 agents, while Corcoran lured some of its biggest names, including Gold, Davis and Dana Power.

“Every firm had approached me, and I had some crazy offers,” Gold said, noting that he decided to go with Corcoran because he believes in the traditional brokerage model.

“In Town’s case, I think there was a series of unfortunate events,” Gold said. “I don’t agree that [brokerages] will go by the wayside.”

Even before Town’s fall, the city’s residential firms were constantly swapping agents as a way to one-up their competition. Barron joined Corcoran from Elliman last year, while Shemesh did the exact opposite. It should be noted that in cases where an agent jumped firms midyear, their original firm shared the financial benefit of the closed deals on this ranking — despite the agent’s current affiliation.

Barron said there were three new development projects that she would have worked on at Elliman — if she had stayed. But she said she was factoring in the long game.

“I know some people think you only move for money, but sometimes you make a strategic move because it makes sense,” she said. “You have to think 10 years out.”

But when it comes to the short game and to the current market, everything is in flux.

“As of now, my numbers are down, 100 percent, no doubt about it,” Shemesh said, referring to his 2018 track record. “But that could change quickly with two deals.”

— David Jeans contributed reporting to this story.