Opportunity is scarce for companies looking for industrial or office space on Long Island, leading to bidding wars between would-be tenants, many of whom are looking to move east from New York City or other parts of the Island.

“Our commercial and industrial portfolios are currently seeing record occupancy rates at 99 percent,” said Mitchell Rechler, managing partner of Rechler Equity Partners, a Long Island real estate company. “Long Island’s industrial real estate market is thriving.”

The vacancy rate hit 3.1 percent in the industrial market in the fourth quarter of 2016, a 20-year low, while asking rents rose to $10.27 per square in the fourth quarter, a 3.6 percent jump from the third quarter, according to a Newmark Grubb Knight Frank report. The report also noted that the average asking rent has risen 3 percent annually since 2010.

On the office market front, availability in the fourth quarter of 2016 was 12.4 percent, a 10-year low and a drop from 14.5 percent the year before, according to data from CBRE. Overall asking rents in the fourth quarter were $26.30 per square foot, while Class A office space went from $30.22 per square foot to $30.62.

On the office market front, availability in the fourth quarter of 2016 was 12.4 percent, a 10-year low and a drop from 14.5 percent the year before, according to data from CBRE. Overall asking rents in the fourth quarter were $26.30 per square foot, while Class A office space went from $30.22 per square foot to $30.62.

The area’s strong job market and growing economy are key, industry experts say, as is a continuing exodus of companies from high-rent areas like Queens and Brooklyn. This is especially true for the industrial sector.

“Right now there’s such a shortage that vacant industrial buildings are selling for more money per square foot than vacant office buildings. That’s the first time in my career that that’s happened,” said David Pennetta, executive director at Cushman & Wakefield’s Long Island office.

Martin Lomazow, a senior vice president at CBRE in Long Island who’s worked in real estate for 30 years, shared similar sentiments. He said that little speculative construction and huge demand have resulted in some landlords converting office space that was once classified as industrial back to that use “to meet the demand of industrial companies.”

The year ended with 2.3 million square feet of leased industrial space, according to Jones Lang LaSalle’s 2016 fourth quarter report, just half of the 4.6 million square feet leased in 2015, a drop attributed to a “supply-demand” imbalance.

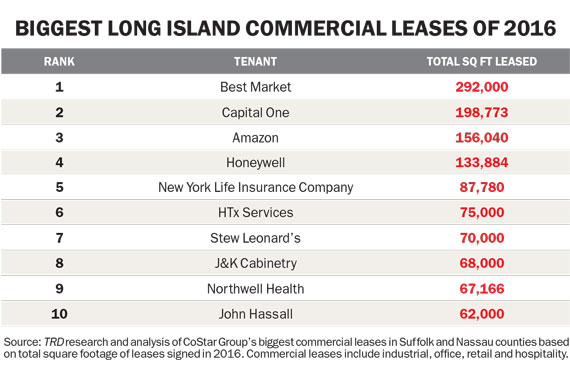

Noteworthy 2016 deals included Amazon.com’s lease of a nearly 160,000-square-foot warehouse and distribution facility in Bethpage, formerly used by Goya Foods, according to Cushman & Wakefield. Storage Post purchased a 228,852-square-foot space in Floral Park for $36 million — $157 per foot. And a pharmaceutical manufacturing company based in India bought a warehouse at 155 Commerce Drive in Hauppauge for $13 million. The 110,000-square-foot property will be used to produce generic drugs.

The latest industrial market report from Newmark Grubb Knight Frank said the average industrial building sale price was $108.26 per square foot in the fourth quarter of 2016, an 8 percent jump over the previous quarter. But new properties were listed for up to $200 per foot.

Brokers say that the flow of companies in Brooklyn and Queens moving to Long Island remains strong. While many are lured by lower lease prices, a good number were convinced the time was right after multifamily developers made lucrative offers that encouraged them to “cash in and move east.”

JLL’s report also cited the trend of Queens and Brooklyn companies moving or expanding into Long Island. A 140,000-square-foot facility in Islandia sold for $12.6 million to Queens-based Entourage Commerce, a distributor of health and beauty products. The space is nearly five times larger than the company’s two facilities in College Point. Another Queens-based company, Keystone Electronics Corporation, which produces electronic components and computer hardware, announced plans to move from Astoria to a 50,000-square-foot facility in New Hyde Park.

Charles Tabone, executive vice president and managing director at Newmark Grubb Knight Frank in Long Island, said that although there are some challenges in Long Island, rents in the city are still prohibitively high.

“It’s a significant difference in price. I mean Brooklyn industrial rent is over $20 a foot, and the Bronx is the least expensive of them at $15.25 a foot. But even the Bronx has 4.1 percent vacancy,” Tabone said. “Even if a company wanted to stay in Brooklyn, Queens or the Bronx, the chances are they can’t find a building. So that’s driving them to come to Nassau and Suffolk.”

Although some landowners are taking advantage of the increased interest and accepting lucrative offers for properties in Brooklyn or Queens, the current lack of inventory and limited construction will keep availability there low. Brokers say this may force tenants to look to New Jersey or other suburbs, or try going farther east in Suffolk.

But there is some commercial development in the works that would help alleviate demand. Pennetta of Cushman represents the seller of a 600-acre vacant plot in Riverhead that was recently sold for $45 million. The site has been approved for 9.8 million square feet and is likely to be developed to accommodate technology, avionics and manufacturing companies, he said.

In Hicksville, a nine-acre parcel of vacant land got nine bids soon after it was listed, said Pennetta. He expects the seller will accept a higher bid from a multifamily developer although it’s zoned for industrial. “There’s always competition for the industrial space when you’re in western Long Island,” he said.

A bidding war broke out last year over a 20,000-square-foot industrial building in Nassau, which attracted four serious bidders, Tabone said. His client walked away with the property, but not before the bidding war pushed the price up by at least $20 more per foot than what each of the bidders and their brokers had anticipated, he said. The final price was $3.6 million, about $400,000 more than expected.

After the client, whom Tabone could not name, went into contract to purchase the building, one of the unsuccessful bidders offered him $250,000 to flip the contract. He declined.

Office space isn’t as scarce as industrial space, but securing large chunks of Class A office space is a game of chance, brokers say. Pennetta said it was very difficult to find 50,000 square feet or more of Class A space.

Real estate analysts say an upswing in demand, lack of new construction and tenants moving to higher-quality spaces has led to the extraordinarily low overall availability rate. Availability in Class A office space was even more extreme, at 9.1 percent in the fourth quarter, a drop from 11.8 percent during the same period in 2015. Year-over-year leasing volume fell 11 percent in 2016, to 1.97 million square feet, according to CBRE data, a decline attributed to low availability.

Overall, Suffolk County saw more of the office action, partly due to low availability in Nassau. This was notable in the third quarter, when 67 percent of the large office blocks available for lease were in Suffolk, and 24 percent of that was 100,000 square feet or larger, JLL reported.

The heavy demand among medical companies contributed to Western Nassau’s status as the most expensive of all submarkets at $31.62 a foot.

One notable transaction last year involved Publishers Clearing House, which signed a lease to occupy 170,000 square feet at 300 Jericho Quadrangle in Jericho. The sweepstakes company was previously in Port Washington and will lease the space from the We’re Group.

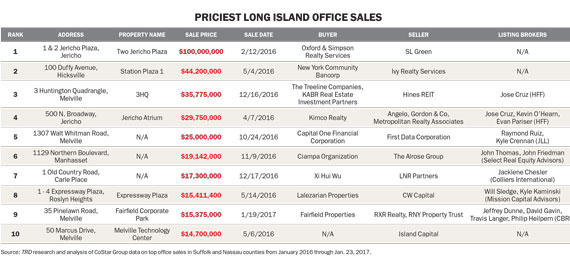

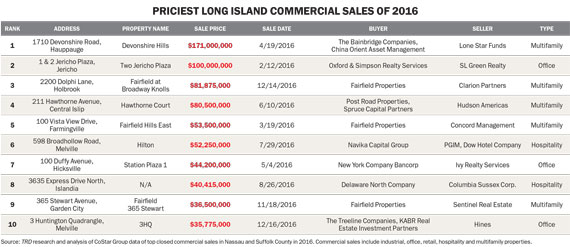

In Nassau, the office buildings in Lake Success remain a top attraction mainly because of their proximity to New York City. For many companies , location is the primary concern, said Michael Ciotta, director at Oxford and Simpson Realty Services. He is handling the leasing at Jericho Plaza, a 650,000-square-foot building that was recently sold for $100 million.

It’s not easy to build new space, so availability will not “shoot up” anytime soon, said Ciotta. However, there are some office projects in the pipeline that will generate product, including a proposal for a 112,000-square-foot office building that is part of the Wyandanch Village revitalization.