On a recent early-morning flight to New Orleans, a flight attendant with an acute sense of comedic timing landed a zinger: “I am looking to sell a house, can anyone assist me?”

The joke was met with immediate laughs from a group of Keller Williams agents, some in matching T-shirts, others carrying swag adorned with the company’s bright red logo — all headed to the firm’s annual “Family Reunion.”

At this year’s mid-February conference, 17,000 agents and franchise owners descended on the New Orleans Convention Center, which had the feel of a giant homecoming party complete with brass music blaring and performers walking around on stilts.

By the time company co-founder Gary Keller emerged onstage — to AC/DC’s “Back in Black” — the crowd was whipped into a frenzy.

But behind the festivities, the national franchise brokerage has been grappling with some hard realities, including aggressive poaching and an urgent need to keep pace with tech companies trying to bring real estate out of the dark ages.

Keller Williams is still the biggest franchise brokerage in the U.S. and Canada, with more than 159,000 agents. (According to the National Association of Realtors, Coldwell Banker is No. 2 with 89,000 agents, followed by Re/Max with 62,441.)

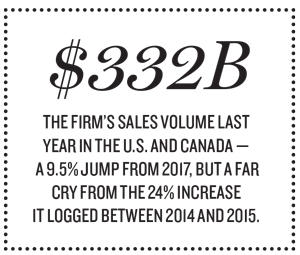

But it’s been increasingly difficult to maintain aggressive growth — both in terms of agent headcount and transactions. Last year, the firm’s sales volume hit $332.4 billion in the U.S. and Canada — a 9.5 percent jump from 2017, but a far cry from 24 percent growth it logged between 2014 and 2015.

And its model has struggled to gain traction in urban markets like New York, where most of its agents don’t play in the high end.

In addition, in January, the firm saw a leadership shakeup when Keller seized full control of the company, replacing CEO John Davis, a company veteran who served two years in the post.

“It’s just kind of interesting to me that they’ve gone through three CEOs in the past five years,” said Steve Murray, founder of the research firm Real Trends, who sat in the front row during Keller’s keynote address in New Orleans.

Despite Keller’s three-hour update on the firm’s $1 billion tech push, Murray said, “He glossed over the fact that for the first time in 12 years, the company didn’t grow.”

An evangelical leader

Gary Keller has something of a cult following within the Keller Williams universe.

Gary Keller has something of a cult following within the Keller Williams universe.

A Texas native and son of schoolteachers, Keller grew up dreaming of becoming a musician. But after graduating Baylor University in 1979, he moved to Austin and got into real estate. In 1983, Keller and his co-founder, Joe Williams, borrowed $44,000 and launched their firm out of a one-room office.

Their growth was swift.

Within two years, Keller Williams — which started with and still maintains “core values” of God, family and then business — was the No. 1 firm in Austin, and it quickly expanded throughout the state.

Though a millionaire many times over, Keller doesn’t live a flashy lifestyle of private planes and New York City penthouses. He and his wife, Mary, live in an 8,400-square-foot house in Austin they bought nearly two decades ago.

Onstage in New Orleans, the 62-year-old wore his preferred uniform of black jeans, a Keller Williams shirt and an Apple watch. And he managed to channel both Steve Jobs and the average Joe, mentioning that he was (once upon a time) a broke agent who borrowed $500 from his dad. As he laid out lofty goals for the company, he peppered his speech with aphorisms like “I do not fear physical failure. Failure leads to growth.”

For many agents, Keller’s teachings (he’s written three best-selling real estate books) are the backbone of the brokerage, which is known throughout the industry for its intensive training programs.

Lately, Keller’s charisma has given his fans confidence that he can steer the company through these increasingly tumultuous times in the residential brokerage business.

“It’s like Steve Jobs coming back to Apple. We’re all behind him,” said David Osborn, one of the largest Keller Williams franchise owners in the country.

Abe Shreve — who joined Keller Williams in 2006 as an agent before becoming a team leader and then an agent coach — said Keller is the right person to be leading the firm through this time of digital warfare.

“Google and Amazon and Zillow are all getting into the real estate business. When they can, they’ll cut out the agent. Gary sees that. He fights for us,” said Shreve.

Shreve, who launched a sister company called MAPS Business Coaching for Keller Williams last year, is one of many who has benefited from the firm’s entrepreneurial ethos. Keller Williams is involved in a string of nonbrokerage businesses both within and outside the company (see sidebar).

Osborn — who began as an agent — claims to have started 35 real estate-related businesses. Within Keller Williams he is an investor in five regional franchises, which have offices in California, Texas, New Mexico, Florida, Virginia and Canada. He also owns 15 market centers, as -individual offices are called in Keller Williams parlance.

Osborn compared Keller’s training to getting an MBA. “I think it’s a passport to a career for some agents,” he said.

Scaling up — fast

Keller Williams has been in growth mode from the start.

For years, it’s differentiated itself through a profit-sharing system that rewards agents with a portion of profits generated by their office for bringing in recruits.

To date, the brokerage says, it’s doled out $1 billion to agents through that program.

Keller Williams was also an early adopter of agent teams, which it embraced in the ’80s as a way of making top agents more productive.

“Keller Williams was able to attract the top talent because of its embrace of teams,” said Rob Hahn, founder of real estate consulting firm 7DS Associates. “When Re/Max was debating whether they wanted teams, Keller Williams was out there recruiting them.”

Four years ago, it took that a step further when it introduced “expansion teams,” encouraging top agents to hire brokers in new markets. (For example, a top Texas-based agent can now do deals in L.A. by partnering with local agents.)

While its profit-sharing model fueled recruitment in the 1980s, Keller’s next big growth spurt came in the 1990s when it began selling franchises outside of Texas.

In general, franchise business models like Keller and Berkshire Hathaway’s HomeServices of America — which did $136 billion in 2018 sales with 44,000 agents last year, compared to KW’s $332.4 billion — are designed to scale up quickly.

By selling franchises, the corporate office can build 10 to 20 offices at a time.

For those looking to own one of those offices, joining Keller Williams as a franchisee requires an initial $35,000 plus 6 percent of gross revenue.

The firm also has a unique decision-making structure.

Unlike bureaucracies with a top-down approach, Keller Williams gives its most productive agents a say in corporate decisions. For example, “mega agents” are invited to participate in “mastermind” groups that advise company executives on various initiatives.

The model has attracted attention beyond real estate.

In 2015, Stanford University business Prof. David Larcker wrote in a white paper that part of the success of Keller Williams is that it “willingly cedes significant decision-making authority to its associates and relies on culture to ensure that its operating model and people are successful.”

#KWNYC

But Keller Williams’ plug-and-play model isn’t foolproof.

Historically, national brands have struggled to crack the insular world of New York brokerage in the absence of a local multiple listing system.

The company’s New York City franchise, which launched in 2011, has been wracked with financial trouble, an exodus of agents and leadership tumult.

After ballooning to 900 agents in Manhattan, the firm dropped to 686 in early 2019, according to The Real Deal’s ranking of Manhattan firms. The analysis also found that it had closed 187 Manhattan deals valued at $204 million in 2018.

In Manhattan, Keller Williams’s two offices — in Midtown and Tribeca — are both owned by Ilan Bracha and Haim Binstock but are run separately.

In February, the Midtown office lost its third CEO in roughly a year when Michael Guerra was pushed out.

Keller Williams NYC co-owner Ilan Bracha

And in April 2018, Keller Williams Realty International sent a letter of default to the Midtown office, citing an “alarming number of questions and concerns about the leadership and viability of the market center.”

The two-page letter, a copy of which was viewed by TRD, said the Midtown office had submitted “materially false” reports to KWRI. The office was also four months behind on its $110,000-a-month rent and delinquent in state and local taxes, the letter said.

Bracha declined to comment on the letter, but he said the Midtown office is “doing great” under interim leader Elizabeth Cho.

Over the past few months, the franchise has tightened its belt and renegotiated one vendor agreement that Bracha said “has saved in the millions.”

Keller Williams NYC has also reduced its monthly fee to agents to $120 from $150 and is considering lowering the point at which agents keep 100 percent of their commission.

One former manager said the New York City offices don’t operate like the rest of the country. “All the technology Keller Williams builds helps suburban agents,” the source said.

Bracha said it’s true that certain tools have taken longer to implement in New York City, which doesn’t have a centralized MLS. But he called Keller’s vision for a tech platform “amazing.”

Either way, it’s not just New York facing headwinds.

Nationally, Keller Williams’ model has been under attack, too.

In March, the company was forced to slash nearly 11,000 “ghost” agents from its rosters after news reports hit that the firm kept inactive agents on the books to inflate its headcount. The incident didn’t come as a surprise to everyone; observers said the practice was the industry’s worst-kept secret.

And for years, critics have tried to poke holes in Keller’s profit-sharing system — calling it a multilevel marketing gimmick. “If profitability is squeezed, payouts go down,” said one brokerage CEO.

But by and large, agents have rejected those claims. “The agents love it,” said 7DS’ Hahn. “Some of them make a lot of money from it.”

While Keller Williams is facing all of the pressures other traditional brokerages are seeing, its biggest threat has come from eXp Realty, a fast-growing national virtual brokerage that also gives agents profit-sharing — plus stock options.

After going public in May, eXp saw its market cap soar to $1 billion, and last year the company’s revenue skyrocketed 220 percent to $500.1 million.

And it’s snagging agents, too: Between December 2017 and 2018, eXp increased its headcount 139 percent to 15,570 agents, and by the end of this past February that number grew another 1,500-plus.

Many brokers see eXp as a new and improved version of Keller Williams. And though it’s difficult to quantify, the virtual firm has been aggressively poaching from Keller Williams.

Last year, eXp tapped Dave Conord — a top recruiter at Keller Williams — to lead its American expansion. And an Arizona-based team called Group 46:10, which has 50 agents in four states, defected to eXp.

David Devoe, a Hoboken-based agent who led one of Keller’s biggest teams until recently, said eXp’s economics are too good to ignore. Since swapping firms, he said, his monthly profit share has increased 20-fold. “Once you see eXp,” Devoe said, “you can’t unsee it.”

The tech conundrum

To catch up with eXp — and surge past a wave of innovation threatening traditional brokerages — Gary Keller declared in 2017 that his firm was no longer a real estate company.

“We are a technology company,” he said at Family Reunion that year. Not long after, Keller Williams announced its $1 billion plan to build out its own tech platform.

In New Orleans in February, he devoted several hours onstage to explaining the firm’s suite of new tools like Command (a CRM hub) and Connect (where agents and teams communicate internally).

He was also eager to showcase the work of Keller Labs, an R&D forum that worked with 27,000 agents across the company to develop the firm’s new tools.

Its research showed that in 2018, Keller agents collectively shelled out $1 billion to cover costs connected to the existing patchwork of tech tools. “That number shocked us,” he said. “Our goal is to replace that money for you.”

Keller acknowledged his skeptics: “We had to build a platform,” he said. “In the process of doing that, you look stupid because you don’t have anything. But you are building it.”

To vouch for the process, Philadelphia agent Mike McCann joined Keller onstage. McCann, a top Berkshire Hathaway agent for decades who closed $365 million in deals last year, joined Keller in January with his 25-person team.

“The acceleration of change in the industry isn’t like anything I’ve seen. I’m here to embrace the new world,” he said.

In one sense, Keller Williams is trying to beat its rivals at their own game. Last year, the company tried (unsuccessfully) to buy a virtual company later snapped up by eXp. Keller Williams President Josh Team has also said the company is watching Redfin because it thinks it can “copy the technology of Redfin before Redfin can take the market share.”

But some of the industry’s biggest players have rejected Keller’s approach.

Last year, Realogy CEO Ryan Schneider steered that brokerage conglomerate away from creating, delivering and maintaining all of its tech.

Instead, the New Jersey-based company — whose NRT division operates the Corcoran Group, Coldwell Banker and Century 21 — is combining proprietary tools with third-party tools that agents already use.

Now, the company is more strategic about where it allocates time and resources, said NRT CEO Ryan Gorman. For example, he said, creating a CRM from scratch isn’t worth it because “to create a product that is so good that a successful agent who’s happy with their current tool will change to use ours is a very, very high bar.”

“We focus on what’s necessary,” he said. “If it exists, we use it. If it doesn’t, we build it.”

Real Trends’ Murray said that unlike public brokerages such as Realogy, Keller Williams is well-positioned to pivot quickly because it is not beholden to shareholders.

“Gary has redirected tens of millions of dollars — because he can,” he said. “It’s his company.”

Within Keller’s ranks there is widespread support for the tech investment.

Charles Olson, the owner of Brooklyn-based Keller Williams Realty Empire, said the company’s tech is already paying off for him: Recently, an agent in Florida connected him with a client looking to sell her $5 million Brooklyn townhouse.

Despite his faith in Keller’s leadership, Murray has doubts as to whether betting heavily on technology pays off for brokerages in general.

His own research shows two-thirds of consumers choose an agent because of a personal connection.

“It’s almost like a zero-sum game. Every one of them has to build something,” he said. “But if they think that’s the panacea to growth, I have a big question about that still.”

Osborn, the franchise owner, said he’s seen Keller reinvent his brokerage model many times over, adding mortgage, coaching and publishing to stay competitive.

“You’d be a fool to underestimate Gary Keller,” he said. “I’ve seen him pivot before many times.”