They flirted for two years before heading to the altar.

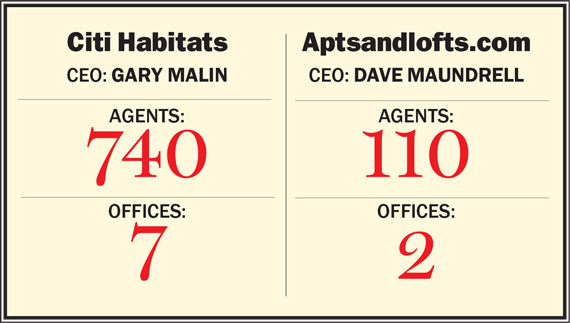

That’s how Gary Malin, the president of rental firm Citi Habitats, describes his courtship of David Maundrell, the Brooklyn evangelist who founded the brokerage Aptsandlofts.com more than a decade ago from an industrial stretch of Williamsburg.

Finally last month, the two announced that Citi Habitats would buy the smaller firm.

The acquisition price on the deal, which closed last month, was not released or disclosed in public records. But several sources noted that Citi Habitats’ offer — which was undoubtedly fueled by a necessity to gain a foothold in a borough booming with residential development — was obviously sweet enough to entice Maundrell, who’d been growing his firm rapidly on his own.

“[We] knew if we combined Aptsandlofts.com and Citi Habitats, it would create an amazing powerhouse,” said Maundrell, who is taking on the title executive vice president of Brooklyn and Queens’ new development.

How much of a powerhouse remains to be seen. But the deal reinforces just how crucial a moneymaker the Brooklyn market has become for developers and brokerages alike.

Overnight the deal gave Citi Habitats two large offices in prime locations, Williamsburg and Cobble Hill, in a borough where it had none. As for Aptsandlofts.com, the company will be dropping its web-centric name and folding all operations into Citi Habitats.

Malin, who noted that his agents were doing deals in the borough despite the lack of a physical presence, said getting into Brooklyn was always part of the plan.

“It was something we knew we needed to do,” Malin said. “I was being asked by agents, ‘Why are we not there?’ For me, growth is important. It’s essential.”

Last holdout

Citi Habitats is one of the last major New York City brokerages to expand into Brooklyn.

The Corcoran Group — which like Citi Habitats is owned by NRT, a subsidiary of real estate behemoth Realogy Holdings Corp. — has had a presence in the borough since the 1990s, while other major Manhattan brokerages like Douglas Elliman have been furiously expanding there in recent years. Brown Harris Stevens pushed into the borough in 2004, when it acquired William B. May Real Estate’s Brooklyn Heights and Park Slope offices; while more recently, Halstead Property has bought Cobble Hill Realty, Heights Berkeley Realty and Aguayo Real Estate Group.

So while establishing a foothold in Brooklyn was a nagging necessity for Citi Habitats, it was also a strategic challenge given the head start its rivals had. In addition, as many of Citi Habitats’ rental clients got priced out of Manhattan it also became an increasingly vexing issue. But sources say folding Aptsandlofts.com’s more than 100 agents into the mix will go a long way toward jump-starting Citi Habitats in its new territory. (Aptsandlofts.com’s agents are, in fact, already licensed under the Citi Habitats’ umbrella by the Department of State.)

So while establishing a foothold in Brooklyn was a nagging necessity for Citi Habitats, it was also a strategic challenge given the head start its rivals had. In addition, as many of Citi Habitats’ rental clients got priced out of Manhattan it also became an increasingly vexing issue. But sources say folding Aptsandlofts.com’s more than 100 agents into the mix will go a long way toward jump-starting Citi Habitats in its new territory. (Aptsandlofts.com’s agents are, in fact, already licensed under the Citi Habitats’ umbrella by the Department of State.)

“They’ll benefit from the running start that they’ll get in Brooklyn,” said Andrew Heiberger, who founded Citi Habitats and sold it to Realogy in 2004 for a reported $49.6 million. (Heiberger, of course, later founded Town Residential and is now the CEO of that firm.)

There are, however, still challenges ahead. Most pressing is whether Citi Habitats will be able to hold onto all of Aptsandlofts.com’s new development business. In contrast to Citi Habitats’ corporate identity, Aptsandlofts.com has cultivated a hip vibe that’s reflected in both the projects it’s handled and its offices. Its storefront at 236 Court Street in Cobble Hill, for example, features double-height ceilings, exposed brick walls, vintage light fixtures and reclaimed wood and furnishings from local vendors.

Still, it’s no wonder Citi Habitats — like other brokerages before it — was tripping all over itself to be in Brooklyn.

The average sales price in the borough hit a record $856,839 during the third quarter, an 18 percent jump from the prior year, according to real estate appraisal firm Miller Samuel. And many new development projects, including Pierhouse and 1 John Street have units selling for more than $7 million.

Meanwhile, the market is still growing. The number of sales rose 14 percent in the third quarter from the prior year to 2,368 transactions, compared to Manhattan’s 9.8 percent jump to 3,654 deals.

There’s also been an explosion of Brooklyn rental development at a time when high land prices in Manhattan are forcing developers to forgo rental development there.

“The lion’s share of new product is rental, and the market is expanding and changing, so it makes sense to expand your presence there,” said Jonathan Miller, founder of real estate appraisal firm Miller Samuel.

Malin said rather than finding space and building out an office, acquiring Aptsandlofts.com not only gave Citi Habitats an instant presence in a hot market, but also paired the firm with Maundrell’s deep ties to the local market.

“To get that local knowledge and expertise is huge,” Malin said. “It’s kind of like one plus one equals five.”

The Maundrell metric

Since founding Aptsandlofts.com more than a decade ago, Maundrell has been called many things: Student of his craft. Real estate pioneer. Brooklyn cheerleader.

During his first month in business in 2002, Maundrell rented 30 apartments in Williamsburg. To date, his company has worked on 300 new rental and condo projects, encompassing 16,000 units. Its current pipeline of 70 projects includes units scattered citywide that are scheduled to come online within the next three years.

A rendering of Spitzer’s 800-unit plus Williamsburg project

Those projects range from Brookland Capital’s seven-unit condo at 357 Prospect Place in Prospect Heights to Spitzer Engineering’s three-tower Kent Avenue project in Williamsburg, which will have more than 800 units.

Former governor-turned-developer Eliot Spitzer told The Real Deal that Citi Habitats’ acquisition would have “absolutely no impact” on his relationship with Maundrell. “The project is his and we love him,” Spitzer said in an email.

Longtime Brooklyn players said Citi Habitats’ foray into the borough simply reinforces Brooklyn’s strong pull.

“The market is fully detached from Manhattan. It’s not an alternative; it’s a first choice,” said Aleksandra Scepanovic, founder of Ideal Properties Group, the Brooklyn-based residential brokerage.

She said a tipping point occurred during the recession, when the Manhattan market faltered. “Meanwhile, you had Brooklyn … gaining traction.”

But Maundrell’s ability to expand beyond Brooklyn has been less straightforward.

In 2009, he publicly stated a desire to expand nationwide but those plans never materialized. He’s also tried, in vain, to break into the Manhattan market over the past two years.

To be sure, he has not been alone on that front. Residential firm MNS shuttered its only office in Manhattan last month, moving its headquarters to 102 North 6th Street in Williamsburg. Founder Andrew Barrocas told TRD at the time that the new office had a “better location” that would enable MNS to focus on outer-borough new developments.

But Maundrell had a breakthrough this spring and is currently working on three Manhattan projects: A&E Real Estate’s repositioned 114-unit rental building at 245 East 80th Street; Benenson Capital Partners and Mack’s redevelopment of the former Peter Stuyvesant Post Office on East 14th Street, which also has 114 rental units; and an 80-unit rental at 65 East 125th Street developed by Greystone.

Selling Aptsandlofts.com to Citi Habitats will undoubtedly help him lease up those units. Indeed, not only will the smaller firm be able to market Maundrell’s portfolio of projects to Citi Habitats’ vast rolodex of rental clients, it will also be able to tap the resources of the rental giant’s sister companies Corcoran Group and Corcoran Sunshine Marketing Group, which have powerful research operations. “That is something that is very valuable to me,” said Maundrell, who will be overseeing new development marketing and sales in Brooklyn and Queens for Citi Habitats.

In addition, Maundrell can now farm out the time-consuming administrative tasks associated with running a boutique firm — from payroll to office repairs to shoveling snow — giving him more time to consult with clients.

“For my new development clients, all they want really is for the product to be rented or sold for the highest price, in the quickest amount of time,” he said. “This allows me to expose my product to a wider audience. You go from 100 agents to 850 agents pushing product. That’s pretty powerful.”

“For my new development clients, all they want really is for the product to be rented or sold for the highest price, in the quickest amount of time,” he said. “This allows me to expose my product to a wider audience. You go from 100 agents to 850 agents pushing product. That’s pretty powerful.”

Town’s Heiberger said selling a firm is what every small brokerage founder dreams of.

“Dave Maundrell has done an excellent job at winning assignments one by one and giving his clients the proper attention they need,” said Heiberger. “As a result he was able to amass a large amount of inventory and was able to get 100 people to follow him. He created some value for himself.”

Maundrell declined to comment on the specifics of his contract — including whether it has a non-compete clause — but said he plans to be with Citi Habitats for a “very long” time.

“My intention was never to sell and sail away on a boat,” he said. “I wanted to join forces with the right entity to not only grow what I’ve started but also to have my own growth professionally in terms of marketing new development properties.”

‘Shot in the arm’

Heiberger founded Citi Habitats in 1994 as a predominantly rental brokerage.

When the firm was sold to Corcoran 10 years later, it had more than 800 agents and 19 Manhattan offices.

Malin, Heiberger’s college roommate at the University of Michigan, became president in 2008 and spent the next few years steering the firm through the financial crisis.

And while the firm clocked in as the fourth-biggest firm on TRD’s most recent survey of biggest Manhattan residential brokerages with 745 agents (up from 703 a year earlier), its sales listings dropped 32 percent to a paltry $76.4 million on March 31.

Andrew Heiberger

At the time, Malin said the firm’s listings were impacted by the city’s widespread inventory crunch, and he noted that TRD’s analysis was based on a one-day snapshot that didn’t give the firm credit for closed deals.

In that category, Citi Habitats has, in fact, grown. The firm sold $119.6 million worth of real estate for the 12 months that ended March 31, up nearly 200 percent from 2013.

And the firm was able to drum up those sales despite the fact that it’s best known for its no-frills approach to leasing apartments. In addition, it also must contend with the reality that agents who want to sell pricey real estate often graduate to other firms.

“It is hard when your parent company owns you and one of their brands is Corcoran,” said Kathy Braddock, co-managing director of William Raveis NYC.

In addition, in the last few years, Citi Habitats has seemed to recede from the limelight a bit while the industry’s attention has focused on luxury condos.

In an effort to distinguish itself, the company has rolled out a rebranding that’s included renovating seven consolidated offices (down from 14), upgrading its listings database and redesigning its website.

“Today’s renters are tomorrow’s buyers and the next day’s sellers,” said Malin, who noted that his firm is focused on both rentals and sales.

But Citi Habitats has also weathered some rockier times, including the departure of several key executives and the restructuring of its new development division in 2012, when the firm’s new development projects were given to Corcoran Sunshine Marketing Group.

The latter move prompted the firm’s new development chief Clifford Finn to decamp to Elliman. The following year, Gordon Golub, the firm’s No. 2, left for startup brokerage Compass. New development head Jodi Ann Stasse came on board in 2013 to relaunch the new development division, which is now largely comprised of Manhattan rentals.

“When we changed our focus, it was because we were ending the rental cycle. The amount of rentals coming online didn’t justify the size and scale we had at that moment,” Malin said. “If you look at the market now, bigger and larger rental jobs are coming out.”

He said Maundrell and Stasse would collaborate to land new business.

Aptsandlofts.com’s Cobble Hill office

There’s also the issue of moving Maundrell’s business over. Going forward, all new development projects will be signed under Citi Habitats New Development, but some of Maundrell’s legacy projects are remaining under the Aptsandlofts.com name until they are completely sold or leased.

“Our goal is to also transition these jobs to the Citi Habitats brand after consultation with their respective owners,” Malin said.

“Dave’s got his book of business that he’ll continue to work on and grow,” Malin added. If anything, Maundrell will leverage his track record with small to mid-sized developments while Stasse will focus on “multi-hundred-unit” projects.

Given Citi Habitats’ new development turnover, David Schlamm, founder of City Connections Realty, said Maundrell would “give Citi Habitats a nice shot in the arm” as well as a presence in Brooklyn.

“They’ve been a little off the past few years so I think this actually will help.”

Consolidation situation

Overall, the brokerage world is as consolidated as it’s ever been, as large firms seek economies of scale in an increasingly competitive market.

One day before Citi Habitats announced its acquisition of Aptsandlofts.com, brokerage Engel & Völkers, which is based in Germany, announced a merger with the boutique firm Mercedes/Berk.

And bigger firms are likely paying good money to gobble up their smaller counterparts.

Schlamm said Maudrell’s company is “probably worth more now than it has been in a while.”

Still, Schlamm said, “It’s tough to operate as a small-to-medium-sized company unless you control listings.”

In Brooklyn there are, of course, plenty of listings to go after. Overall, there are more than 5,700 units for rent and nearly 2,800 units for sale there, according to listings website StreetEasy.

Ideal Properties’ Scepanovic predicted Citi Habitats’ acquisition would not be the last one. But, she noted, its foray into Brooklyn wouldn’t put smaller firms out of business.

“There’s so much to be done in Brooklyn, there can’t be a single brokerage [big enough] to cover the entire footprint,” she said.