Some relief might be on the way for commercial real estate if the past is any guide.

According to an analysis by Trepp, recent — and likely future — Fed rate cuts might increase transaction activity and cause borrowers to seek refinancing, particularly those with floating-rate debt.

Lower interest rates can also cause higher property valuations, since investors can pay for more without losing out on returns.

As the world struggled with the COVID-19 pandemic, interest rates dropped to zero in 2021 and total transaction volume surged $346 billion. In 2022 and 2023, interest rates surged and transaction activity fell.

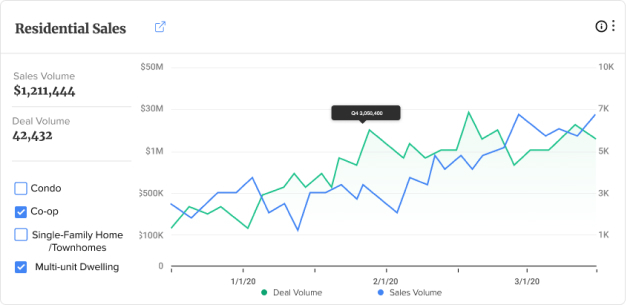

Here’s how interest rates have affected the level of commercial real estate transactions from 2000 to the present.

Subscribe to TRD Data to unlock this content