Tenants at Ellis Lakeview in Chicago’s South Shore neighborhood started off the year desperate for a new owner at their apartment complex. Their building had problems, like broken boilers, pest infestations and clogged sewers, which had worsened under an old landlord, an entity called Apex Chicago. Some tenants went on a rent strike.

But this wasn’t just any landlord-tenant dispute.

Government-sponsored Freddie Mac owns Ellis Lakeview after it took control following a foreclosure on that previous landlord, an entity with links to some of the real estate investors whose names were on a recently revealed Fannie Mae blacklist: Boruch “Barry” Drillman, Chaim Puretz and Oron Zarum.

By March 2024, months before the foreclosure sale, Fannie had placed eight real estate investors on this blacklist, a rare move that prevented the investors, who included the Ellis Lakeview trio, from doing business with the government-sponsored agency.

The owners on the list bought properties, deferred maintenance and ran the buildings into the ground, an internal email from Fannie Mae obtained by The Real Deal warned. And when things got bad, the investors would flip property to a related party or inflate the financials. The strategy allowed the players to buy properties with no equity.

The blacklisted investors owned properties across the U.S. But Chicago, with its cheap prices relative to other large cities, upside potential from a slew of planned developments and eager sellers, was a prime target. What happened after they purchased these local buildings gives a sense of how to get on Fannie’s bad side.

At their peak, the investors managed companies with at least 1,235 Chicago-area apartment units. They bought other asset classes as well. Drillman owned an industrial development in the Gage Park neighborhood. Meanwhile, another blacklisted investor, David Helfgott, controls an office building in Rockford.

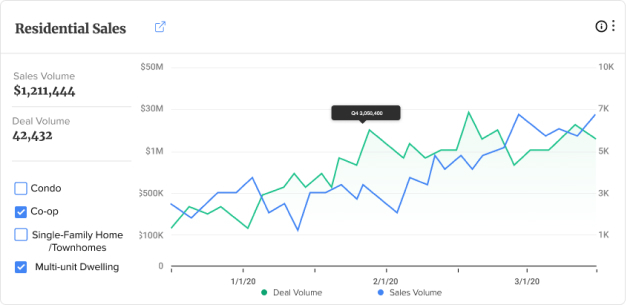

Between 2017 and 2021, the eight investors spent at least $97 million for properties in the Chicago area and secured $101 million in debt against them, according to a TRD analysis.

Multiple buildings controlled by the blacklisted investors have fallen into foreclosure. Freddie Mac seized the 105-unit South Shore property from a Zarum-led entity. Fannie is also foreclosing on LLCs tied to Moshe Silber and Gottesman that own a portfolio of more than 150 units on the South and West sides.

In addition to Drillman, Gottesman and Zarum, Fannie put five others on this blacklist — including Fred Schulman, Chaim Puretz, Moshe “Mark” Silber, Israel Katz and Helfgott. In total, Fannie had exposure of more than $700 million in loans to these players as of March 2024. Many of these sponsors had ties to Lakewood, New Jersey, and conducted business with each other.

Drillman, Silber and Schulman have pleaded guilty for their role in a criminal mortgage fraud scheme in a Cincinnati rental complex. Silber and Schulman were sentenced to prison time.

Create an account to continue

The Chicago Gamble

Parts of Chicago’s South Side became a magnet for real estate speculation over the last decade. Investors bet prices would rise around the planned 19-acre Obama Presidential Center in the Jackson Park neighborhood, as well as the slow-moving, multi-billion dollar redevelopment of the former Michael Reese Hospital site known as Bronzeville Lakefront, industry sources told TRD.

Speculators’ gambles may prove lucrative in years to come. But during the in-between years, many investors, including Drillman, Gottesman and Silber, were stuck with their buildings, many requiring substantial repairs.

In the case of Ellis Lakeview, problems continued, even under Freddie Mac. More than a year after Freddie moved to foreclose on Ellis Lakeview, it has not been able to sell the property. In late February, 17 tenants said they planned to withhold portions of their rents over living conditions they contend are still in violation of city and federal regulations, the Hyde Park Herald reported.

“Over the past two years, Freddie Mac Multifamily has implemented a series of policy and process enhancements that further strengthen underwriting due diligence, bolster fraud detection and deterrence, and mitigate other risks,” a spokesperson from Freddie said in a statement. “We take issues of fraud and abuse seriously and work closely with stakeholders across the industry to implement best practices for managing risk and improving our execution.”

The city has flagged building code violations at other blacklisted investors’ Chicago properties. At least one building owned by a member of the blacklist became so run down and neglected that it was host to regular gang activity, according to a person familiar with the property.

The Federal Reserve’s decision to raise interest rates only added pressure on the investors. But these landlords seemed to want to hold onto their properties, sitting back while values increased, and spending little on upkeep.

“The South and West sides of Chicago are management intensive. You can’t operate as a landlord here from Skokie, let alone New Jersey,” one Chicago landlord said.

The blacklisted investors and several of their attorneys either didn’t return requests for comment, or attempts to reach them were unsuccessful.

The WJ portfolio

In 2017, an unknown investor named Boruch “Brian” Gottesman scooped up a portfolio of more than 600 units in Chicago’s South and West sides for upwards of $33 million. The properties were owned by WJ Management’s Wafeek “Wally” Aiyash, a businessman who started selling off his real estate in the mid-2010s after being convicted of trying to bribe a Chicago alderman, according to Crain’s.

By 2017, Gottesman was a big buyer of such property. He secured about $42 million in financing from Arbor Realty Trust, which was then sold to Fannie Mae. At some point, two other names started showing up on legal documents: Moshe Silber and Fred Schulman. Silber, then in his late 20s and hailing from Suffern, New York, and Schulman, an attorney in his late 60s who was friends with Silber’s father, worked together on real estate acquisitions across the U.S.

It is unclear if this deal led Gottesman to be placed on Fannie’s blacklist. So far no criminal allegations have been brought against any of the blacklisted players for Chicago real estate deals.

But around the same time Gottesman was placed on the blacklist, he was pushed by Fannie Mae to sell part of his Chicago portfolio because of the poor property conditions, according to a source familiar with the matter. Jeffrey Zwick, a Brooklyn-based real estate transaction lawyer, was also the closing attorney for Gottesman’s Chicago deals, public records show. Further, Fannie stopped doing business with Zwick at least until it completes an investigation of him, the Promote reported. (Zwick did not return a request for comment).

Affiliates of Chicago-based WPD Management, an experienced operator in the West Side of Chicago, acquired the portfolio for an undisclosed price.

WPD ultimately assumed $23.8 million in Fannie Mae loans on the property. WPD was also required to put millions more into the building repairs.

But it took a painstaking negotiation. The seller — an entity tied to Schulman, Silber and Gottesman — dragged its feet on closing the sale to WPD after realizing Fannie would require it to pay down a chunk of the loan balance before walking away from the properties, according to a source familiar with the matter.

There were still expensive renovations required of the new ownership. So, the sellers fought to minimize payments to their lender.

Fannie and the lenders have explored trying to find new borrowers to take on other Chicago properties owned by members of the blacklist. But they haven’t found any more takers, according to a source familiar with the matter.

Instead, Fannie pursued foreclosure against the landlords in Cook County court. These properties are encumbered by $6.7 million in debt and include two buildings at 5248 and 5300 South Martin Luther King Drive in Washington Park and a third at 7600 South Essex Avenue in South Shore.

Fannie is also pursuing a foreclosure for a $3.3 million loan tied to apartments at 5644 West Washington Boulevard and 114 and 124 North Parkside Avenue in the Austin neighborhood.

The government-sponsored agency will take them over, as at Ellis Lakeview, and they’ll likely be marketed for sale after a while.

At least at Ellis Lakeview, the new owner hasn’t solved the tenants’ problems. Freddie brought in a property manager who threatened tenants with eviction lawsuits for withholding rent, sources familiar with the matter said.

The tenants claim they followed all necessary procedures to legally withhold rent from a landlord who fails to maintain adequate building conditions. They, in turn, are considering filing a lawsuit against building management and ownership to prevent eviction suits from moving forward. They also want to force Freddie to negotiate a contract with any new owner that includes pledges to maintain the building in line with local and federal codes.

Time will tell whether they can find such an owner — a real operator who will invest to make the buildings competitive again — or just another gambler who seeks to limit expenses while hoping interest rates fall, property values rise and regulators look the other way.

Read more