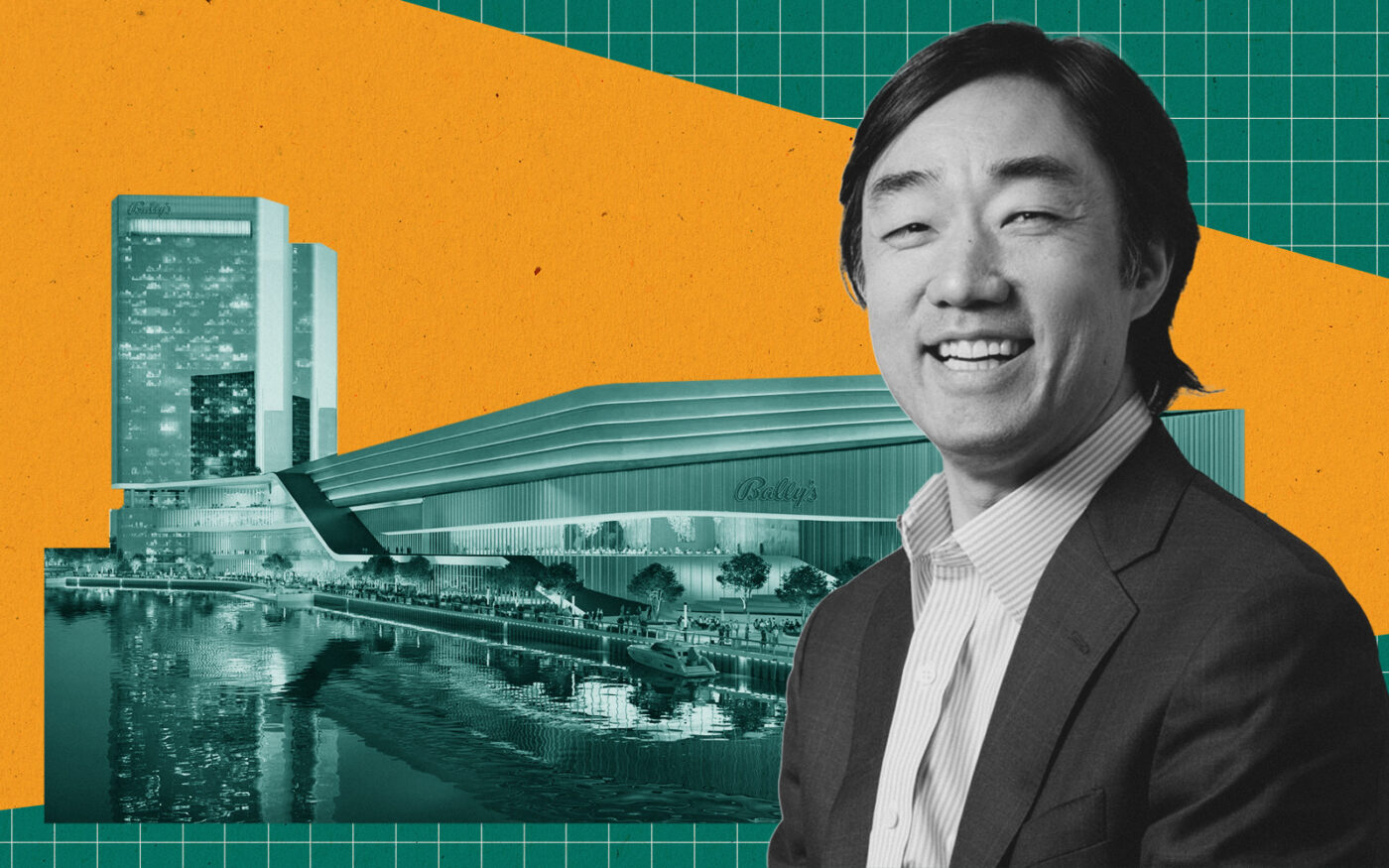

Bally’s is hedging a bet on its controversial diversity-focused fundraising plan for its $1.7 billion Chicago casino development on the former Tribune newspaper printing plant site in River West.

Bally’s Chicago is now seeking to raise $195 million through a private share sale, as the Securities and Exchange Commission has halted an effort to raise $250 million through an initial public offering exclusively targeted at women and minority investors, the Chicago Business Journal reported.

The shift in fundraising methods comes as the company, a subsidiary of Rhode Island-based Bally’s Corp., is navigating significant regulatory challenges for its project, which is set to become the Windy City’s first full-fledged permanent gambling emporium.

Last summer, Bally’s Chicago garnered attention with plans for a $250 million IPO exclusively targeting qualified female and minority investors. This initiative was prompted by a mandate from the city of Chicago, stipulating that 25 percent of the new casino must be owned by minorities and women. However, the SEC has yet to approve the IPO, citing the need for updated audited financials from Bally’s Chicago.

In response to the regulatory delay, Bally’s launched a private placement offering, which has already secured over $83 million from 270 accredited investors, the outlet reported, citing the firm’s financial disclosures. This approach is running alongside the stalled public offering and includes individuals who meet the criteria specified by Chicago’s ownership mandate, according to Bally’s spokesperson Richard Land.

Legal hurdles loom, however. The IPO has faced federal court challenges, with accusations of discrimination leveled by plaintiffs supported by groups like the American Alliance for Equal Rights and the Liberty Justice Center. These lawsuits argue that the IPO unfairly favors minority and female investors, potentially excluding others from participating in the investment opportunity.

Meanwhile, Bally’s continues to refund deposits to potential IPO investors as it strives to gain SEC clearance. The company remains optimistic about its casino project, which has recently received site plan approval and is slated to open in September 2026. The complex promises a 500-room hotel, entertainment venues, multiple dining options, and public spaces, and aims to redefine Chicago’s hospitality and gaming scene.

— Sam Lounsberry

Read more