A Grayslake-based real estate company whose manager reportedly paid an unhoused Chicagoan to take over the deeds of run-down properties it picked up in bulk and later sought to offload has become the latest target of the city.

The company, Goldmine Investments, and another Hinsdale-based investor, QCD Financial, follow a pattern of owners being pursued by a city task force that’s designed to pin down Chicago’s most indebted landowners. Both firms are alleged large-scale “land speculators” that bought up heavily distressed properties, often vacant lots, purchasing them under the names of various LLCs used to muddy the ownership of the properties, according to complaints filed by the city in Cook County Circuit Court.

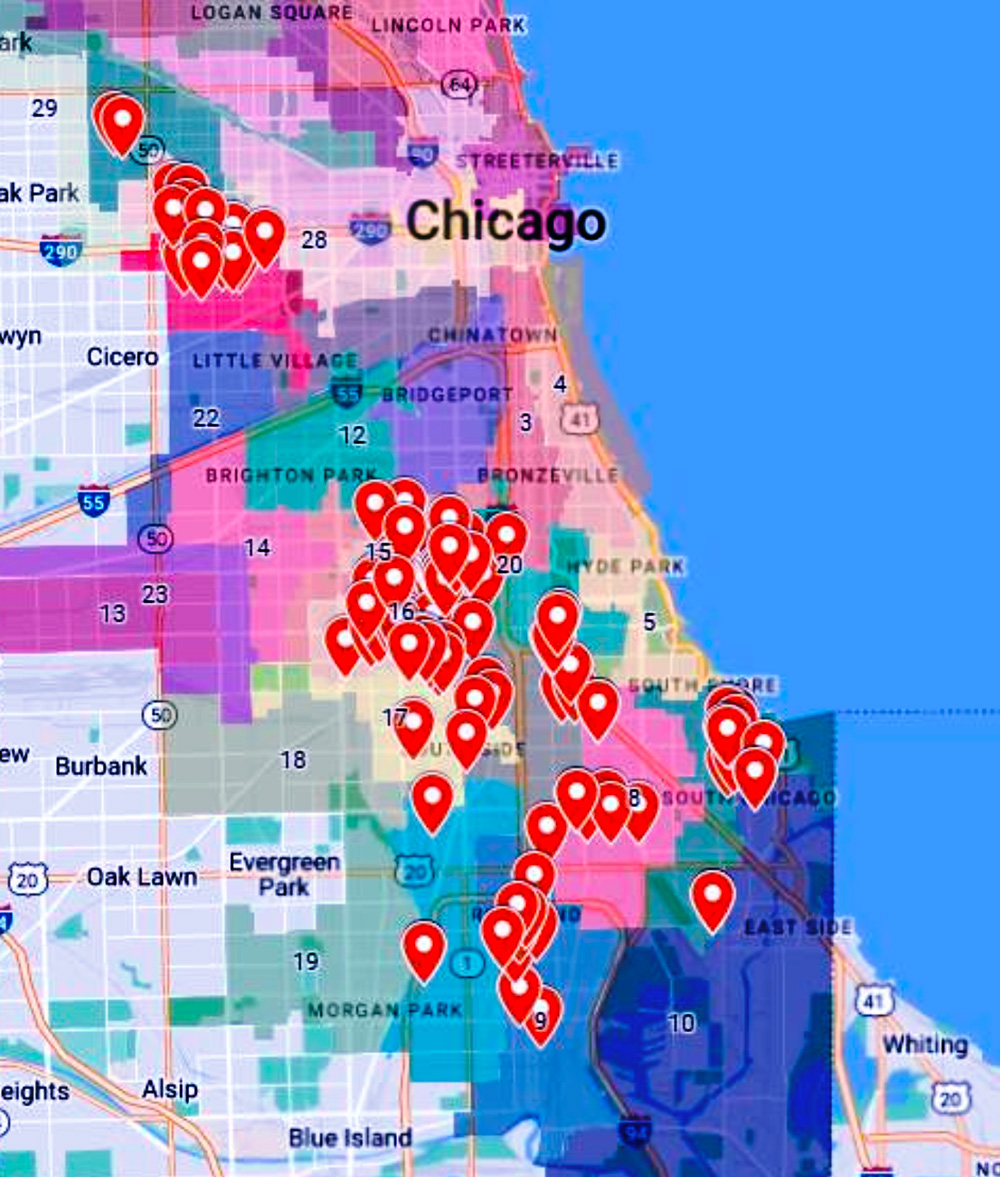

They collectively owe $9 million in fines to the city from municipal code violations related to neglect and environmental hazards at their properties, which are predominantly concentrated in disadvantaged neighborhoods on the South and West sides of the city.

This is when “land speculation becomes problematic,” the city said in the case brought against QCD.

For its most negligent landowners, the Chicago Department of Law’s special collections unit is moving to consolidate judgements made against owners in city administrative hearings into lawsuits filed with the Circuit Court — as it did for QCD, Goldmine and infamous Chicago landowner Suzie Wilson in recent months. The city recently reached a tentative, $11.5 million settlement agreement with Wilson to resolve an estimated $49 million in legal claims it brought against her and her companies.

After bringing down Wilson, the city “seized an opportunity once we learned that there was an individual — individuals — who are accumulating property in a particularly unique way around these title structures that allow them to constantly change the titles without anyone in the city or the county noticing that was happening,” Chicago’s top lawyer Mary Richardson-Lowry said.

Now, the unit is doing more research to track ownership and moving aggressively when they can bring legal action against the people behind the landlord LLCs — and officials are open to seeking to freeze personal assets in some circumstances as a “motivator,” said the city’s deputy attorney David Holtkamp, who runs the unit.

Next on the city’s list of troubling landowners: Grayslake resident Keith Moll, the manager of Goldmine, according to court filings and business registry information.

Digging into Goldmine

The city says that Goldmine owns hundreds of properties in Chicago and is just “one of many shell companies created by (Moll) to hold title to real estate in distressed neighborhoods.” Goldmine allegedly owes the city over $5.2 million in fines from more than 1,500 counts of blight-related code violations, according to city litigation.

This is not the first time that an LLC managed by Moll has been sued by the city, according to a Chicago Tribune report from 2015. The city sued Z Financial Illinois G Properties, LLC a decade ago to force the company to repair, demolish or cover the cost of demolishing unsafe structures on its properties.

Shortly thereafter, Moll transferred ownership of several of the properties to an unhoused man named Abana Tabb, who told the newspaper Moll paid him to take the five properties.

“(He said) ‘I wanna dump a couple of houses on you. Don’t worry about it. You’re not gonna get in trouble, blah, blah, blah … sign here,’” Tabb told the newspaper.

As a result, Tabb was added as a defendant in the city’s cases against the properties and Z Financial was let off the hook in nearly every case. The Cook County Sheriff’s Office later investigated the transfers, but ultimately closed the case without filing any charges.

Z Financial acquired the properties through the county’s delinquent tax and scavenger sales — a high-risk, high-reward investment arena.

Tax buyers used to be able to earn double-digit interest rates as residents paid back taxes — they can still earn significant interest after state law was recently reformed to lower the maximum rates to cut a break to homeowners who fall behind. But when those taxes aren’t repaid and the deed is turned over to the taxbuyer, investors like Moll can end up with a lot of properties that are worth less — or would cost more to repair — than they paid for them.

Moll didn’t return requests for comment made by The Real Deal via phone and email.

Transferring property in this way is not illegal and Moll told the Tribune that he gave the properties to Tabb because the man expressed a desire to rehabilitate and live in them. But a co-defendant in a recent city lawsuit filed against Goldmine, Damien Garrett Chiodo, said this instance of it is unethical, if true.

“I don’t know these guys. For all I know, they’re good guys and got themselves in just a pickle,” Chiodo said. “But I do know it smells bad.”

Chiodo said he became aware of Goldmine when he received notice that he was named in a city lawsuit filed against Goldmine, Moll, himself and Novacore, LLC — an Arizona-based company, now inactive, formerly managed by Chiodo and others, according to court records and business registry information.

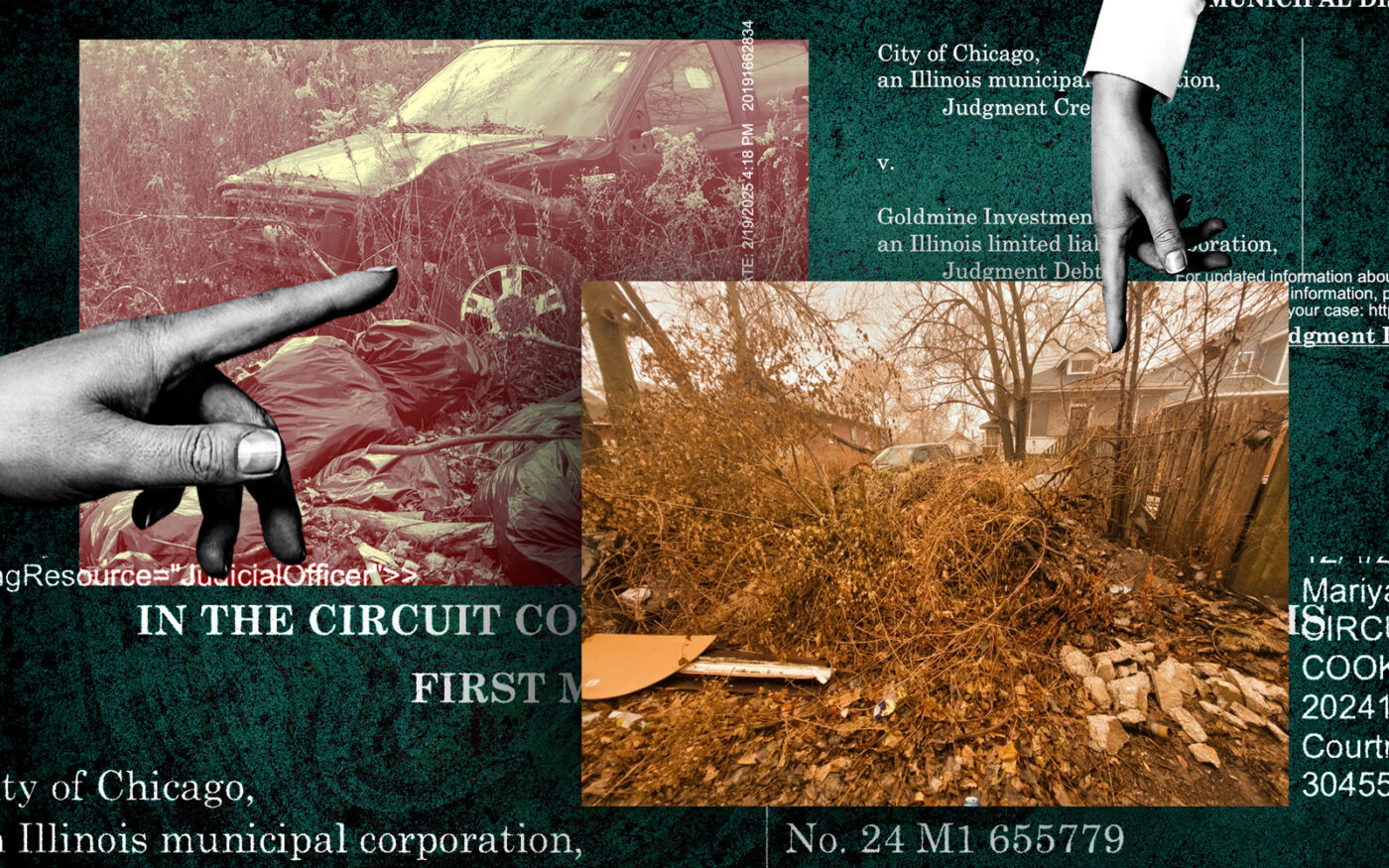

The complaint, which came in December as the city restarted gunning for Moll, centers around two neighboring properties in the South Shore neighborhood that the city claimed owners allowed to become “an illegal parking lot and dumping ground for abandoned vehicles and refuse.”

Now, this is where things get tricky.

Until 2014, a single-family home straddled the line between the two properties at 7543 and 7545 South Oglesby, so they were typically bought and sold together, but had two separate property identification numbers with the county.

In 2003, the then-owner of the property transferred the ownership to someone new and signed a deed for both properties that was only recorded against the property identification number for 7543 South Oglesby. The other property, 7545 South Oglesby, was later sold at a scavenger sale, creating a whole different chain of ownership for that parcel.

Moll’s other company, Z Financial Illinois G Properties, bought 7545 South Oglesby in 2011 and then transferred it to Goldmine via quit claim deed in 2017, property records show. Novacore acquired 7543 S. Oglesby through a quit claim deed in 2014, a deed that also included the property description of the neighboring lot.

The two properties have been in a state of neglect that the city claims is an environmental hazard to the neighborhood since 2023. So, when notices of code violations weren’t met with compliance, the city filed suit against both companies and the people they could tie to them, including Chiodo.

Chiodo, who is now the president of KeyLink, a company that helps manage distressed real estate assets for clients like banks and hedge funds, said he did not receive notice of the violations sent to the business because it has been dissolved. Arizona business registry information shows that the LLC has been inactive since 2019.

The city asked the court to order that the defendants in the case clean up the properties immediately and is seeking $4.35 million in damages, based on complaints that the owners of the properties used it as an illegal parking lot for abandoned vehicles and failed to put up required fencing or take down a falling tree, creating an environmental hazard for residents in the area.

When he received notice of the suit, Chiodo said he paid to clean up the sites as requested and is hoping to clear things up with the city as soon as possible.

“We had no idea we even owned the thing, and we’re just trying to make it right and get out from under this mess,” Chiodo said.

Meanwhile, Moll is unlikely to be absolved anytime soon as the city has moved to consolidate three cases brought against Goldmine Investments to be litigated together in Circuit Court.

QCD Financial

Hinsdale-based investor QCD Financial has been found liable “at least 1,618 times” for municipal code violations across 125 properties it owns, allegedly amassing over $3.8 million in fines and interest since 2013, according to court records.

QCD has been operating in Chicago for at least the last 11 years, and the city has been slapping the landowner with health and safety violations ever since, court records show. The company currently owns at least 123 properties across the South and West sides of the city, according to a map compiled by the city.

A Circuit Court judge granted a city motion that was filed in December to consolidate past judgements made against QCD into a single case. In the coming months, the court will weigh in on the central question that remains before the two parties: how will QCD pay its debts to the city?

Attempts to reach QCD weren’t successful.

A spokesperson for the Chicago Department of Law declined to comment on the specifics of the cases brought against QCD and Goldmine in recent months, but confirmed that the city’s special collections unit had taken “additional enforcement actions” against the two companies.

The city’s special collections unit is a group of attorneys housed under the Law Department’s Collections, Ownership, and Administrative Litigation Division that evolved out of lessons the division learned while tracking and enforcing the debt racked up by another Chicago landowner Suzie Wilson, Holtkamp said.

Wilson racked up over $15 million in fines for municipal property violations and may be barred from ever investing in Chicago real estate again as part of any settlement that might be reached in a bankruptcy case filed by her businesses in the fall, Holtkamp said. The two sides will meet to discuss the proposed settlement on April 1. It remains uncertain whether the final agreement will include a ban on investing in Chicago.

As the city’s special task force ramps up its work, it will start by focusing on about 10 more landowners that hit a certain threshold of unpaid fines and fees with the city, including QCD and Goldmine.

Read more