Bidding is now open on more than 800 parcels of land that an infamous Chicago landlord, Suzie Wilson, must sell as part of a fight with the city that led to her bankruptcy filing.

As the legal action between Chicago and Wilson is still working its way through court, the bankruptcy sale represents the largest mass sale of land in Chicago since the Great Chicago Fire over 150 years ago, according to an ABC7 report.

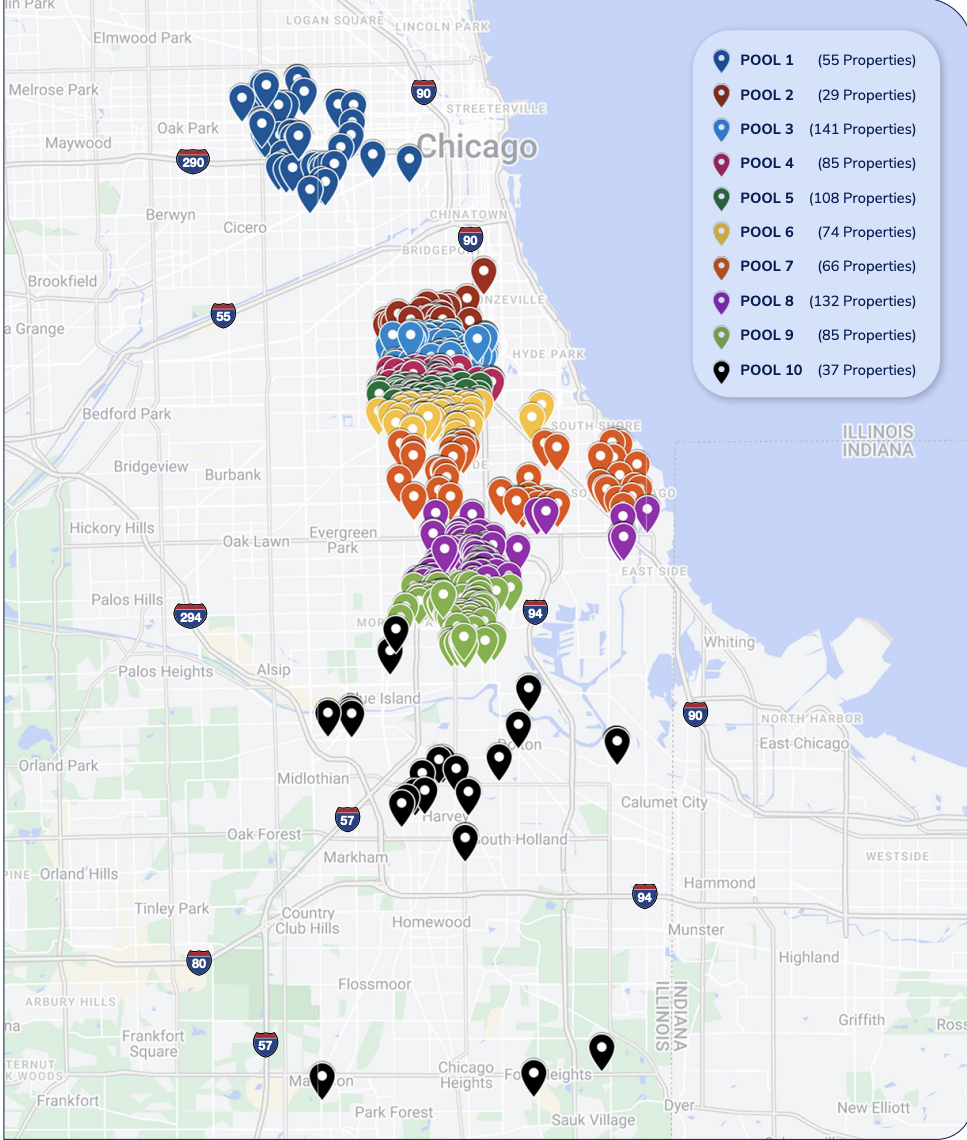

Hilco Real Estate is managing the sale and has broken the 812 properties out into 10 different “pools” based on their location in the city, though they are all on the city’s South and West Sides.

“These areas that have been overlooked for decades and underserved,” said Steve Madura of Hilco Real Estate, a financial services firm handling the bankruptcy sale. “There is a real opportunity here.”

About 60 to 70 percent of the properties are zoned residential, Madura estimated, but the portfolio also contains many commercial and industrial properties. Some of them fall along the Chicago Transit Authority’s planned Red Line train extension, or neighbor incoming developments and megadevelopments like the Obama Presidential Center in Jackson Park and the Illinois Quantum & Microelectronics Park in South Chicago, he said.

The properties are for sale individually or in any combination, but bids must be made by March 7 and are subject to court approval, according to Hilco marketing materials. If needed, there could be a second phase of property sales through an auction, Madura said.

The properties’ former owner, Northbrook resident Suzie Wilson, was dubbed Chicago’s “worst landowner” by the city after she amassed $15 million in unpaid municipal tickets for failing to address rat infestations in her buildings and dumping garbage on vacant lots.

The city filed a lawsuit against Wilson last spring seeking $10 million in damages from her and her real estate company in connection with the vacant lots she allegedly turned into dumping grounds for environmentally hazardous waste like old tires.

The lawsuit called her a “scourge on the city and its residents,” and accused her and her sister, Swedlana Dass, of hiding their wealth by transferring ownership of local properties to businesses based in South Dakota. This left their Illinois-based LLCs, which owe the city millions of dollars in fines and fees, “completely insolvent,” according to an Illinois Answers Project report.

This ultimately led to Wilson filing for Chapter 11 bankruptcy last fall under the company name B.A.S.S. & M, Inc. — a case that is still working its way through Illinois district court.

“That’s nuts and bolts the catalyst of why we’re kind of where we are now,” Madura said.

The city initially contested the bankruptcy filing, which Madura said was primarily because it wanted to make sure the city was “protected as a creditor and that things would be done appropriately” — an issue that he said has since been resolved.

Revenue generated by the sale of the more than 800 pieces of land formerly owned by Wilson will go to satisfying the debts she and her company owe to the city as well as two other lenders named in the bankruptcy case — Charles L. Walker and New York-based global alternative asset manager Nine Left Capital.

An attorney representing Wilson and various LLCs named as “interested parties” in the lawsuit did not respond to requests for comment. An attorney for B.A.S.S. & M, Inc. and other companies named as debtors in lawsuit declined to comment Monday.

The Office of the U.S. Trustee did not respond to requests for comment. A representative from the Chicago Department of Law declined to comment on behalf of the city, stating that it “does not comment on ongoing litigation.”

The city spokesperson also declined to answer questions about the land sale and whether the city is working to ensure the properties do not fall back into the hands of negligent owners.

“We are not beyond outside investment, and we are going nationally with this advertisement campaign, both locally, regionally and nationally,” Madura said. “Ultimately, our job is to maximize the value, but I don’t think that’s exclusive to also reaching out to those that would benefit most, which are the neighboring property owners, the business owners, the people who have been in these areas for generations and want to continue to be.”

Hilco has been working with the CTA and local aldermen and organizations like the South Side Community Investors Association to increase awareness of the opportunity among local developers and entrepreneurs, Madura said. Madura is working on the sale along with fellow senior vice president Joel Schneider and Michael Kneifel and Henry Nash, also of Hilco.

Read more