Amendments to an anti-gentrification ordinance covering several Northwest side neighborhoods and Pilsen were approved by the Chicago City Council Wednesday, giving clearer guidance to local tenants and landlords after its initial passage this fall stirred a frenzy within the real estate industry.

The bulk of the ordinance went into effect in October. Wednesday’s vote amended, and delayed the implementation of, a component that gives tenants the right to buy their building instead of letting it be sold to outside investors — known as the right of first refusal.

Meant to prevent the area’s naturally occurring affordable housing — particularly two- to four-flats — from being replaced with pricey residential developments, the provision requires landlords to notify tenants when they intend to sell and give them time to match the bid of a third-party buyer.

This portion of the ordinance has by far received the most backlash from real estate industry groups, like the Neighborhood Building Owner’s Alliance, who say it will delay the sale of buildings, discourage investment in the area and, ultimately, could lead to depressed property values.

“The amendments make a very bad ordinance slightly less bad. And we’re opposed to the whole thing,” NBOA President Mike Glasser said. “There is really no series of amendments, outside of outright repeal, that would make any sense to those of us who are in the industry.”

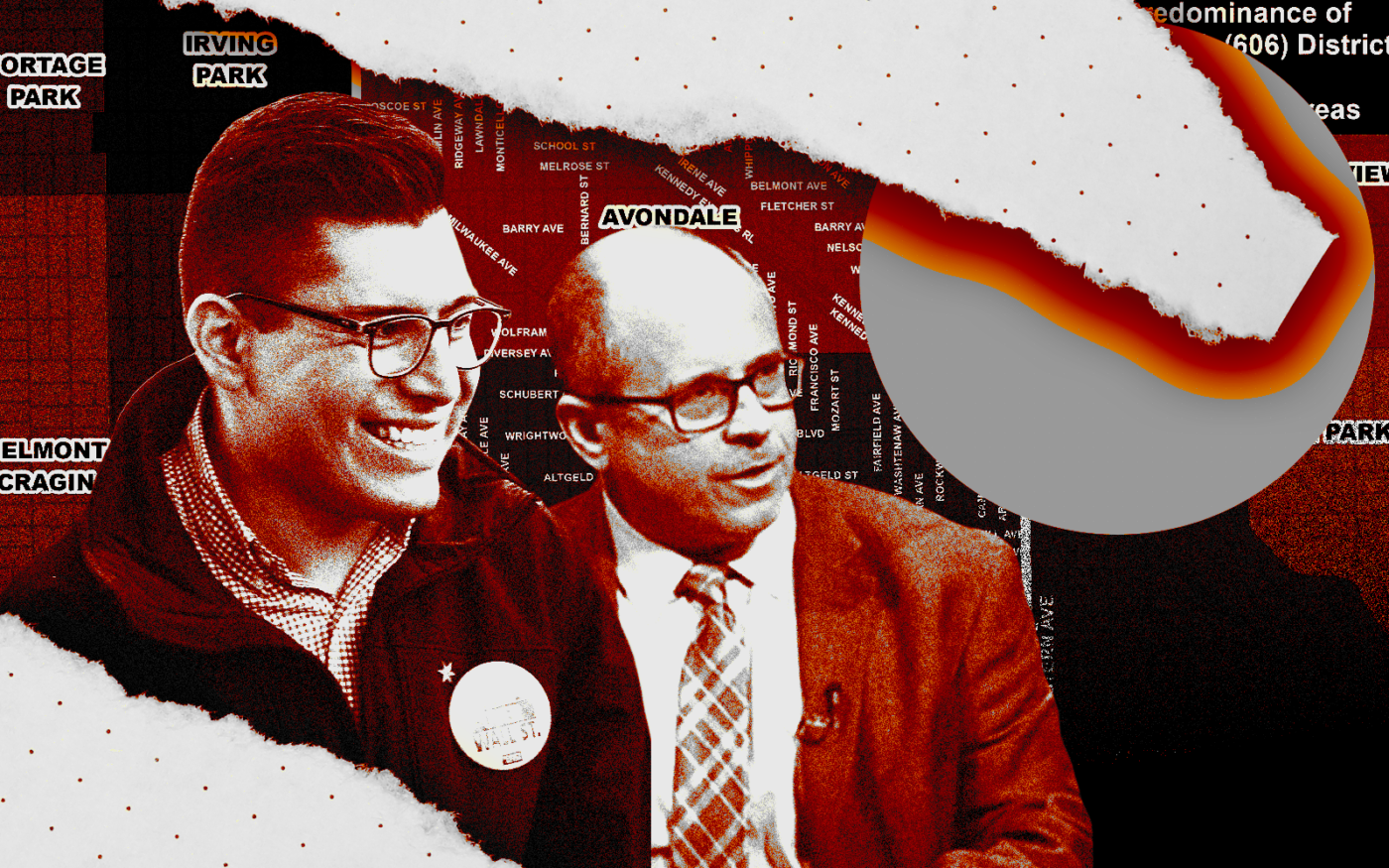

The Northwest Housing Preservation Ordinance applies to Logan Square, Avondale, Hermosa, Humboldt Park, West Town, as well as a portion of Pilsen – a neighborhood on the Lower West Side. The Northwest side neighborhoods covered by the ordinance began gentrifying rapidly about 10 years ago when developers started tearing down two- and three-flats and replacing them with luxury homes along the 606 trail. The area lost 6.1 percent of its two- to six-flat buildings between 2013 and 2018, according to the DePaul Institute for Housing Studies.

One of the ordinance’s aldermanic sponsors, Carlos Ramirez-Rosa, said he pushed to delay implementation of the right of first refusal until March 1, in part to meet concerns from the industry. The city worked with the Chicago Association of Realtors and others in the industry to do so, he said.

Though it maintained its opposition to the ordinance as a whole, the Chicago Association of Realtors filed a letter of support for changes made this week to the city’s planning and zoning committee.

The first amendment requires tenants to get pre-approval from a lender in order to buy properties of four units or fewer and, for larger buildings, tenants need a lender’s letter of intent. This was done in response to industry concerns around tenants potentially making bad-faith offers just to delay a sale.

“We really don’t see how it is that any group of tenants, or their assignees, can legitimately gain control of a building and run the building any better or more affordably,” Glasser said.

Tenants’ right of first refusal, also known as the Tenant Opportunity to Purchase Program, already exists in Chicago’s Woodlawn neighborhood as well as the Washington, D.C., metro area and various other communities across the country, Ramirez-Rosa said.

In the metro area just outside of D.C., this right has been used to purchase about 1,500 units, Ramirez-Rosa said. He said he was not sure if the right has been used to buy a building in Chicago’s Woodlawn neighborhood, located just south of Hyde Park. The Woodlawn program, however, only applies to buildings with 10 or more units, and Ramirez-Rosa said it can be more challenging for tenants to secure financing on larger buildings.

Ramirez-Rosa, whose 35th Ward is located in the heart of the pilot program area, said he anticipates that the right of first refusal will be utilized most frequently to purchase rental buildings within the one- to four-unit range, which are easier to finance.

These smaller buildings have the shortest timeframe, too, he said. Sellers only have to provide renters with a 30-day notice of intent to sell and then renters have 15 days to exercise their right of first refusal, compared to 60 and 90 days, respectively, for larger buildings.

The second change states that the pilot program will terminate at the end of 2029 unless renewed, another point of concern voiced by members of the NBOA in an October conference call.

The final amendment pushes the Tenant Opportunity to Purchase Program back to March 1, which Ramirez-Rosa said will give more time for landlords, brokers and tenants in the area to better understand and prepare for the program.

The vote to pass the amendments Wednesday morning was nearly unanimous, with one dissenting vote cast by Alderman Anthony Beale of the 9th Ward.

Another portion of the ordinance, already in effect, increased the area’s demolition surcharges from $5,000 per unit and $15,000 per building to $20,000 per unit and $60,000 per building.

The pilot program also increased the density of zoning in the area to support the creation of more affordable housing, allowing for two-flats to be built “by right” – without the need for a zoning change – in any RS-3 areas previously earmarked for single-family homes.

“We’re looking at all of the different tools to promote housing affordability and we recognize that building more housing is a key component of that,” Ramirez-Rosa said. “We’re hoping that this helps pave the way for a citywide expansion of allowing new multi-family by right.”

Many in the real estate industry favor more flexible zoning as an affordable housing solution, including Brie Schmidt, a landlord in the area and managing broker at Second City Real Estate. Still, Schmidt said she opposes the ordinance as a whole, citing concerns with the increased demolition fees and the tenants’ right of first refusal.

Finally, the ordinance disallows the construction or conversion of buildings to create new single-family homes on any block where the majority of housing is made up of multi-family buildings, also known as “predominance of the block,” Ramirez-Rosa said.

Editor’s note: This story was updated to clarify the amount of housing purchased by tenants in Washington, D.C.

Read more