Chicago commercial landlord Ruben Espinoza’s legal and financial troubles look set to follow him into the new year.

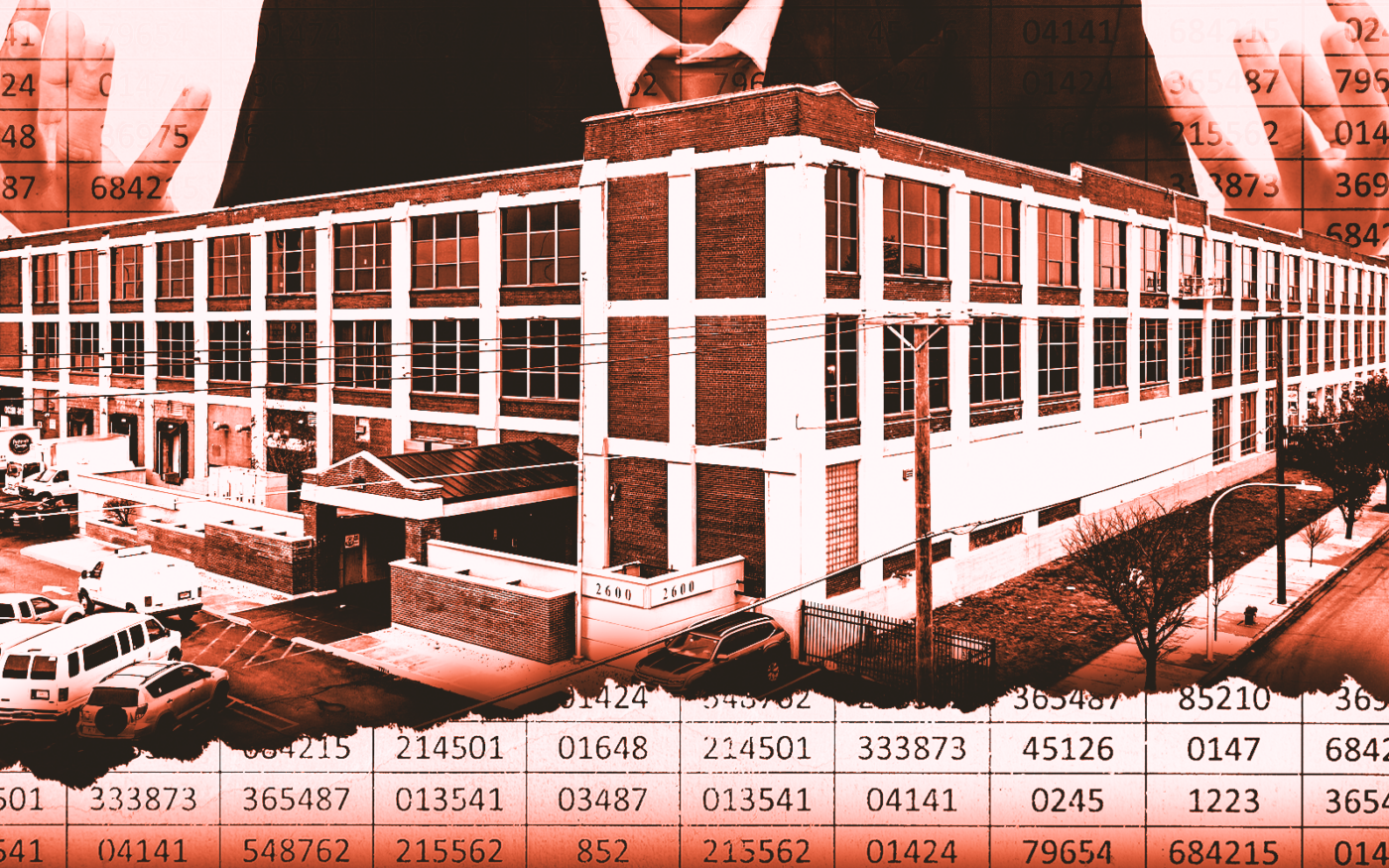

A $35 million loan Espinoza took out on an warehouse-style retail property known as the Chicago Business Center is headed to special servicing — which is normally a sign of financial trouble — after he fell behind in debt payments this September, CMBS loan data collected by Morningstar Credit shows.

Prior to falling behind on his payments, Espinoza was headed for trouble with the two-building property between Little Village and Brighton Park after a studio production company tenant decided not to renew its lease, according to loan commentary.

The production company is the building’s largest tenant, renting over 100,000 square feet percent of the property’s total 671,000 square feet of space. A Cushman & Wakefield flier marketing the property for lease shows there’s up to 300,000 square feet in the property available.

Espinoza has long owned the property. He took out a $22.8M fixed rate loan with a 3.65 percent interest rate for the property in 2017 and refinanced it in 2022 with a $35 million loan that’s now in default. That loan, issued by Franklin BSP Realty Trust before being packaged with other commercial real estate debts and sold off to investors, is also fixed at a 3.69 percent interest rate and matures in January 2032.

But problems surrounding the property aren’t limited to the missed payments and vacant space. It is also at the center of a legal squabble between a prospective tenant and Espinoza.

On Aug. 1, a local soccer club was supposed to move into Espinoza’s warehouse space at 2600 West 35th Street. The club was unable to move in, however, because a furniture store that occupies the space had yet to move out, despite Espinoza’s assurances that the retailer would vacate by June 1.

The club had planned to retrofit the space as an indoor soccer facility with a bar but was unable to get into the premises before or even after the lease’s scheduled start date and ran into zoning issues that the club claims hadn’t been discussed in the process of securing the lease, which was set to cost $52,000 per month in rent.

In late July, the club sued Espinoza claiming he refused to refund its $330,000 security deposit despite its inability to use the space. Espinoza has yet to file a response. He and legal representatives of the soccer club did not respond to requests for comment.

The challenges at 2600 West 35th Street join a series of legal and financial issues that have recently faced Espinoza.

They include:

- A lawsuit filed by an investor who alleges Espinoza has failed to pay back a $3 million debt

- A court order from a judge to pay $557,000 in insurance proceeds to a receiver

- Delinquent loan payments on a $9.6 million River North office portfolio

- A $3.1 million foreclosure on a bridge loan for a suburban Bloomingdale hotel redevelopment plan that was backed by a personal guarantee signed by Espinoza

- A recently completed $21 million foreclosure on an office building at 19 South LaSalle Street

The array of struggling properties comprise the majority of Espinoza’s mostly Chicago-based real estate portfolio, according to his former website, which appears to have been taken offline in recent weeks.

Read more

Amid the legal drama, Espinoza along with investor Igor Gabal, claimed in October to have struck a deal to buy the historic Burnham Center office building at 111 West Washington Street. The deal has yet to be recorded in Cook County property records. Espinoza and Gabal also purchased the historic 300 West Adams office building in the Loop out of distress, in a deal that has also faced legal challenges from investor John Thomas who claims he was wrongly cut out of the deal. So far, a judge has sided against Thomas in the case but he may appeal.