The future of a shuttered Bloomingdale hotel is uncertain now that embattled investor Ruben Espinoza may have to dip into his personal assets to pay off a defaulted loan tied to the property.

If he can’t come up with the money, while facing several other legal battles, the property may end up in the lenders’ hands with redevelopment plans put on pause.

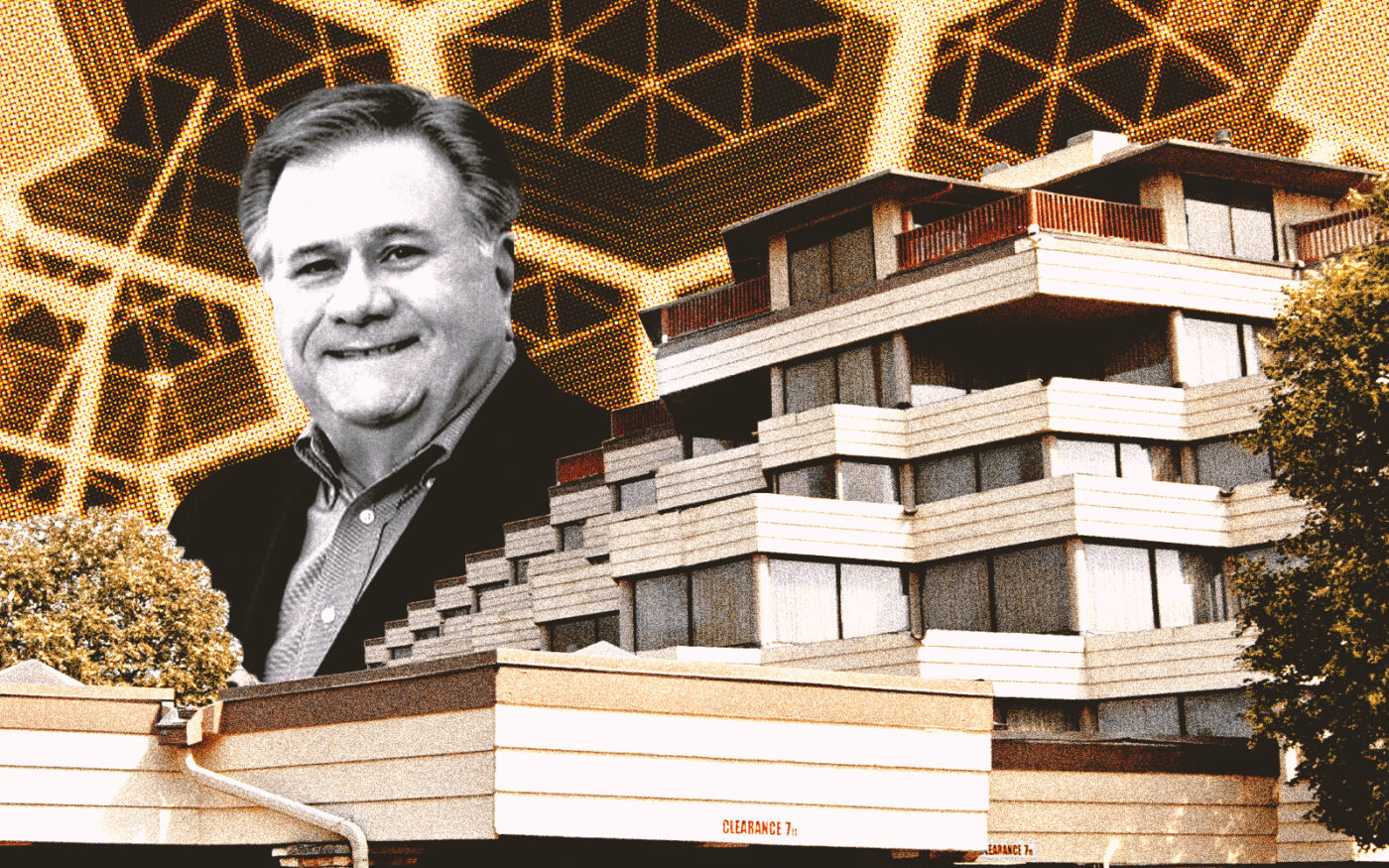

Espinoza and hospitality executive Robert Habeeb Jr. bought the 300-room Indian Lakes Hotel with a $3.8 million loan in 2022. They refinanced that loan ahead of its maturity date this spring with Chicago-based lender CRE Bridge Capital.

The missed payments, which started June 1, plus late fees and an exit fee implemented by the lender add up to about $200,000, all of which could be covered by escrow money that the Habeeb-Espinoza venture put down when the loan closed.

But the borrowers’ monthslong failure to make interest payments set off a domino effect and constituted a default on the full loan amount, according to the lawsuit. As a result, CRE Bridge Capital had the right to request that the borrowers repay the $3.1 million principal or risk losing the property altogether.

Last month, Espinoza told The Real Deal that the dispute was a “misunderstanding” between the ownership group and the lender.

But an attorney representing Espinoza and Habeeb signed a “confession of judgment” on behalf of the duo, which admits that they owe CRE Bridge Capital the full $3.1 million requested via the lawsuit. A personal guarantee signed by Espinoza puts him on the hook for curing the default using personal funds. Although Habeeb signed mortgage and deed-related documents, he did offer a personal guarantee.

Meanwhile, Espinoza is facing several other lawsuits, alleging he owes investors, lenders and a commercial tenant upwards of $4 million.

The lawsuits include allegations that Espinoza failed to pay back a $3 million promissory note, owes nearly $600,000 to a receiver and kept a security deposit from a potential commercial tenant without making the agreed-upon rental space available.

Espinoza — who runs NDR Holdings — has a real estate portfolio that primarily consists of several office, retail and industrial buildings in downtown Chicago and the surrounding area. In addition to the Indian Lakes Hotel, Espinoza’s firm’s website also lists a Rosemont Hyatt as a part of its portfolio.

The lawsuits against Espinoza bubbled up this summer and are still working their way through the court system.

It could be some time before plans for the Indian Lakes Hotel get back on track, if they resume at all.

It’s been a long road for the property since local authorities shut the hotel down after a shooting at the hotel that left one person dead and several others injured.

The resort’s previous owner was Habeeb’s former firm First Hospitality Group. Its business license was revoked by the Village of Bloomingdale in 2021 following the shooting.

Read more

A year later, Habeeb and Espinoza bought the property through Habeeb’s new firm, Maverick Hospitality, which planned to fully renovate and re-open the resort. Habeeb and Espinoza planned to pour $30 million into renovations to the property, the Northwest Herald reported. The golf course portion of the resort had already been sold off to the Village of Bloomingdale for $8 million two years prior.

When the partners refinanced with CRE Bridge Capital, they were also looking for a separate lender to issue a construction loan that would fund renovations for the hotel, a LinkedIn post from CRE Bridge Capital stated.