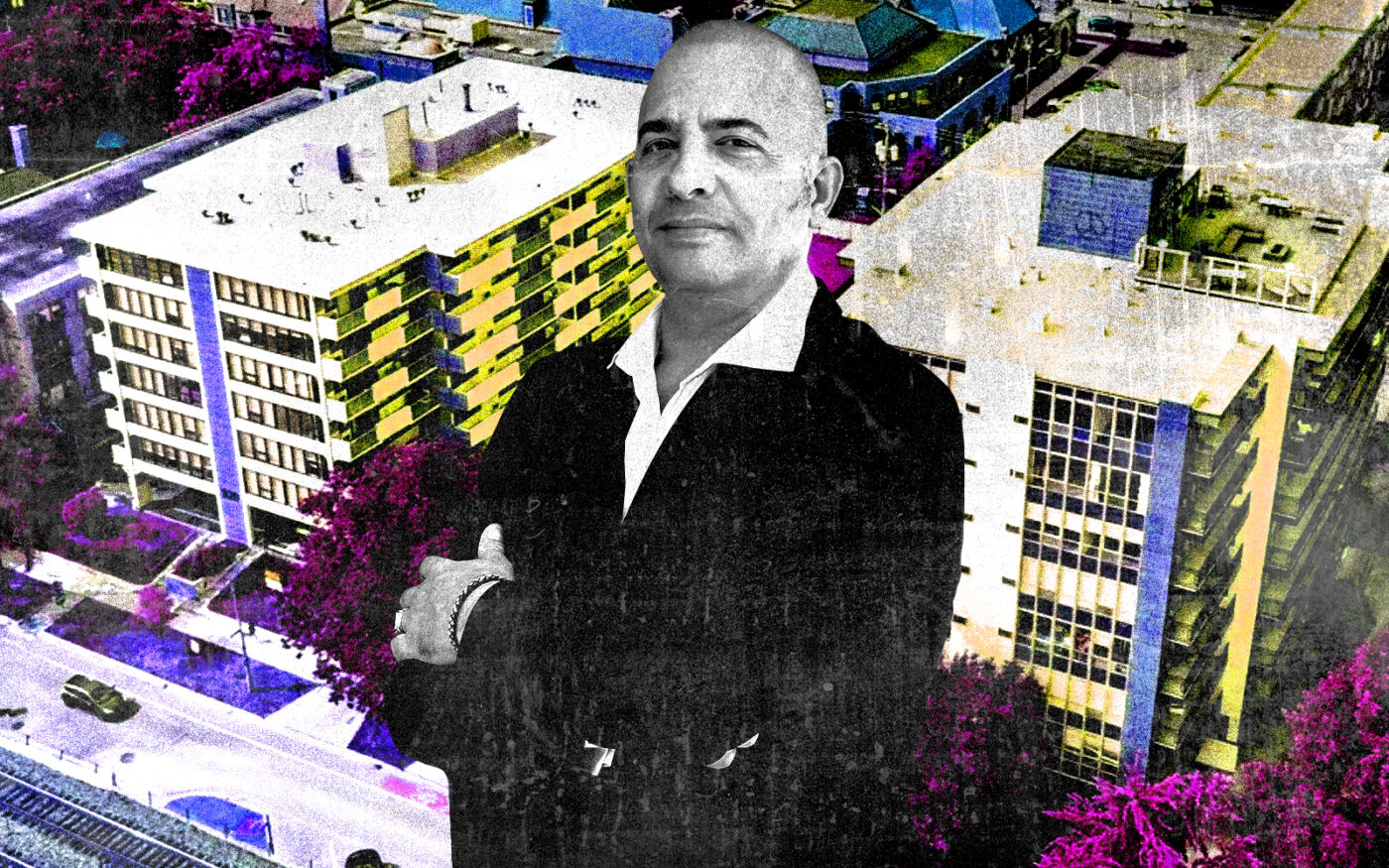

Hadar Goldman’s portfolio of thousands of Chicagoland apartments is at risk of shrinking due to a big loan default in suburban Oak Park.

The Israeli businessman is more than three months behind in paying a $25.5 million floating interest rate loan for the two-building, 104-unit complex known as the Rhythm & Blues Towers in the suburb just west of Chicago, according to loan servicer commentary compiled by Morningstar Credit. The loan amount comes to $245,000 per unit.

The loan servicer, hired on behalf of the debt’s originator, Ready Capital, claimed last month that Goldman defaulted on the deal in July and hasn’t fixed the issue since. The landlord, however, has signed a pre-negotiation agreement with the loan servicer, which allows the lender and borrower to discuss how to resolve the distressed loan.

The debt wasn’t scheduled to mature until March 2025, meaning the landlord failed to pay the monthly debt service costs to trigger the default. The Federal Reserve recently made a cut to interest rates, slicing costs for many floating rate borrowers, but Goldman looks to be one of a handful of real estate players to have struggled with floating rate loans amid the central bank’s rate-hike campaign that began in early 2022.

Goldman, in multiple conversations with The Real Deal, denied the default would linger. He first insisted he would avoid defaulting on the debt in late July, saying at the time he had a new lender preparing to refinance the property. He reiterated that he was set to close on refinancing earlier this month, but there has been no sign of a new loan, and the property is being shopped for sale.

“The lender and us have reached an agreement that we shall refinance or sell in a few months,” Goldman said, adding the buildings are nearing fully leased.

The property was listed about a month ago with Chicago-based midmarket multifamily brokerage Essex Realty Group, with broker Brian Karmowski leading the listing. People familiar with the offering said the seller is seeking about $30 million, which market experts acknowledged as a high price for the asset. Karmowski declined to comment.

KeyBank, the special servicer for the loan — which Ready Cap sold off to investors in securitized real estate debt instruments — also declined to comment.

Goldman bought the Oak Park buildings — which were developed in 1969 — for $8.3 million in late 2019. He then took out the loan from Ready Cap last year with the intent to refinance his previous acquisition loan and to renovate the buildings in order to increase rents.

Read more

The Essex listing shows Goldman poured nearly $8 million into renovations, which have been completed. The buildings are nearly fully leased, with a handful of units still vacant, people familiar with the property said. But the asset wasn’t cash-flowing as the floating rate loan’s debt costs rose while much of the property had to be kept vacant during renovations, loan servicer commentary shows. The landlord had to kick in nearly $1 million out of pocket so far this year to cover the property’s expenses and the costs of debt service, and it was $2 million in 2023, loan data shows.

It remains unclear how Goldman intends to resolve the default. It’s not the first time he’s been involved in a complicated sale process in recent years. He listed a portfolio of about 1,700 units of workforce housing on the South and West sides of Chicago over a year ago with a CBRE team, and he suggested it could fetch $200 million, but it hasn’t sold so far.