Real estate brokerages still haven’t escaped.

Illinois homebuyers last week sued three more national brokerages last week, claiming that their participation in the National Association of Realtors’ policies around broker commission amounts to “collusion” and “anti-competitive behavior.”

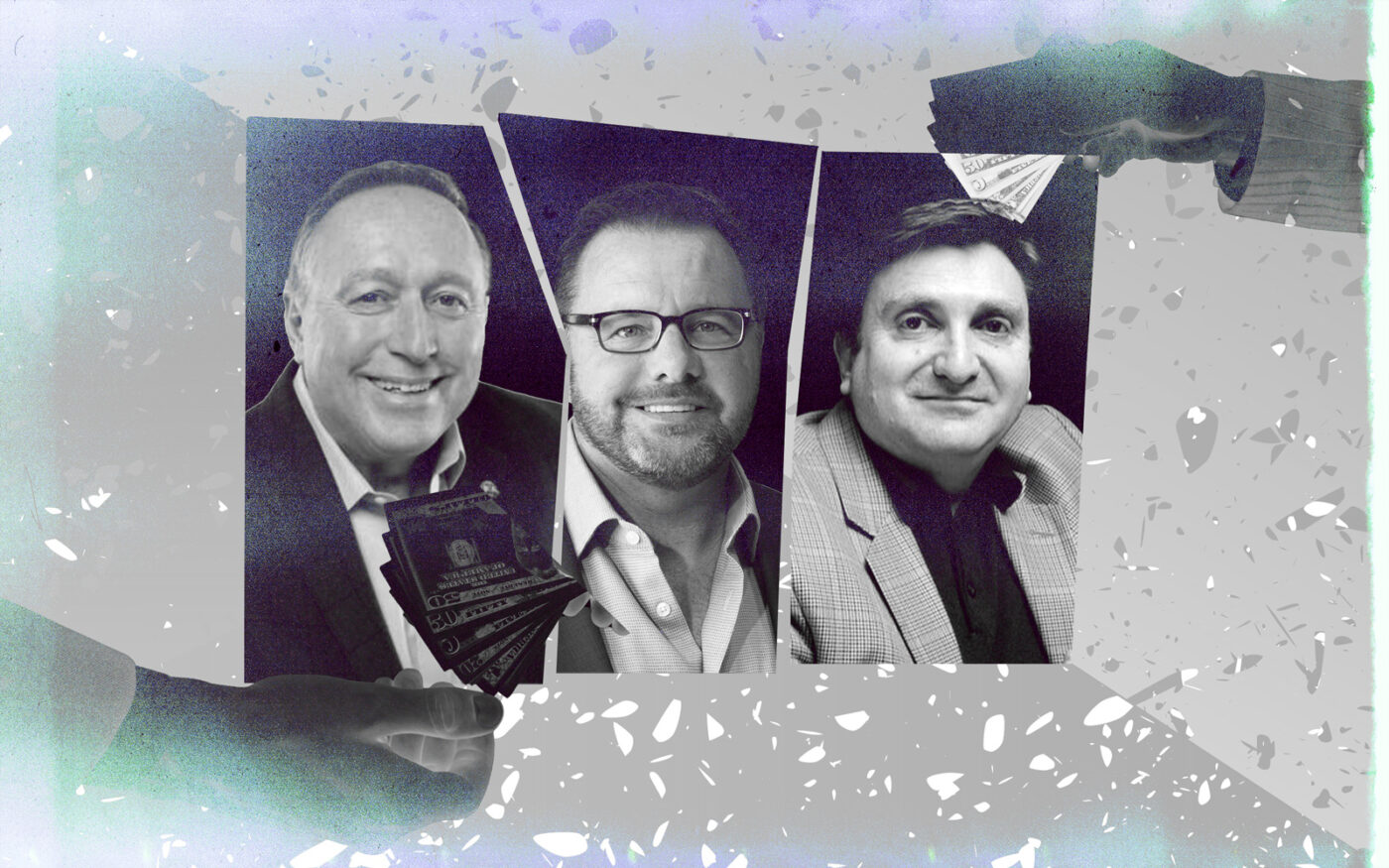

The federal antitrust lawsuit names Equity Real Estate, HomeSmart International and Fathom Realty and names NAR, multiple listing services affiliated with NAR and NAR-affiliated brokerages and realtor associations as co-conspirators.

The plaintiffs — Dawid Zawislak, who bought a Chicago home in 2021, and Michael D’Acquisto, who bought in west suburban Bartlett in 2022 — are seeking class action status and demanding a jury trial.

The lawsuit shows that even after NAR’s August policy overhauls — driven by its settlement of a similar case, known as Sitzer/Burnett — the country’s biggest residential brokerages remain in the hot seat.

Theirs isn’t the only antitrust case home buyers are battling out in Illinois federal court. Two other Illinois-based lawsuits, known as Batton 1 and Batton 2 after lead plaintiff Mya Batton, have been filed against a slew of national brokerages.

Attorneys for the plaintiffs in those lawsuits, the first of which was filed in 2021, have struggled to tie all of the plaintiffs and defendants to the jurisdiction of the Illinois federal court, and the cases against many of the brokerages named in the cases have since been dismissed.

Like other similar suits filed in recent years, D’Acquisto and Zawislak claim that NAR’s broker commission policies constitute “agreements among real estate brokers who would have otherwise been competing,” according to the complaint.

Specifically, the lawsuit takes issue with NAR’s long-held policy, before the August changes, that required listing agents to offer a portion of their commission paid by the seller — a rate that typically hovered around 5 or 6 percent — to the buyer’s agent and advertise this offering on the MLS.

NAR also used to allow buyer brokers to “filter searches for properties by commission amount, and NAR ethics rules allowed buyer-agents to show these filtered properties with higher commissions to buyers,” the lawsuit alleges.

This is significant because MRED, the local multiple listing service in the Chicago area, requires agents to be members of NAR to list homes, and buyers have little choice but to use the MLS to find a home, meaning there is little opportunity for brokers and buyers to work outside of the system, the lawsuit claims.

This caused buyer agent commissions to become “artificially elevated,” which was “ill-understood by the homebuyers” paying those commissions, the lawsuit claims. The commission rates historically charged by brokers would “not exist in a competitive marketplace,” the suit alleges.

As of the Aug. 17 deadline for NAR’s policy changes, listing agents can still split commissions with buyer’s agents if sellers agree to it, but this information can no longer be made public to buyer’s agents through the MLS. Also, buyer agents must now sign a written exclusivity agreement with buyers outlining how they will be paid before touring any homes.

A NAR representative declined to comment on the new lawsuit. Equity Real Estate, HomeSmart International and Fathom Realty did not respond to requests for comment. An attorney for the plaintiffs also did not respond to requests for comment.

When a judge found NAR and two brokerages guilty of collusion in the landmark Sitzer/Burnett case last fall, the association said that changing its policies would disadvantage first-time buyers and others who may not be able to afford representation if they had to pay for their broker’s commission out of pocket.

Only time will tell, but plaintiffs in the latest lawsuit filed in Illinois claimed the old way of doing things was misleading and “opaque” to buyers.

“The NAR ethics code permitted and encouraged buyer agents to advertise their services as ‘free,’ despite the fact that buyer agents are in fact paid a commission from the sale price of the home that the buyer pays,” the complaint reads. “Current NAR regulations also limit physical access to houses for sale to only NAR members, further reducing competition from unaffiliated brokers.”

The defendants have yet to file a response to the lawsuit, which was filed in the Northern District of Illinois federal court, and assigned to Judge John Robert Blakey.

The plaintiffs claim the lawsuit should be litigated in Illinois because the named plaintiffs bought homes there, the defendants operate in the district as well as nationally, and NAR is headquartered in Chicago, according to the complaint.

Damages in the case exceed $5 million and there are more than 100 potential class members who may join the case, according to the lawsuit. The plaintiffs are seeking “treble damages,” which allows the court to award three times the damages determined by a jury, as well as the compensation of attorney’s fees and “injunctive relief,” meaning some kind of action or policy change.

Read more