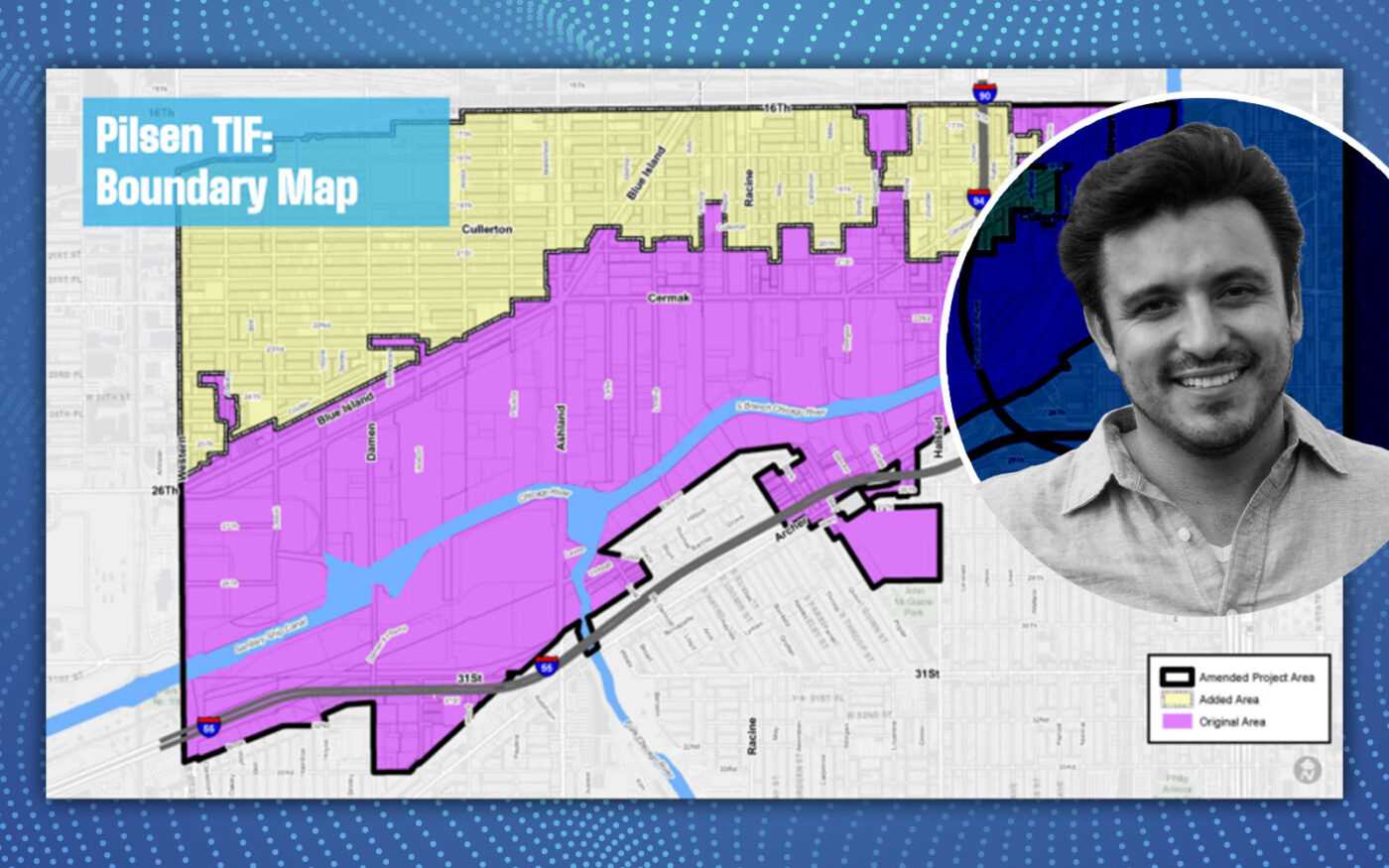

Alderman Byron Sigcho-Lopez is facing mounting resistance to his proposal to expand the Pilsen tax increment financing district in his Southwest Side ward.

Sigcho-Lopez, a progressive voice who has often been critical of TIFs, argued that expanding Pilsen’s will help fund critical public works and offer relief to residents overwhelmed by rising property taxes, the Chicago Tribune reported.

However, resistance to the plan is evident, with signs along Ashland Avenue reading, “Pilsen no se vende se defiende | No TIF expansion | Pilsen is not for sale,” signaling frustration from some community members.

Under his proposal, the Pilsen TIF district would grow by more than 685 acres, capturing nearly $1 billion in property tax revenues over the next decade, a significant increase from the $115 million projected from the current TIF.

About $440 million of the expanded TIF budget would go to public works, such as school repairs, park improvements and affordable housing projects, including Casa Yucatan and a development at 18th and Peoria, according to the city’s planning department.

Still, many remain skeptical. Alderperson Nicole Lee, whose 11th Ward includes part of the current TIF, expressed concerns over the expansion’s size and scope. Alderperson Julia Ramirez is also hesitant, unsure of how the expanded TIF would benefit constituents in nearby McKinley Park and Brighton Park.

The debate around TIFs often centers on their ability to trap property tax revenues within a specific area, limiting the funds available for schools and other citywide services. Opponents argue that Pilsen’s growth and rising property values make it an inappropriate candidate for TIF funds, which are intended to spur development in “blighted” areas.

The larger issue is how the system diverts property taxes from other essential services, said Javier Ruiz, a tenant organizer with the Pilsen Alliance.

“Whether they’re used for a good cause or not, TIFs in general still work by diverting property taxes away from the normal taxing bodies like CPS, Cook County, etc. So you could say ‘We’re going to use the money for a good cause,’ but you’re still diverting the money from other neighborhoods,” Ruiz said.

— Andrew Terrell

Read more