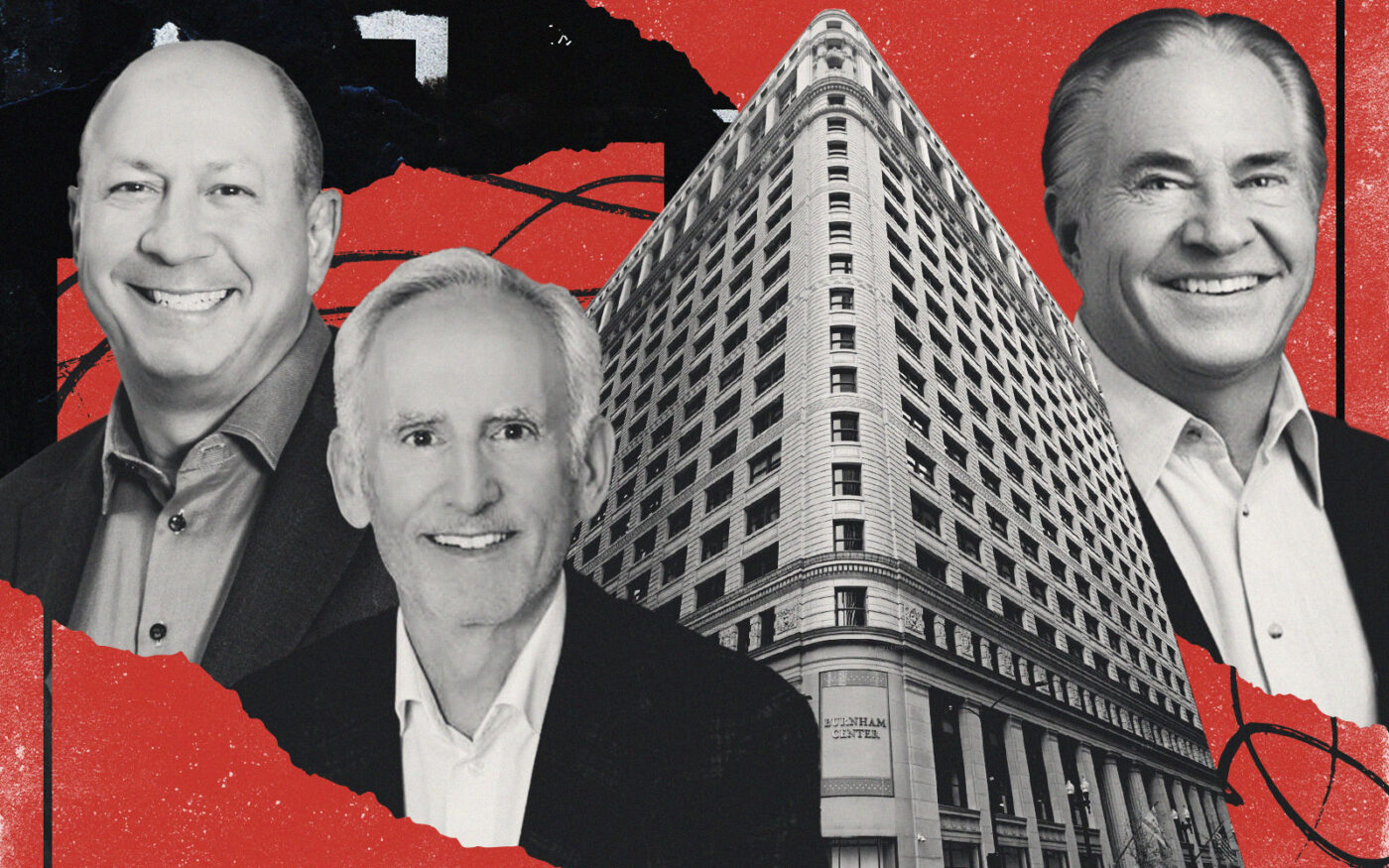

After failing to find a buyer, Golub & Company appears set to surrender the Burnham Center, the Loop office tower that was famed architect Daniel Burnham’s last project before he died in 1912, foreclosure documents reveal.

Wells Fargo, on behalf of a trust, this week filed a foreclosure lawsuit against an affiliate of Jay Shidler’s Shidler Group for failing to make payments toward a $42 million loan issued for the land at 111 West Washington Street, where Golub had an interest in the 21-story building.

Chicago-based Golub bought the 584,000-square-foot Burnham Center office building in 2019 and entered into a ground lease agreement with Shidler. At the time, Golub took out a $75.4 million loan with CIT Group to fund the $80 million purchase.

That deal solidified Shidler’s move to split the ownership of the building from the land, as Shidler had purchased the entire property for nearly $95 million in 2012. When Golub bought the leasehold interest in the building, it was required to make regular ground rent payments to Shidler.

Legal filings show that Golub terminated its ground lease with Shidler, potentially leading Shidler to begin missing payments in April on the loan issued by Wells Fargo for the land. The lawsuit alleges Golub failed to make its ground lease payments earlier this year, and claims the Shidler affiliate that owns the ground failed to cure the tenant’s default.

Shidler owed the trust represented by Wells Fargo $39 million as of last week, the foreclosure filing states. Wells Fargo is requesting that John Rothschild of Newmark take over the land as a receiver to steer the property through the foreclosure process.

Wells Fargo didn’t respond to a request for comment, and CIT did not respond to requests for comment. Golub & Company and Shidler Group did not respond to requests for comment.

The lawsuit marks at least the third instance of a ground lease issued by Shidler playing a role in the demise of a major Chicago-area office building. There’s a Shidler ground lease still intact at 300 West Adams Street, where a separate lawsuit is playing out between investors who claim its owner Igor Gabal cut them out of a deal to buy the property at a huge discount through a foreclosure sale. Another Shidler affiliate previously owned the building and surrendered that portion of the property to its lender while keeping ownership of the ground.

A similar situation played out near O’Hare International Airport. Lender Varde Partners seized the 627,000-square-foot Triangle Plaza complex’s leasehold interest from a Shidler venture known as Alliance HP after it failed to pay off a $78 million debt tied to the asset, even as a separate Shidler venture continued to own the underlying land.

Back at the Burnham Center, the future of the building itself is unclear. It’s uncertain whether either Golub or its lender CIT Group have a path to recoup their investments, as ground owners and their lenders traditionally have senior interests in a property over leasehold owners.

Golub hired Cushman & Wakefield to put the struggling Loop office building on the market last year but it appears the firm has yet to find a buyer. At the time, the building was struggling to stay afloat financially and had an occupancy rate of just under 65 percent. In March, the building took another hit when a big tenant, food delivery service GrubHub, signed a sublease in the Merchandise Mart for 95,000 square feet, a major downsize from the 164,000 the company had leased in the Burnham Center.

Golub has also taken some wounds in the office market as low demand for workspace coming out of the pandemic combines with higher interest rates to make it financially untenable for many landlords to refinance or pay off debts secured by their properties.

Golub surrendered a four-building office complex in suburban Oak Brook after buying it for $58 million in 2014 and then spending another $26 million on upgrades after it was refinanced in 2019.

Golub is also expected to take a loss on 444 North Michigan Avenue, where it has an interest in the property along with its frequent partner CIM Group. The ownership earlier this year missed a deadline on a $123 million debt owed to a Blackstone vehicle for that 36-story building, and it’s since been marketed for sale in an offering expected to draw about half the value of the debt.

Meanwhile, Golub is gearing up to lead one of four office-to-residential conversions city officials have agreed to help subsidize, in return for the developers committing to make 30 percent of the resulting apartments affordable to households earning percentages of the area median income. Golub is teaming with Corebridge Financial to turn the lower portion of the 43-story building at 30 North LaSalle into 349 apartments. The $143 million proposal would yield 105 affordable units.

TRD’s Sam Lounsberry contributed reporting.

Read more