Daniel Moceri’s first foray into office development never had a chance to come out ahead.

The 210,000-square-foot building his firm developed in Chicago’s Loop has encountered setback after setback, including that it opened in mid-January 2020, as the pandemic began to take hold and rapidly drained offices of people and value.

An eviction fight with coworking company Firmspace over its 35,000-square-foot lease wrapped up earlier this year with a $1.2 million judgment for the landlord. Now the 20-story building is just 50 percent leased, according to a report by its lender from last month, collated by Morningstar Credit.

It’s likely to have a new owner by the end of the year, as its lender angles to seize the property through a deed in lieu of foreclosure before $57 million in debt backed by the building matures in December, loan data shows.

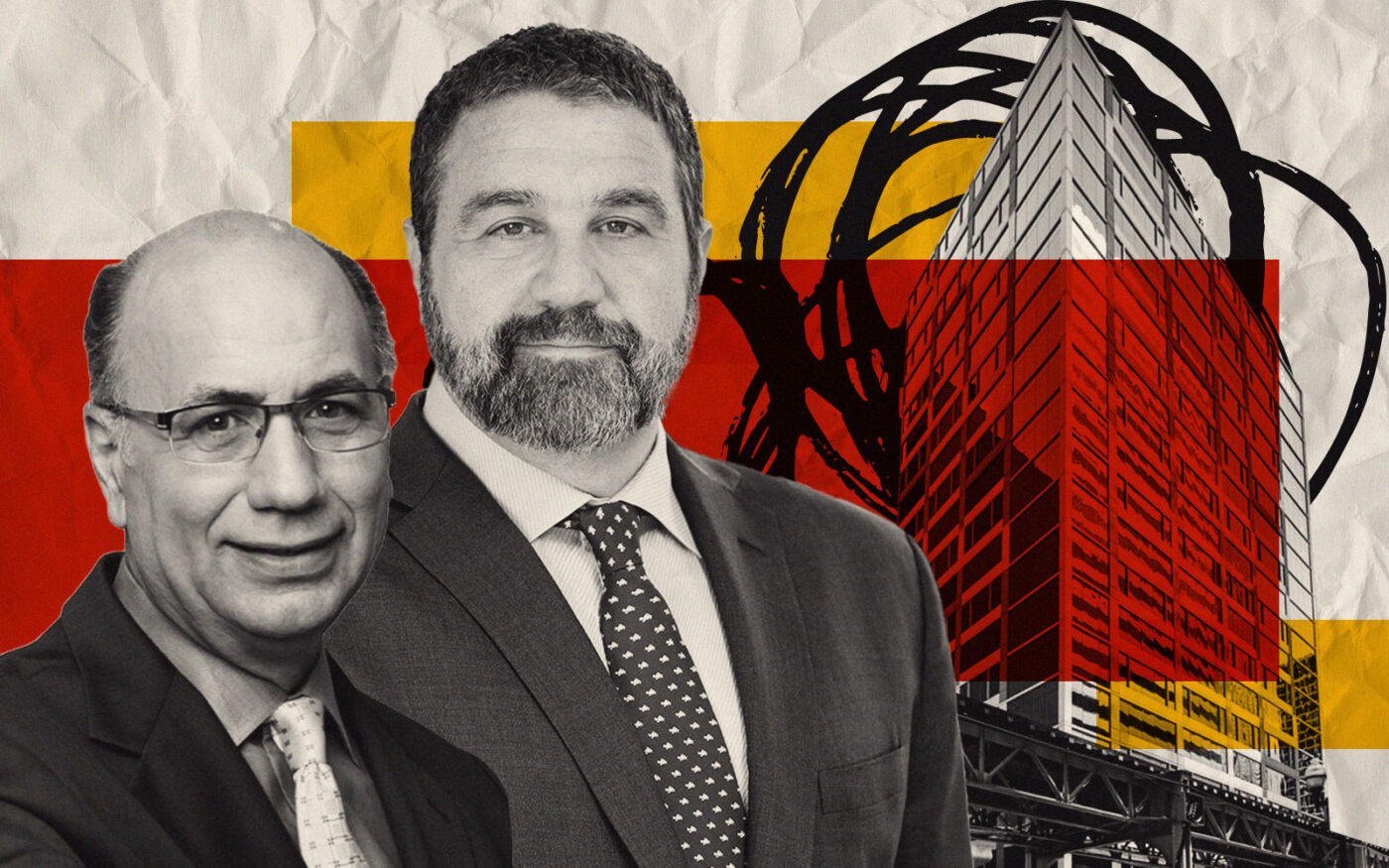

Moceri, co-founder of Convergint Technologies, and representatives of Thomas Roszak Architecture, which partnered with Moceri on the project, didn’t return requests for comment. An attorney for the developer’s ownership LLC also didn’t return a request for comment. The Chicago-based firm Moceri + Roszak has developed apartment buildings previously, but 145 South Wells was its debut office project.

An affiliate of New York-based private equity giant Fortress Investment Group originated the 145 South Wells loan in 2021 to help the developer refinance its construction loan. Fortress loaned Moceri $55 million initially and promised to forward another $16 million to the developer to help fund leasing commissions and other costs of luring tenants. The loan’s remaining balance to be paid off was $57 million as of last month.

Moceri doubled down on the project during the refinancing, as it had to chip in nearly $14 million to pay off its $71.9 million construction debt package taken out in 2018, according to loan data and public records.

The construction debt was secured well before the developers could have known a health crisis would hammer commercial real estate. Before refinancing with Fortress, the developer had previously put more than $20 million of equity into the project, loan data shows, meaning it will be a $34 million loss of equity if the property is surrendered to its lender.

While the loan from Fortress gave Moceri a chance to turn the property around and generate some leasing momentum, interest rate hikes beginning in 2022 presented yet another hurdle that further chipped away at the property’s value.

It was appraised at $78 million while the Fortress loan was negotiated, loan data shows, but it’s likely worth less today as it continues to struggle with vacancy and seeks to collect back rent from Firmspace, which suddenly vacated its lease in November, leaving behind furniture and other personal property.

A Fortress affiliate that’s acting as the loan’s special servicer — a role activated when a borrower falls into trouble with paying off a loan — is the decision-maker for how to work out the troubled debt, according to a person with knowledge of the matter. Fortress didn’t return a request for comment, and Wells Fargo, the loan’s master servicer, declined to comment. Fortress sold off a portion of the loan’s interest after originating the debt, to investors in the commercial mortgage-backed securities market, making details of the property’s performance public.

“The current interest rate environment, combined with the volatility in the office sector has impeded the sponsor’s ability to execute their business plan and increase occupancy,” Wells Fargo said in its June report on the loan.

Of course, Moceri is far from alone, as financial distress rocks commercial real estate borrowers, especially those who used now-struggling office assets as collateral. In recent weeks, developer Jay Javors surrendered a newly built LaSalle Street office building to its lender via deed in lieu of foreclosure after running into trouble with WeWork as a tenant that allegedly wasn’t paying rent, while the coworking company was about to enter bankruptcy. (WeWork ended up retaining its lease in the LaSalle building during its bankruptcy.)

Back on Wells Street, the Moceri venture has continued to pay interest on the Fortress loan, even though the property isn’t generating enough leasing revenue to afford its debt service, loan data shows. That means the landlord has been paying the costs of carrying its debt out of pocket.

The property brought in only $3.5 million in revenue last year, while incurring nearly $5 million in expenses, loan data shows. Funding the property’s interest payments and operating expenses without enough revenue led to a $1.4 million loss last year for the landlord, loan data shows.

Before Firmspace’s sudden exit last year, the tenant was set to lease the property’s 17th through 19th floors through 2036 and pay an annual base rent of $1.2 million, with the rate rising annually to a max of nearly $1.7 million over the course of the lease, according to court records. A Cook County judge ordered the company to pay the landlord $1.2 million in January.

The property’s other tenants are Mark Anthony Brewing, an affiliate of the maker of White Claw hard seltzer that agreed to lease around 13,000 square feet in the building, and legal software company Reveal Data, which leased 25,000 square feet.

Read more