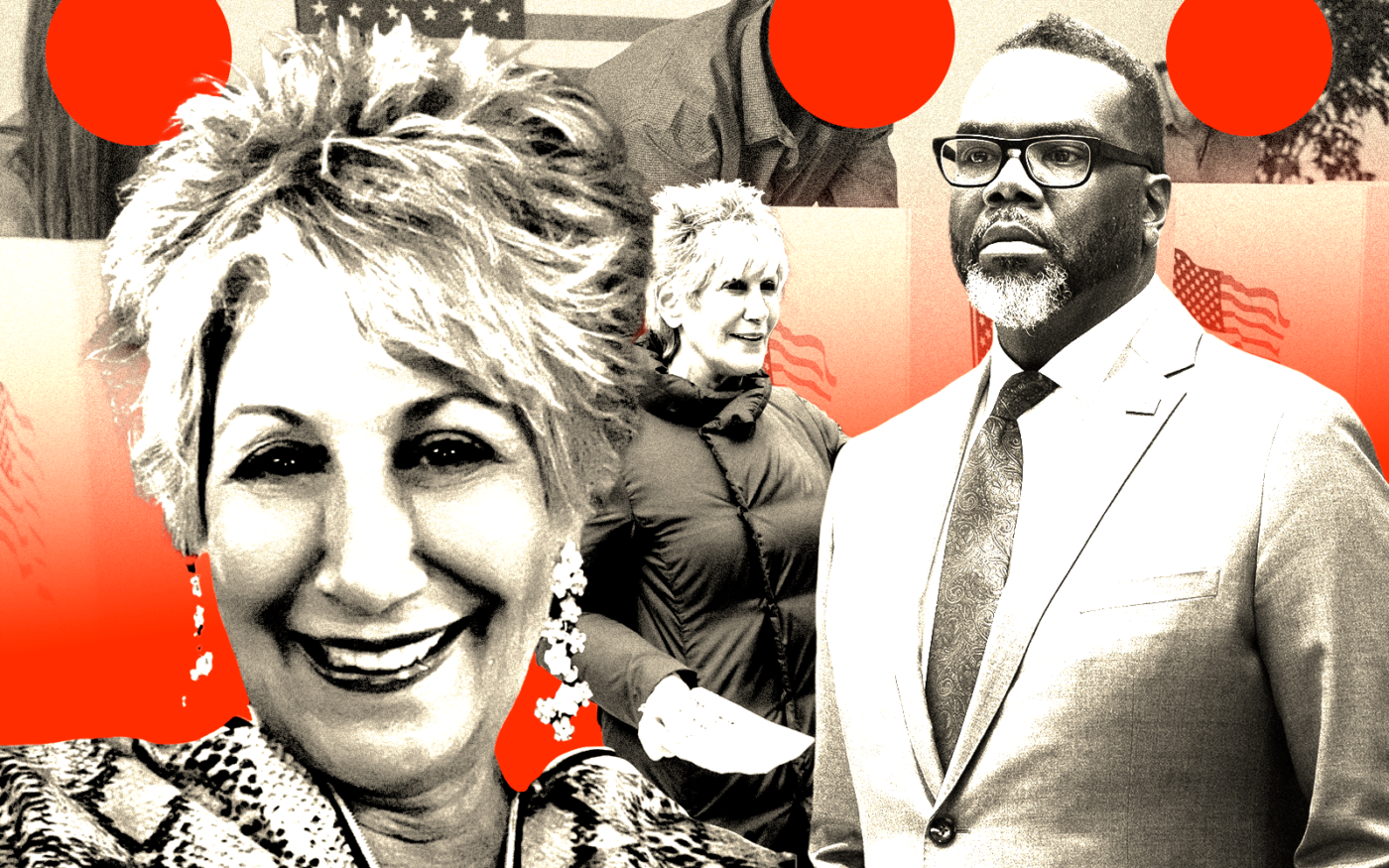

Amid a flurry of legal action surrounding Chicago’s upcoming property transfer tax vote, Cook County Treasurer Maria Pappas is pointing out another possible flaw with the election: the strong potential for low voter turnout.

Pappas on Tuesday released a report detailing voter turnout in previous property tax referendum elections in Cook County, highlighting that the percentage of registered voters who typically cast ballots for such measures during primary cycles rarely cracks the 25 percent mark. Turnouts for November elections, however, typically approach closer to 50 percent, the report states.

“I urge voters to get out and vote, and also to not skip the referendum questions lower on the ballot so these issues can truly be determined by a majority and not by a few,” Pappas said.

She delivered her message as it remains uncertain whether votes will actually count on a real estate transfer tax hike on properties sold for $1 million or more that’s supported by Mayor Brandon Johnson.

Real estate trade groups on Monday filed an appeal to the Illinois Supreme Court in a bid to suppress votes on the measure from being tallied. As of right now, however, they will be counted, after an appeals court ruling this month that reversed an earlier decision by a Cook County judge that invalidated the ballot measure.

At least one recent referendum in Cook County had nearly 70 percent of voters skip the question while voting in other races on the same ballot, Pappas’ report found.

On March 19, city of Chicago voters will be asked to approve or deny an increase of the one-time transfer tax on property sales of $1 million or more while decreasing the tax on properties sold for less than $1 million.

Most of the elections analyzed by the treasurer’s office were bond elections, typically proposed by local school districts. The proposed debts they asked to issue on the backs of taxpayers ranged from $10 million to $180 million.

The treasurer’s office tallied 34 recent referendums that sought a total of $1.3 billion in bonds. Of those, 27 passed for a success rate of 79 percent. As a result, local governments issued $1.16 billion in bonds.

Notable decisions highlighted by the treasurer’s office include:

- A $179 million Elgin School bond was decided by 13% of registered voters in April 2023.

- A proposal to allow the Central Stickney Fire Protection District district to increase taxes by 36% more than state law allows without a referendum was decided by 12% of registered voters in November 2022.

- In south suburban Hometown, the decision to give officials home rule authority, which includes additional taxing powers, passed by two votes, 381-379. Just 27% of the city’s electorate voted in June 2022.

- A referendum to create a park district in University Park failed on a tie vote of 815 – 815, with less than 22% of registered voters deciding the outcome in November 2022.

- In Stone Park, the fire department was eliminated by a vote of 182-145. Only 21% of the village’s registered voters participated in the March 2020 election.

It is not yet clear whether ongoing legal challenges to Chicago’s transfer tax measure will have an effect on turnout, as well. During previous election cycles, legal challenges have threatened to strike candidates from the ballot and notched initial court rulings to that effect, but later got reversed.

In 2011, then-mayoral candidate Rahm Emanuel was deemed ineligible to run due to conflicts with the city’s residency requirements for candidates. However, a higher court later reversed the decision and votes in his favor were tallied, securing his win.

Read more

That’s why voters should take the transfer tax vote seriously whether they are supportive of it or not, said Chicago Board of Elections spokesperson Max Bever.

“It’s not our first rodeo,” he said. “Things can come off the ballot and come back on.”