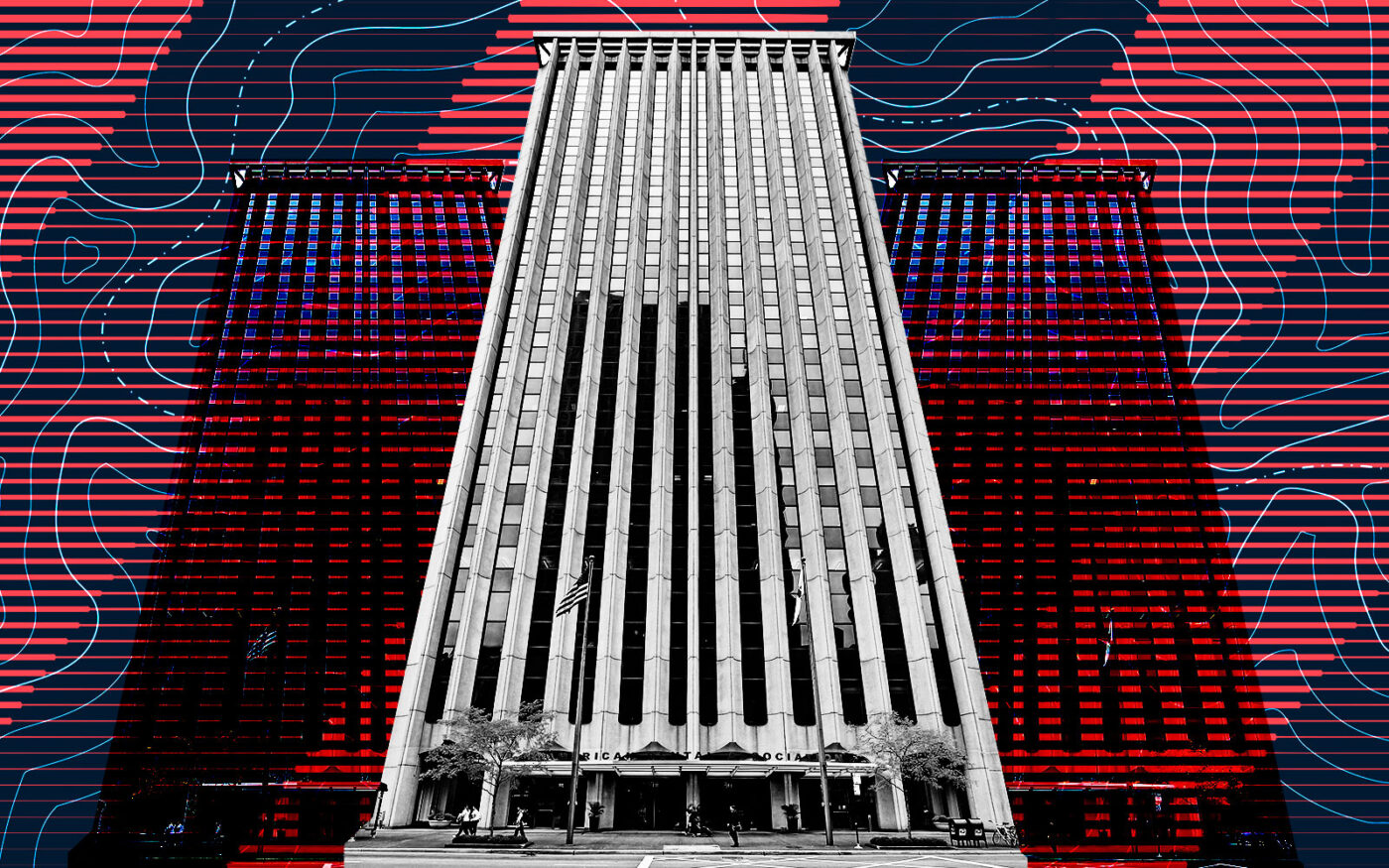

The American Dental Association is on the brink of selling its longtime headquarters in Streeterville, with plans to relocate its main office to the south end of the Magnificent Mile.

The Ann & Robert H. Lurie Children’s Hospital of Chicago is in advanced talks to buy the 23-story building at 211 East Chicago Avenue from the dental association, although the deal has not been finalized and could fall through entirely, Crain’s reported. A proposed sale price wasn’t reported.

Over the past few years, Lurie has been leasing an increasing amount of space in the building, which is adjacent to the 24-story hospital that it opened in 2012.

The negotiations underscore the healthcare sector’s growing interest in Streeterville real estate, with institutions like Lurie and Northwestern Memorial HealthCare expanding their operations for administrative and outpatient services.

The dental association, meanwhile, is close to securing a long-term lease for 60,000 square feet at 401 North Michigan Avenue, contingent on the sale of its 400,000-square-foot namesake building. It has occupied the Streeterville property since it opened in 1965.

The sale and lease offer a glimmer of hope for Chicago’s office sector, which has been grappling with record-high vacancies since the pandemic ignited the remote-work era. Office sales have plummeted in recent years due to declining property values, high interest rates and tough lending standards.

Even though the dental association is downsizing its footprint, it would become the largest tenant at the Michigan Avenue site, marking a big win for the landlord, Chicago-based Walton Street Capital.

Walton Street bought the 35-story tower for $360 million in 2017 and refinanced it two years later with a $160 million senior loan from a group of lenders led by ING Capital and a $65 million mezzanine loan from Heitman, the outlet reported, citing MSCI Real Assets. The dental association lease would help Walton pay off its $225 million debt as the maturity date approaches.

—Quinn Donoghue

Read more