Developer Blue Vista and its partner Bain Capital Real Estate extended their financial runway on a student housing asset near the University of Chicago by snagging a debt package, without throwing more cash into the property.

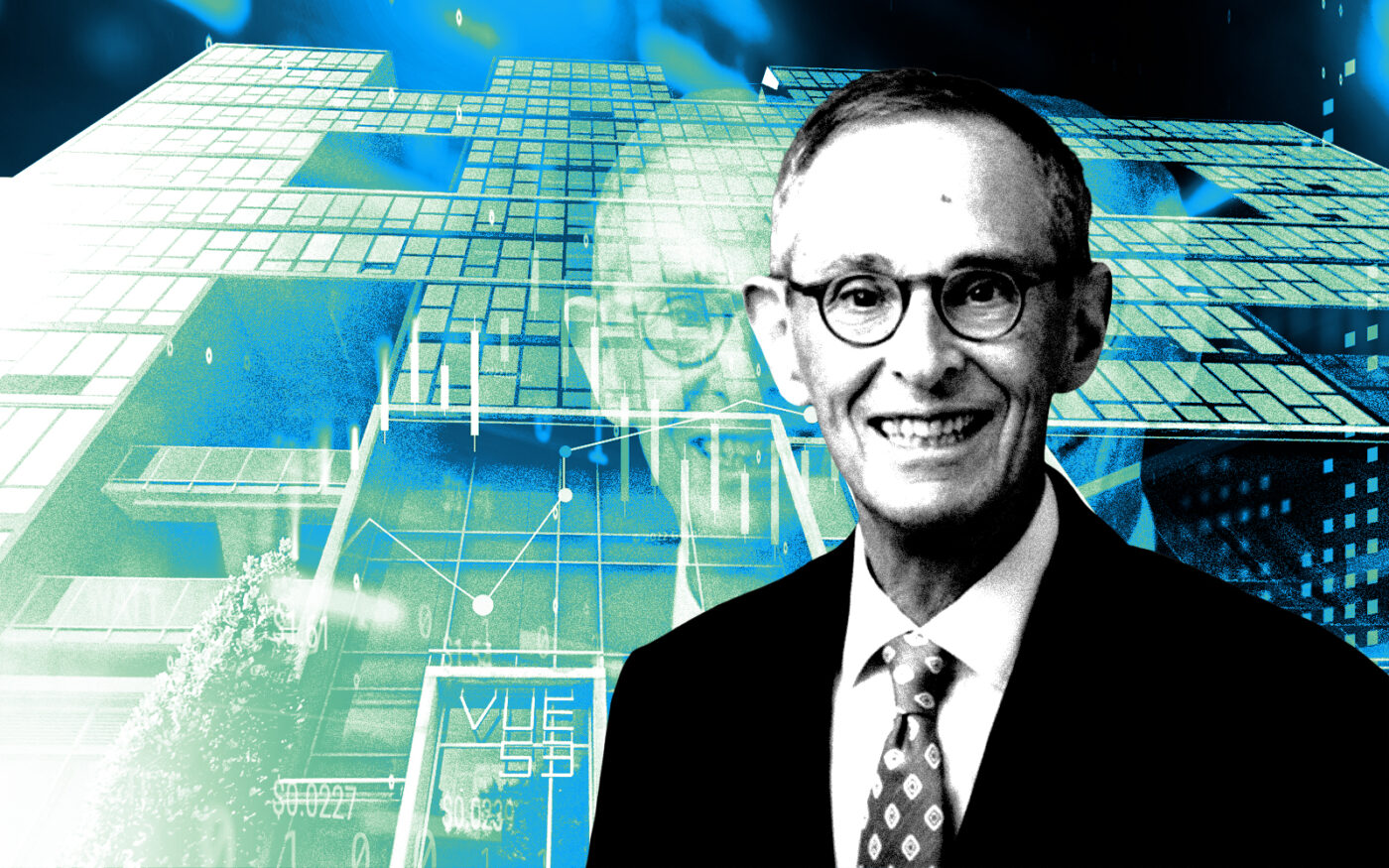

Chicago-based Blue Vista, led by co-CEOs Robert Byron and Peter Stelian, along with Boston-based Bain, took out a $45 million loan from a fund managed by Argentic for the 403-bed property known as Vue53, at 1330 East 53rd Street, in the Hyde Park neighborhood, public records show.

The borrowers beat the clock on the property’s previous debt — a nearly $50 million construction loan from Citizens Bank taken out in 2015. It was supposed to mature in November 2021, and was extended twice, as allowed by the loan agreement, until late last month.

A news report at the time the construction loan was issued pegged its total development cost at $75 million, and it’s unclear why the loan from Argentic left such a gap between the values.

However, the loan satisfied the entire remaining balance of the previous debt owed to Citizens, without the borrowers putting additional money into the property, as other landlords of big Chicago buildings have had to do to secure new loans amid rising interest rates before their existing debt deadlines.

The University of Chicago owns the land and issued a 65-year ground lease to the Vue53 development team, which included Blue Vista, as well as Mesa Development and Atlanta-based Peak Campus Development. Bain declined to comment on how and when it entered the project’s ownership alongside Blue Vista, as well as the reported construction cost.

“We have conviction in the University of Chicago student housing market and, as the newest purpose built student housing asset in the submarket, we believe the asset is well positioned,” a Bain spokesperson told The Real Deal.

Read more

The property also includes nearly 27,400 square feet of ground-floor retail leased to Target, with a Starbucks.

A JLL team of Brian Walsh, Dan Kearns, Tara Hagerty and Dave Hunter represented the borrower in negotiating the refinance.

“We appreciate the high-quality debt options JLL sourced for Vue53, and we’re very happy to be working with Argentic,” Blue Vista’s Brandon Honey said in a statement.