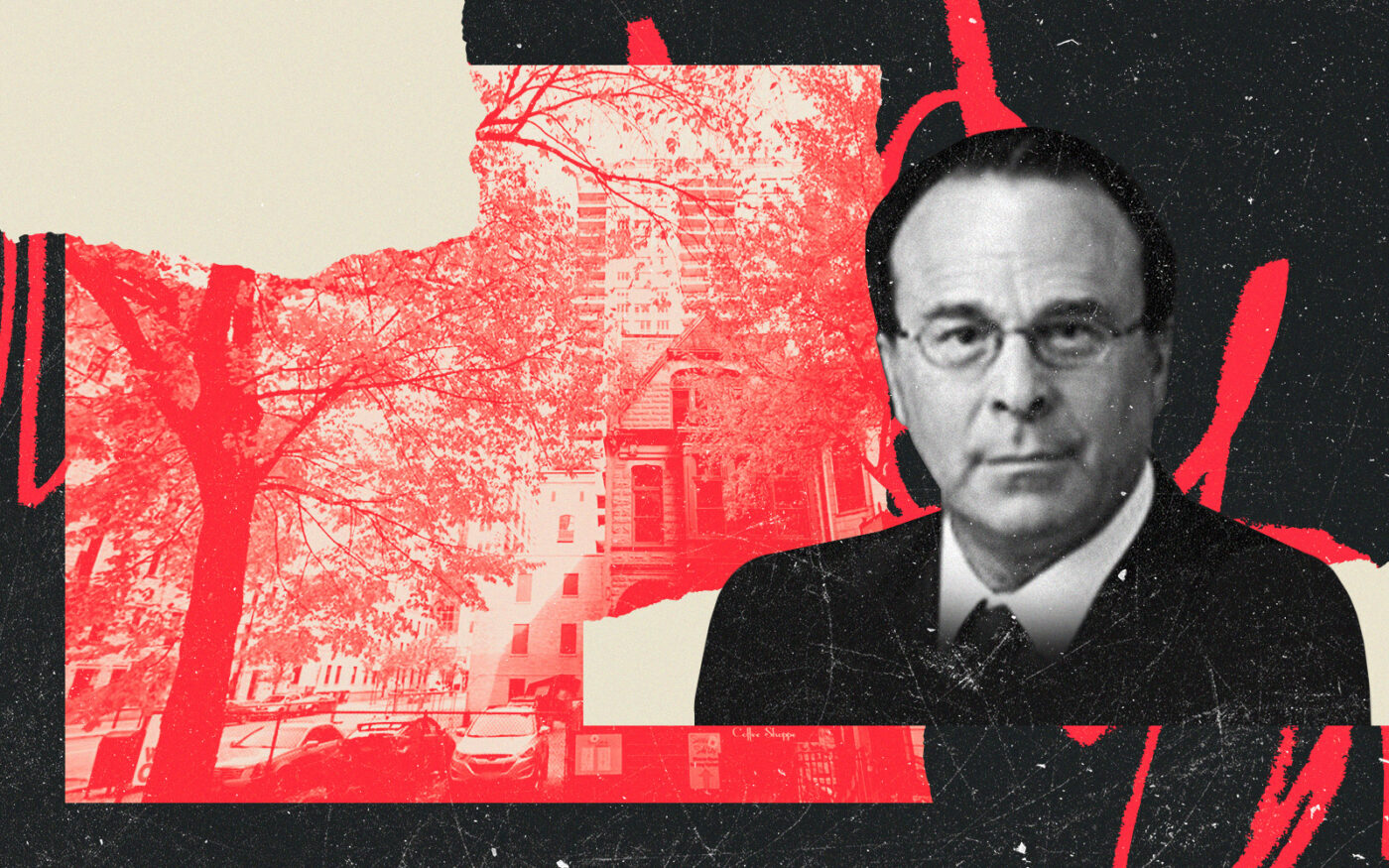

Developers Jeffrey Laytin and Jason Ding seem to have run out of ways to stall foreclosure proceedings for their embattled River North property.

After the pair failed to follow through on plans for a proposed 60-story condo and hotel tower on the northeast corner of Wabash Avenue and Superior Street, their foreign investors sued and obtained a $28 million settlement to be repaid by the developers.

Through a separate foreclosure complaint filed in 2019 by lenders that alleged Ding and Laytin defaulted on more than $22 million in debt tied to the property, it was scheduled to be auctioned off in June of last year. The minimum starting bid was set at $9 million, but a last-minute bankruptcy filing from Laytin and Ding delayed the court-ordered sale.

Now, it appears that the bankruptcy filing only gave the duo a temporary reprieve. The Cook County Sheriff’s office has put the foreclosure auction back on its docket for a Jan. 30 sale.

In bankruptcy court, Ding and Laytin were given until Dec. 1 to get a loan funded that would repay the previous mortgage lenders, and had until Dec. 15 to close on the new debt. But with the foreclosure sale getting rescheduled for later this month, it does not appear that they came up with the money.

Ding told The Real Deal that the foreclosure is still “subject to the (bankruptcy) court’s plan,” and that its next hearing is Jan. 17, about two weeks before the scheduled foreclosure.

Doug Litowitz, an attorney for the Chinese investors who are owed the settlement payment, said the pending foreclosure is a welcome dose of accountability for the developers, but it is unclear how the proceeds of the property sale will be divided up among the creditors and investors.

“I don’t understand how these lenders who are foreclosing could have lent money to these developers without knowing about the prior investments from the Chinese investors that I represent,” Litowitz said.

Laytin did not respond to requests for comment. Representatives of the lenders were not immediately reachable for comment.

The pending foreclosure is the latest result from a series of missteps made by the two developers.

The group of Chinese investors that Litowitz represents raised $50 million through the federal EB-5 program which gives foreign citizens U.S. visas in exchange for certain investments. The money was supposed to fund Laytin and Ding’s proposal to build the 60-story building they planned to call Carillon Tower.

The Chinese investors filed a class-action lawsuit in 2018 after it became clear that the project was struggling to get building permits from local leaders. The suit led to the $28 million settlement agreement between the developers and investors last year.

But the investors allege that Laytin and Ding have not been paying off the settlement and are instead funneling funds to themselves as well as their family members.

In November, a judge froze the developers’ assets when the investors discovered payments totaling more than $1 million that flowed between accounts controlled by Ding and Laytin, while the investors weren’t getting paid.

The judge ruled that Laytin misrepresented his assets on an income and property statement submitted to the court, and ordered both he and Ding to provide the investors information on all the open bank accounts the developers can access.

They were also ordered to notify the court when they receive any assets or money, including loan proceeds to any of their companies, and to seek court approval before withdrawing or transferring any funds, according to a Nov. 6 court filing.