The potential exit of three tenants will create an 87,000-square-foot hole to fill for a Wacker Drive landlord that’s been reeling since the pandemic wreaked havoc on the city’s office sector and drove vacancies to a historic high.

Insurance company Attorneys’ Liability Assurance Society, commercial lender Monroe Capital and financial services firm Mizuho Financial Group are poised to vacate the 65-story building at 311 South Wacker Drive, Crain’s reported.

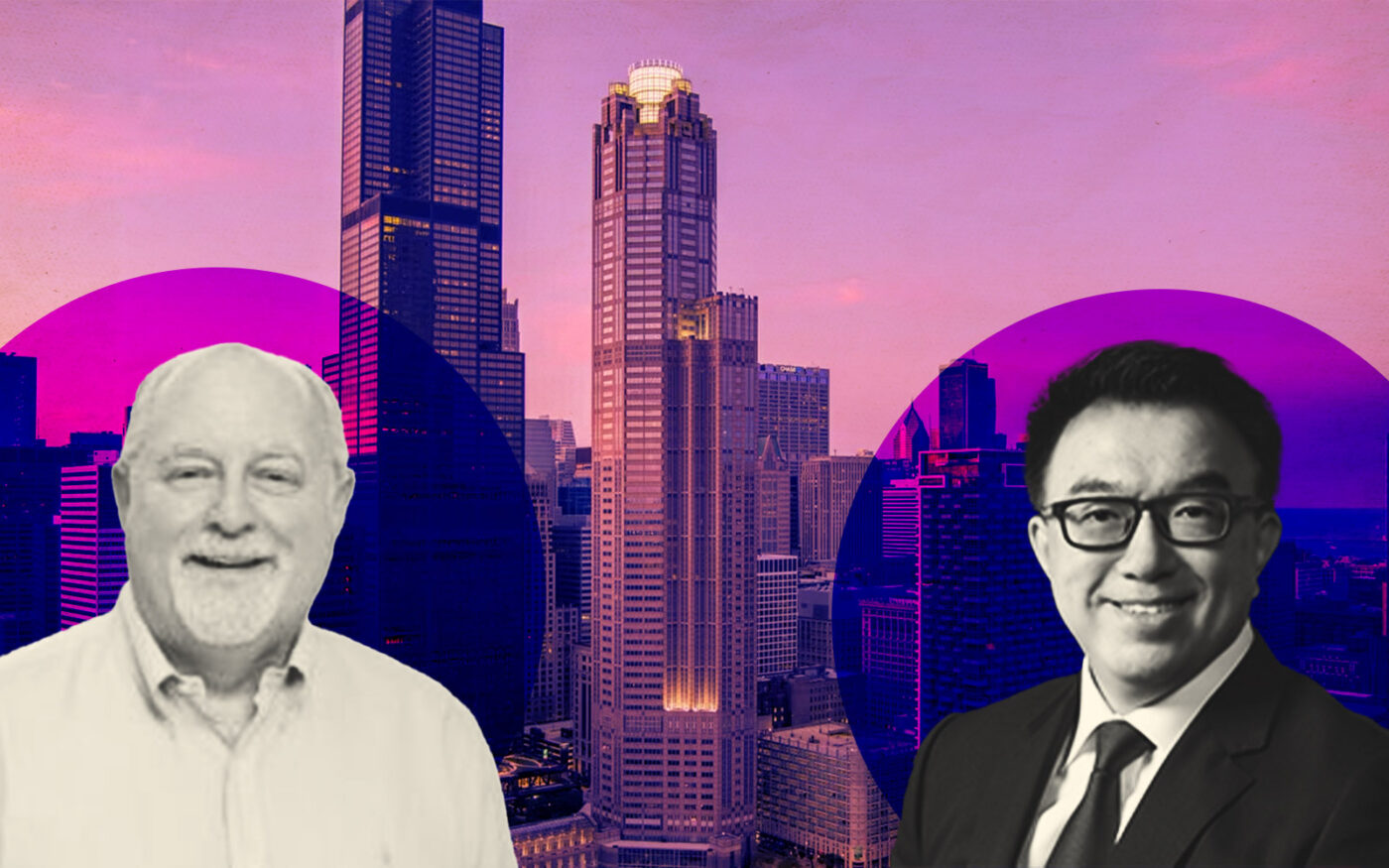

A joint venture of Chicago-based real estate firm Zeller and Chinese investor Cindat Capital Management owns the property. The venture paid $302 million for the building in 2014 and has spent $38 million on renovations.

Attorneys’ Liability Assurance Society is finalizing a 37,000-square-foot lease at 10 South Riverside Plaza, down from its 39,000-square-foot lease at 311 South Wacker. Monroe and Mizuho are in talks to relocate to 155 North Wacker Drive. Monroe Capital could increase its space from 25,000 to 40,000 square feet, and Mizuho could up its footprint from 23,000 to 25,000 square feet.

If all three tenants exit, the building’s occupancy rate would fall from just over 60 percent to below 50 percent, far less than the city average of roughly 76 percent. The property was 86 percent leased before the pandemic.

This move is reflective of a broader trend in which companies are gravitating to new or updated office space. Class A office buildings have seen a marginal rise in vacancies since 2020, while Class B properties have experienced skyrocketing vacancies.

The Wacker Drive building has depreciated significantly since the Zeller-Cindat venture bought it nearly a decade ago. Offers ranged from $100 million to $120 million when it was on the market last year. A 2018 refinance included a $215 million senior loan from a consortium of banks led by Morgan Stanley, as well as $80 million in mezzanine debt, the outlet reported.

In contrast, 10 South Riverside Plaza and 155 North Wacker Drive stand to benefit from these corporate exits. The former, owned by Ivanhoé Cambridge and Hines, is 77 percent leased and undergoing renovations, while the latter has secured new tenants like Ryan Specialty Group, UL Solutions and potentially PNC Financial Services.

—Quinn Donoghue

Read more