Groupon is dramatically shrinking its office footprint in downtown Chicago, prolonging a brutal stretch for landlords since the pandemic hit and drove up vacancies to an all-time high.

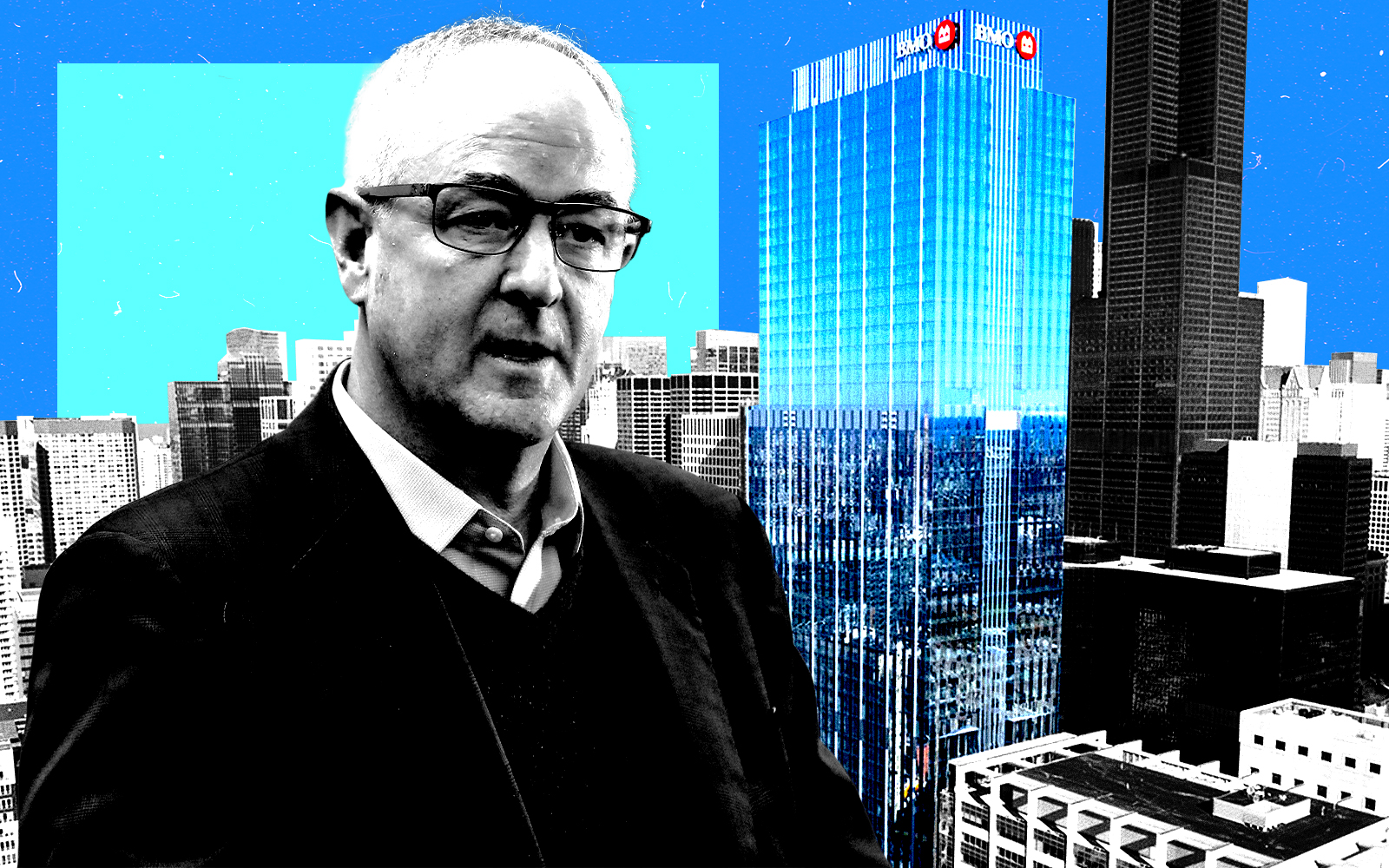

The online-deal company will sublease about 25,000 square feet for 22 months in the 50-story tower at 35 West Wacker Drive, Crain’s reported. Groupon will relocate in January from its nearly 300,000-square-foot headquarters at the Sterling Bay-owned 600 West Chicago Avenue.

Groupon is subleasing the space from media conglomerate Publicis Groupe, which put 350,000 square feet in the building up for sublease in February, making it the city’s largest contiguous block of available office space at the time.

The leasing deal, brokered by JLL’s Andy Strand and Cushman & Wakefield’s Steve Schneider, comes six months after Groupon paid Sterling Bay $9.6 million to terminate its lease early at 600 West Chicago. It was originally set to expire in January 2026.

Groupon’s downsize follows two massive rounds of employee layoffs, cutting about 1,000 jobs over the past 15 months. The company “has always had a thriving office culture, and this move to a space that is better aligned to our new hybrid working ethos is a great step to kick off 2024 for our Chicago team,” interim CEO and board member Dušan Šenkypl told the outlet.

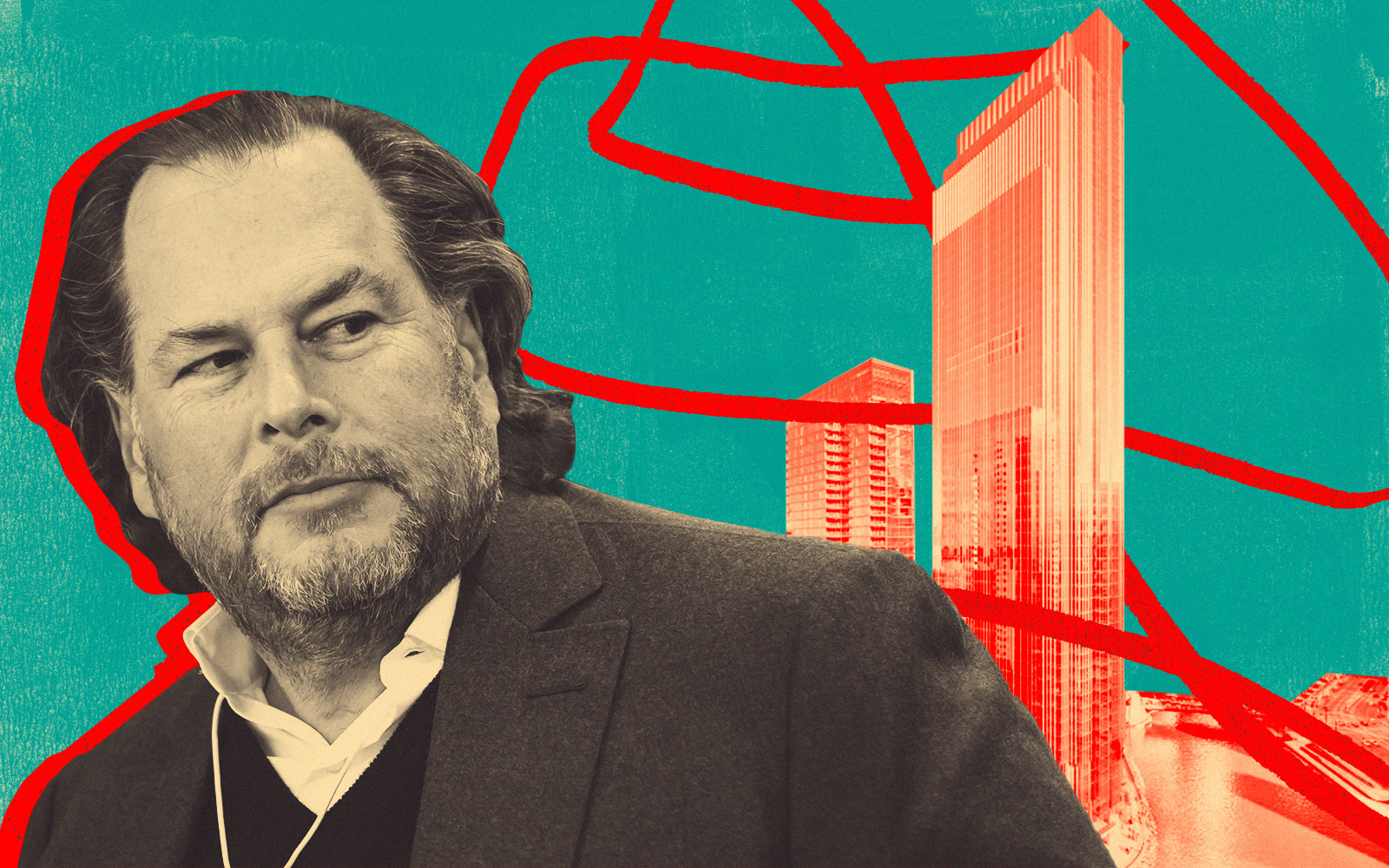

The relocation mirrors a broader trend in Chicago’s office market, as remote and hybrid work schedule policies have allowed companies to shrink their workforce and office footprints. Tech giants Meta and Salesforce shed a combined 240,000 square feet of space earlier this year, for example. Such downsizing contributed to a record-high Chicago office vacancy rate of nearly 24 percent last quarter.

Despite Groupon’s financial struggles, its stock price has shown signs of recovery, closing at $10.92, up from below $3 per share in mid-May. The company reported a net loss of $81.4 million through the first nine months of this year, an improvement from a $180.1 million loss during the same period in 2022.

— Quinn Donoghue

Read more