A Loop office tower poised for residential redevelopment is hitting the auction block next month, as the planned sheriff’s sale out of foreclosure appears set to help facilitate the property’s conversion with its lender’s cooperation.

A Cook County circuit judge entered an order of foreclosure for the 44-story building at 30 North LaSalle Street in April, and a sheriff’s auction is scheduled for Oct. 5.

Lender American General Life Insurance, a subsidiary of New York-based American International Group, filed a $186 million foreclosure complaint against the 988,000-square-foot building’s landlord, New York-based AmTrust Realty, last fall.

Depending on the outcome of the auction and foreclosure litigation, it may be the property’s final days as an office.

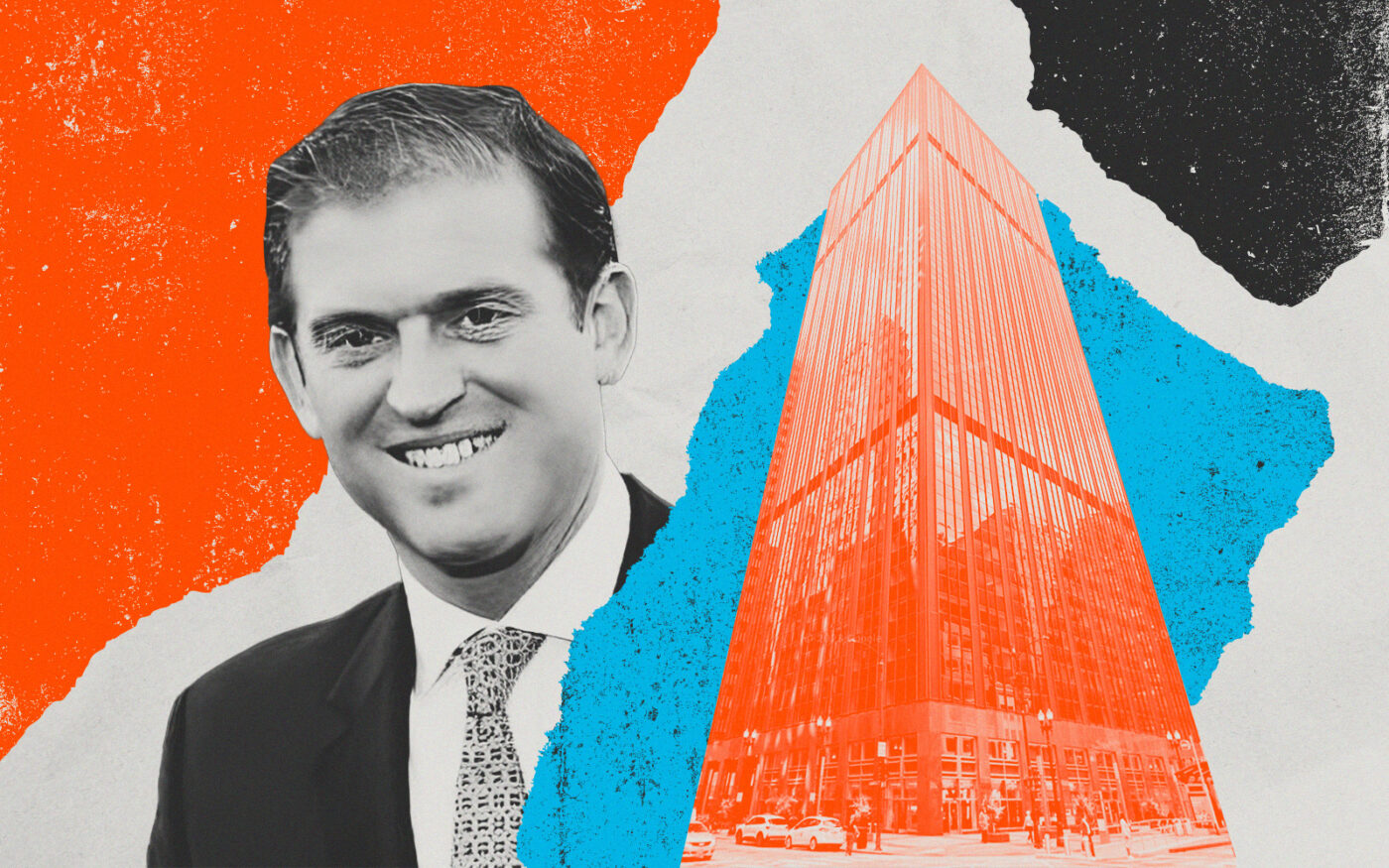

Chicago-based developer Golub & Co. and the lender AIG’s affiliate Corebridge Real Estate Investors together proposed a $143 million redevelopment project to convert the more-than-half vacant office tower into 349 apartments. It’s unclear if the foreclosure proceedings — which AmTrust never opposed — and resulting auction of the asset are part of the developers’ plan to reset its financial basis ahead of its change in use.

The auction sale could provide a door for new investors such as Golub to grab a stake in the property’s equity at a low enough cost that an office-to-multifamily conversion makes monetary sense. It’s unclear, however, if Corebridge would retain ownership of the asset with Golub providing only developer services for the project, or if Golub would take an equity stake in the project, too.

If acquiring the property through auction is the plan to initiate the conversion, though, the developers would have to make a winning bid at auction, which may be simplified due to Corebridge’s affiliation with the existing lender.

“Due to a variety of micro and macro factors, 30 North LaSalle presented extreme challenges that were insurmountable at its current valuation,” AmTrust’s Jonathan Bennett said through a spokesperson. “As we focus our efforts on unlocking the latent value at our other Chicago properties — through both residential conversion and broader capital upgrades — we made the decision not to fight the lender’s foreclosure.”

Through a spokesperson, attorneys for American General Life Insurance declined to comment on the foreclosure sale. The property’s receiver, Hilco Real Estate’s Mitch Vanneman, declined to comment through an attorney. A Golub & Co. executive didn’t return a request for comment and a spokesperson for Corebridge declined to comment.

The residential conversion project came up after the plan was named a finalist to receive public financing by former Mayor Lori Lightfoot’s administration, as part of her “LaSalle Street Reimagined” initiative. That program was aimed at creating affordable housing in the downtown financial corridor by turning a handful of aging and financially distressed office towers into multifamily buildings. While Mayor Brandon Johnson’s administration has not yet made a public statement on the status of the program, a city Planning Department spokesperson said all five proposals selected for LaSalle Street Reimagined are moving forward and currently in an “underwriting” phase.

The other properties being considered for public financing to convert offices into apartments are at 105 West Adams Street, a chunk of Mike Reschke’s building at 208 South LaSalle, the AmTrust-owned 135 South LaSalle and 111 West Monroe Street, which is owned jointly by Reschke and his partner Quintin Primo.

In its pitch to the city for tax increment financing for the 30 North LaSalle project, the Golub and Corebridge development team claimed it would have “unmatched speed to market” compared to other office-to-residential conversions, due to there already being 12 contiguous floors of vacant space in the building, according to a city slideshow. “Demolition could start immediately upon selection,” the developers’ presentation said, and the first residents could be ready to move in by early 2025.

In a court order from April, Judge Marian Perkins wrote that the AmTrust affiliate that owns the building had not responded to the lender’s motions for foreclosure in court. Perkins’ order also states that the debt owed on the building had ballooned to more than $201 million, due to accrued interest and fees.

The nearly 1-million-square-foot skyscraper is not the only downtown building targeted for redevelopment through the “LaSalle Street Reimagined” effort that has been the subject of a foreclosure suit.

A judgment of foreclosure was entered against landlord Musa Tadros over the historic Clark Adams Building late last year, and Tadros filed for Chapter 11 bankruptcy over a $29 million mortgage on the property in July, temporarily scuttling a scheduled auction of the property.

For AmTrust, the auction of 30 North LaSalle comes a little less than two years after the firm announced it planned on injecting $100 million worth of improvements into its Chicago skyscraper portfolio, which includes the office buildings at 33 West Monroe Street, the two-building Illinois Center property in the East Loop, and the 41-story property at 1 East Wacker Drive.

While AmTrust’s distressed former Bank of America building at 135 South LaSalle Street was left off the list of buildings slated for improvements, the firm said it planned to start its renovation plans at 30 North LaSalle. It’s unclear how the foreclosure or auction impacted those plans.

Bennett said AmTrust has conducted a full evaluation of its Chicago portfolio over the past year and is in the process of developing a business plan for each property.

Editor’s note: This story was updated to add statements from AmTrust’s Jonathan Bennett and the city of Chicago, and to note a Corebridge Financial spokesperson declined to comment.

Read more