Failing to find takers for a big Chicago-area office building these days means the next step is usually a foreclosure lawsuit.

It’s a shift from years past, when landlords needing capital to pay off previous debts could fall back on refinancing their property if a loan was approaching maturity and they hadn’t yet found the right buyer.

Now, Skokie-based American Landmark Properties appears to be the next victim of surging interest rates making refinancing unappealing in tandem with falling demand for commercial real estate coming out of the pandemic. After staging a so far unsuccessful search for buyers of a large Schaumburg complex earlier this year, the firm is now facing a lender who wants to take back its keys.

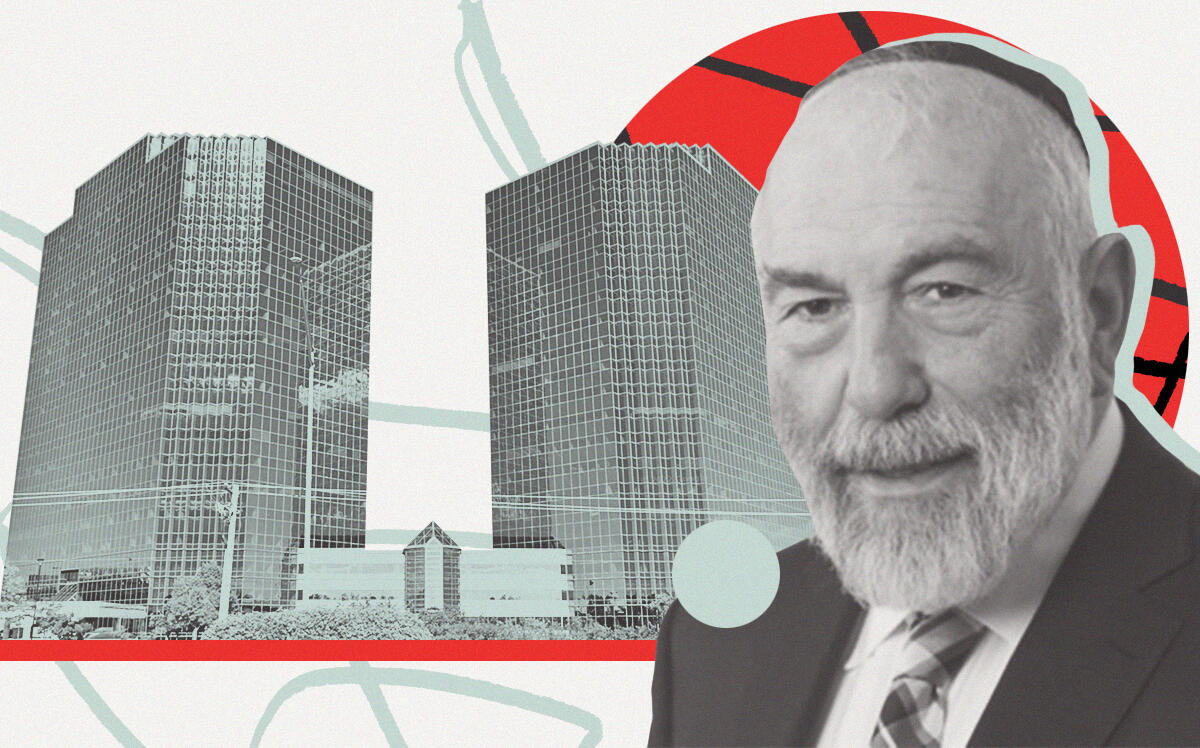

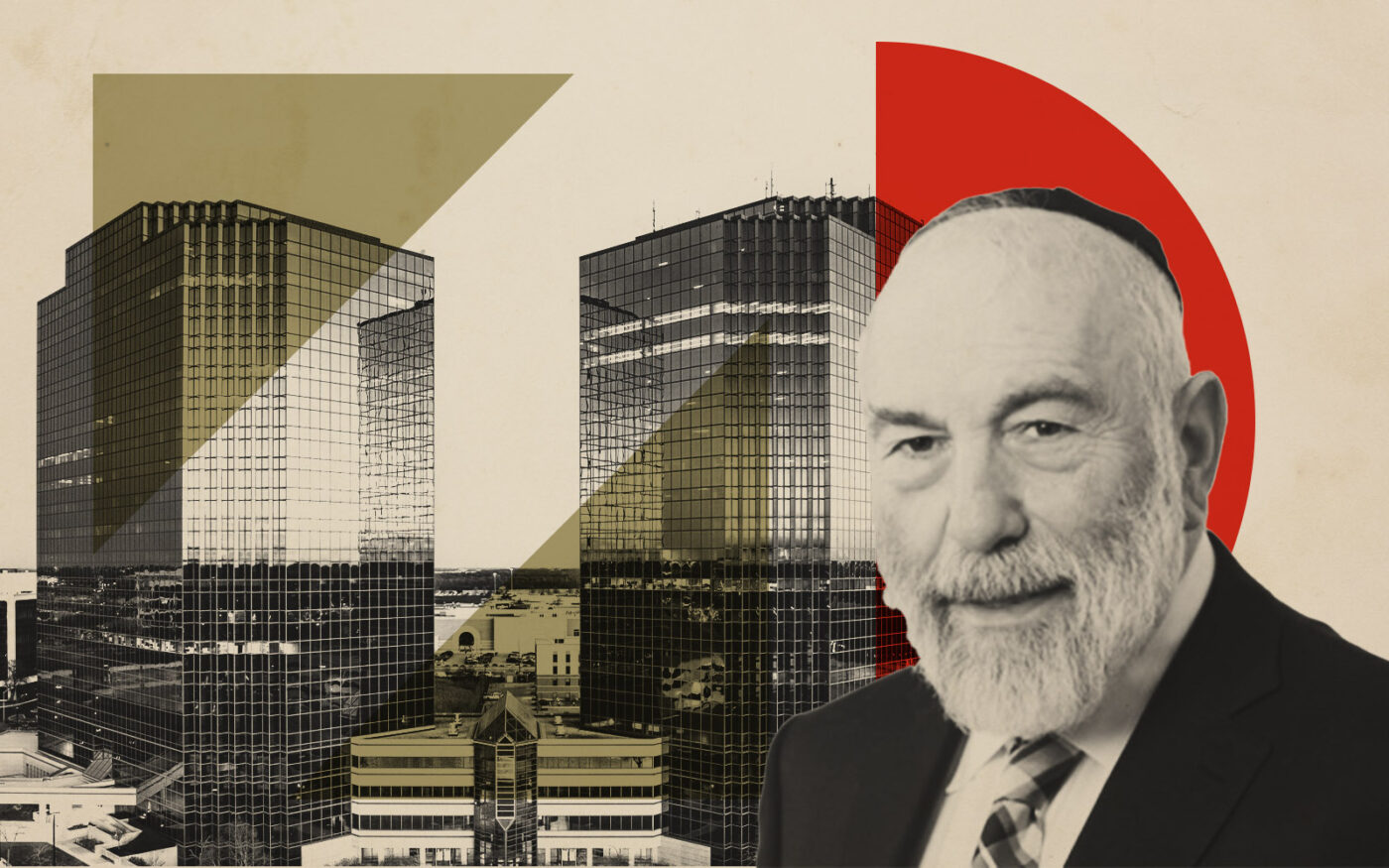

American Landmark, helmed by Yisroel Gluck, defaulted on its $96 million mortgage on the 20-story, 890,000-square-foot Schaumburg Towers at 1400 and 1450 American Lane, lender Prime Finance said in a complaint filed in Cook County court last week. The suit says $83M in principal and interest plus fees and fines is still owed on the loan.

The landlord hired Cushman & Wakefield to sell the Schaumburg property in January, according to previously published reports. While it didn’t have an official asking price, it was expected to draw bids between $110 million and $120 million, people familiar with the offering said at the time.

The suit adds the landlord to the growing list of suburban office owners defaulting on large loans as remote-work trends nudge companies to downsize their real estate footprints.

Vancouver, British Columbia-based Adventus Realty Trust is facing a $114 million foreclosure suit over an office complex it owns near Chicago’s O’Hare International Airport, and Rubenstein Partners is staring down a foreclosure on an $85 million loan on Continental Towers in Rolling Meadows.

In downtown Chicago, Dorchester Corporation, the owner of the historic Jewelers Building at 35 East Wacker Drive, was also hit with a $65 million foreclosure suit filed by John Hancock Life Insurance after the landlord tried earlier this year to market that property for sale to beat the clock on a summer loan maturity.

A similar marketing process played out this year for the retail space across the street from the Jewelers Building on the ground floor of the LondonHouse hotel. That first-floor property was taken over through a deed in lieu of foreclosure by an affiliate of Barry Sternlicht’s Starwood after the previous landlord, a venture of Oxford Capital and Angelo Gordon, hired CBRE to sell it then never made a deal to pay off a $42 million loan tied to the asset.

American Landmark — whose head Gluck is best known locally for being part of the group of investors that sold Chicago’s Willis Tower to Blackstone for $1.3 billion in 2015 — paid $88 million for Schaumburg Towers in 2018. The suburban complex was less than half occupied at the time. After purchasing the property, American Landmark put $20 million toward renovations to attract new tenants.

The repositioning was at least somewhat successful — the complex’s occupancy was up to 78 percent as of February, outperforming the suburban Chicago average. Vacancy in the Chicagoland office market hit a record high of 29 percent last quarter.

American Landmark and its leadership did not return requests for comment on the foreclosure suit. An attorney representing Prime Finance did not respond to a request for comment. Prime Finance sent American Landmark a notice of default on June 9, the day the loan matured, stating that the debt hadn’t been paid.

The firm was also part of one of last year’s priciest commercial real estate trades, picking up a South Loop apartment tower for $180 million in a joint venture with Dallas’ Evergreen Residential.

Read more