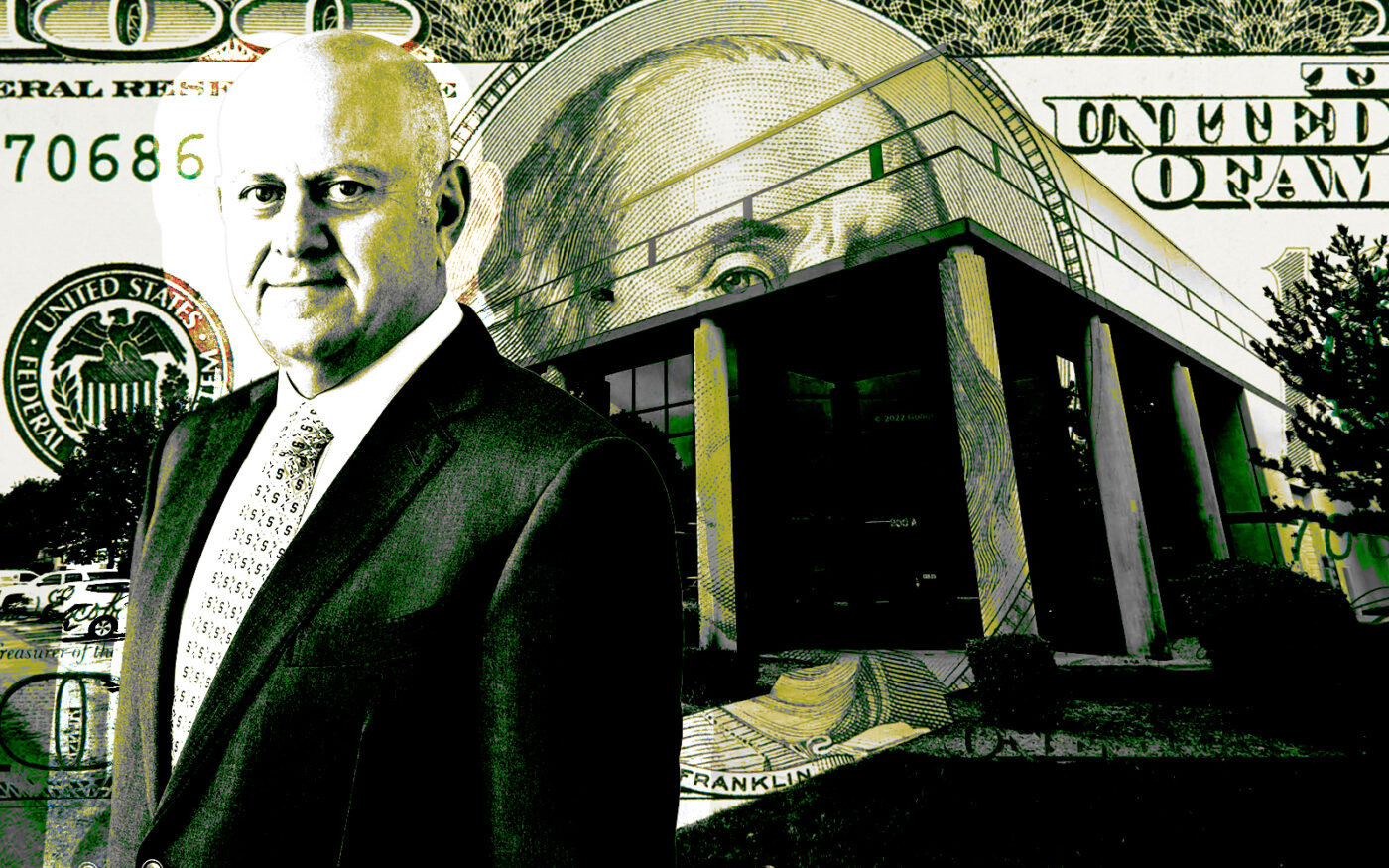

Prologis, the world’s largest industrial property investor, picked up a fully leased asset in Chicago’s southwest suburbs for $23 million.

The San Francisco-based real estate investment trust bought the 240,500-square-foot building at 900 Carlow Drive in Bolingbrook from a venture affiliated with Chicago-based investor Heitman, according to a Will County deed dated Aug. 17. Neither party immediately responded to a request for comment.

The property has been occupied for more than two decades by motor vehicle and powersports parts seller Ed Tucker Distribution, which has more than three-and-a-half years left on its current lease, according to marketing materials from Cushman & Wakefield.

Prologis’ latest moves include paying $3.1 billion for Blackstone’s almost 14 million-square-foot industrial portfolio of about 70 properties across the country in an all-cash deal that closed in June. In 2021, the buyer notched one of Chicago’s largest commercial investment sales of 2021 with its nearly $100 million acquisition of 930 West Evergreen Avenue, a 339,000-square-foot warehouse and office building on Chicago’s Goose Island.

The firm, helmed by Hamid Moghadam, posted record profits and revenue last quarter. Second quarter revenue was $2.45 billion, or nearly double the $1.25 billion from the same quarter in 2022. The REIT’s net earnings were almost $1.22 billion, or $1.31 per share, compared with $160 million on 82 cents a share in the second quarter of 2022.

Prologis owns or has stake in properties and development projects spanning about 1.2 billion square feet in 19 countries, including almost 50 Chicago-area properties.

Read more

More broadly, the industrial market is cooling down after its allure rose in commercial real estate circles during the pandemic. Nationally, there was a 47 percent drop in industrial leasing last quarter compared with the second quarter of 2022, according to JLL.

In the Chicago metro area, the industrial vacancy rate crept up slightly to 4.6 percent last quarter after hitting a record low of 4.5 percent at the end of 2022, according to Colliers International.

Contributing to rising vacancy is the amount of yet-to-be-leased industrial space that’s being built — developers are expected to finish almost 42 million square feet of warehouse space in Chicagoland by the end of this year, making up the largest annual total ever, per Colliers. Most of that space has yet to be leased.