The bulk of Chicago’s real estate community is opposed to Mayor Brandon Johnson’s newly proposed property transfer tax plan, yet one of the city’s biggest players is in favor of the policy, arguing the industry should play a direct role in addressing the issue by paying the charge.

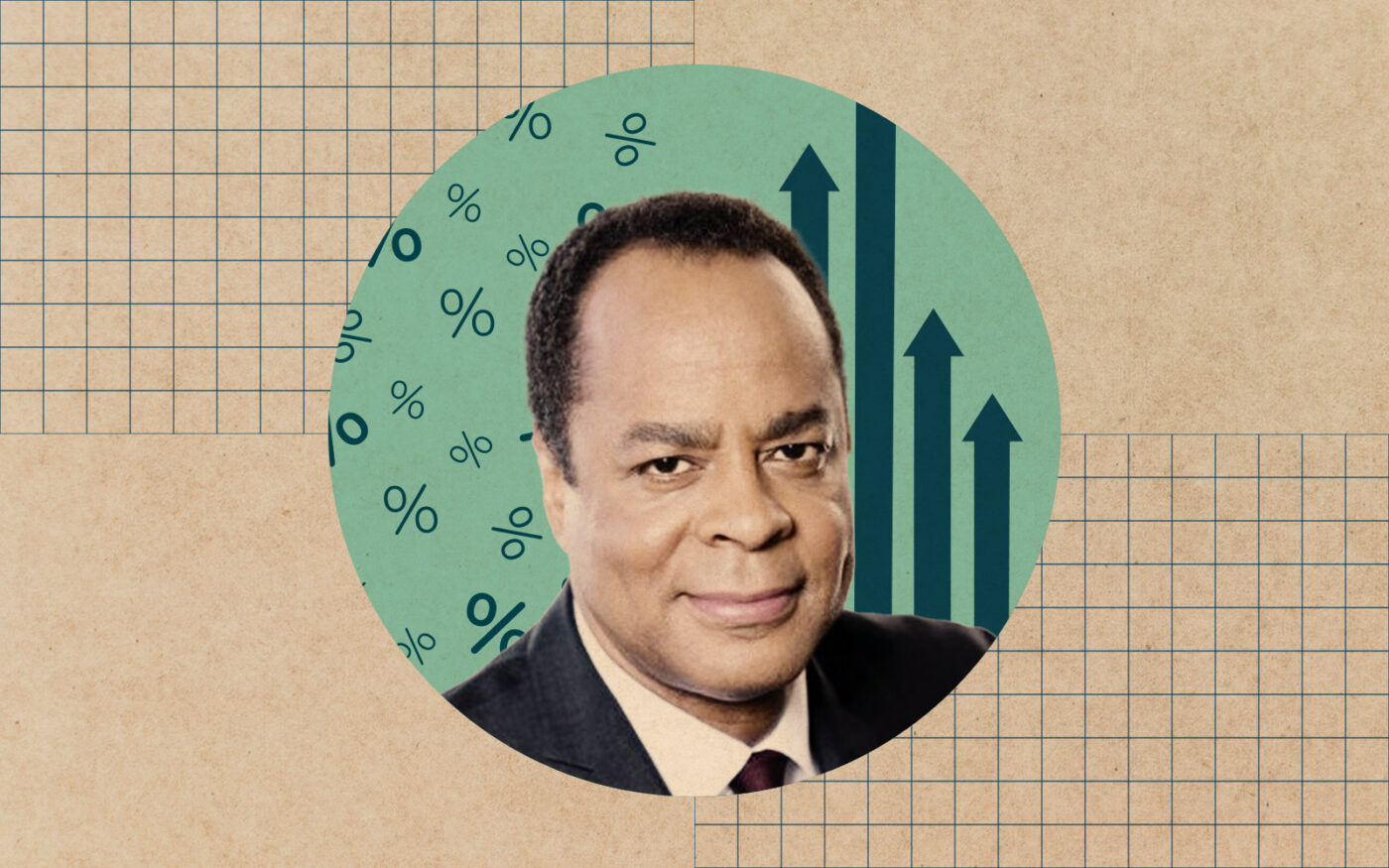

Quintin Primo, founder and CEO of Capri Investment Group and one of the dealmakers set to bring Google to the Thompson Center, stands behind Johnson’s Bring Chicago Home initiative, which, if approved by voters, will funnel revenue from hiked transfer tax rates on pricey property sales toward more affordable housing projects and efforts to curb homelessness, Crain’s reported.

“There are individuals who have larger businesses and corporations that have also expressed interest to address the unhoused,” Johnson told the outlet. “(Primo) supports it because he recognizes that people want to be in Chicago.”

Johnson’s original plan was to more than triple the one-time transfer tax fee from 0.75 percent to 2.65 percent for all property sales of $1 million or more. The revised plan calls for a three-tiered system: The rate would drop to 0.6 percent for all property sales less than $1 million, but it would rise to 2 percent for deals between $1 million and $1.5 million and jump to 3 percent for sales exceeding $1.5 million.

Thus, the tweaked policy would have an even greater impact on high-end deals than initially expected, and most Chicago commercial real estate players aren’t happy. While the rate affects residential sales, too, the bulk of concerns lay in the commercial realm. Office and retail sectors are struggling mightily amid the remote-work era, high interest rates and overall pessimism surrounding the city’s commercial market.

Primo and Johnson share common ground in that they both advocate anti-homelessness measures. Primo and his wife, Diane, serve as co-chairs and CEOs of the Primo Center, a nonprofit that has long been devoted to permanent housing and other services for Chicago’s homeless population. The city estimates there are about 6,100 people experiencing homelessness, based on this year’s point-time count.

“Ninety-nine percent of my business associates, especially those involved in the commercial real estate industry, argue that, yes, homelessness is an issue, but it’s not one that the real estate industry should bear. It’s a classic, ‘Not my backyard, not from my pocket.’ Unfortunately, I take a different tack,” Primo told the outlet.

However, Michael Reschke, a business partner of Primo including on the deals for the Thompson Center and a potential office-to-residential conversion of 111 West Monroe Street, has taken a strong stance in the opposite direction.

“The real estate industry is suffering tremendously right now trying to recover from COVID, a record-high increase in interest rates and reduced demand in office occupancy,” Reschke told the outlet. “It’s an additional burden on the real estate industry.”

While Primo acknowledged real estate struggles in Chicago, he believes the market is simply in a down cycle and will bounce back. Commercial markets in the city are “fundamentally strong,” he said, and will be able to handle the cost of the transfer tax upon a broader recovery of demand from occupiers and stabilization of lending costs.

— Quinn Donoghue

Read more