Auctions are supposed to provide efficient markets, yet two recently held for distressed Chicagoland offices have only shown the messes that can result from bidding contests amid a historic decline in commercial real estate demand and plummeting property values.

The algebra involving these struggling offices isn’t convincing their lenders to let go at auction, under their assumption a pending economic recovery will make it worthwhile to hold on to their assets despite each additional month of ownership bringing more costs from taxes and maintenance.

Auctions held this summer for two lender-owned office properties — one in downtown Chicago, one in the western suburbs — generated interest but still haven’t closed, highlighting that the brokers running the sales are tasked with testing a changing market.

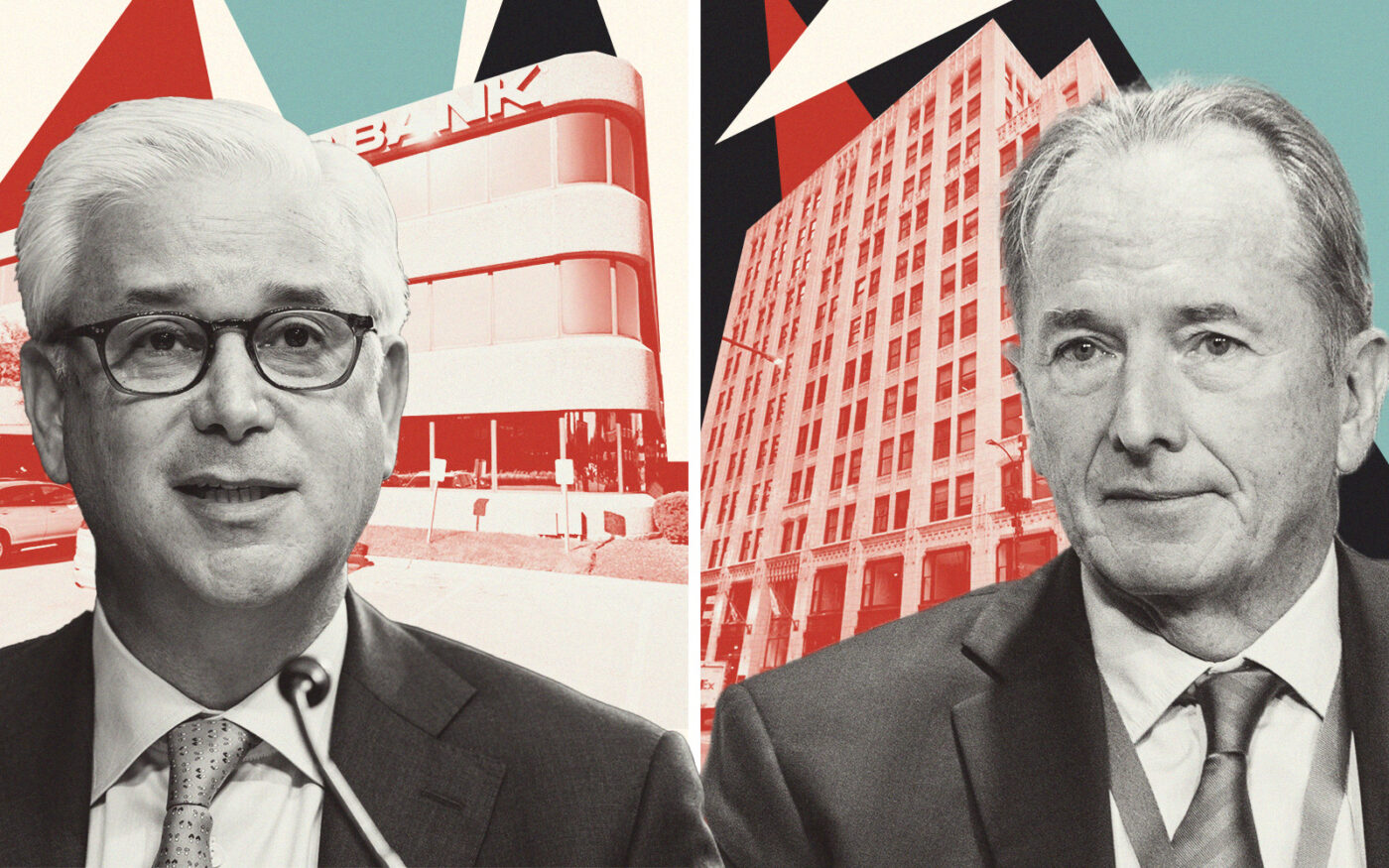

The 300 West Adams Street Building, a 12-story, 254,000-square-foot landmark in the West Loop that’s nearly half vacant, was marketed in an online auction in early June that had a minimum bid of $2 million, but a deal hasn’t closed, and JLL re-listed the property for sale in the weeks since the final bid was counted down.

In DuPage County, offers on the Oak Brook Office Center on Butterfield Road culminated in a final bid of $10.5 million last week, falling short of balance of a $24 million CMBS loan secured by the property.

The bondholders that own that debt’s note are unlikely to sign off on selling the property at that price, however, unwilling to stomach such a large loss, according to a person familiar with the offering. Instead, the property will remain in the hands of the bondholders in the debt instead of getting transferred to the auction’s highest bidder.

The bidder isn’t out any money, and the bondholders could re-market the property for sale through auction again or a standard listing at a time they feel they could get a better price.

Meanwhile, the leasehold interest in the West Loop property in 2021 was turned over to an entity managed by Morgan Stanley, a trustee for bondholders in a $25 million loan on the property, from then-owner Alliance HP. That was after the building’s vacancy rose to 23 percent. JLL began marketing the leasehold interest on behalf of the lender in mid-2022, but a deal never materialized.

Efforts to move the property are likely complicated by Pennsylvania-based Alliance’s 99-year ground lease, which it enacted when it bought 300 West Adams for $51 million in 2012.

Back in Oak Brook, there were five bidders on the four-building, 317,000-square-foot property in the receivership sale held last week by Highland Park-based Frontline Real Estate Partners. But the lender isn’t required to sell to any of them as the reserve price wasn’t met.

The loan on the property went into special servicing in April 2022 due to a payment default by the borrower, Vancouver-based Adventus Realty Trust. That led to a foreclosure and receivership appointment by loan trustee Wells Fargo. Adventus is facing defaults on a separate $128 million loan against the office property Riverway near O’Hare as well as on a $350 million loan tied to eight offices in suburban Chicago and Atlanta.

Though the highest bid won’t cover the Oak Brook office loan, it was at a pricier basis than what some other downtrodden Chicago-area suburban offices have sold for in recent months. An investor bought the 318,000-square-foot building at 2 Overlook Point in Lincolnshire for about $2.9 million, or just $9 per square foot.

The Oak Brook office complex was marketed as a redevelopment play for hospitality or retail uses, something village leadership would welcome for the additional tax revenue.

“We’ve had, certainly, a lot of inquiries from potential bidders on that property about potential alternative uses,” Oak Brook Village President Laurence Herman told The Real Deal before the auction. “We obviously are concerned about what the future use is going to be.”

Read more