Alliance HP handed an office complex near Chicago’s O’Hare International Airport back to its lender rather than fighting a foreclosure over a $78 million loan, joining the list of landlords who’ve been forced to surrender their holdings amid historically low demand for office space.

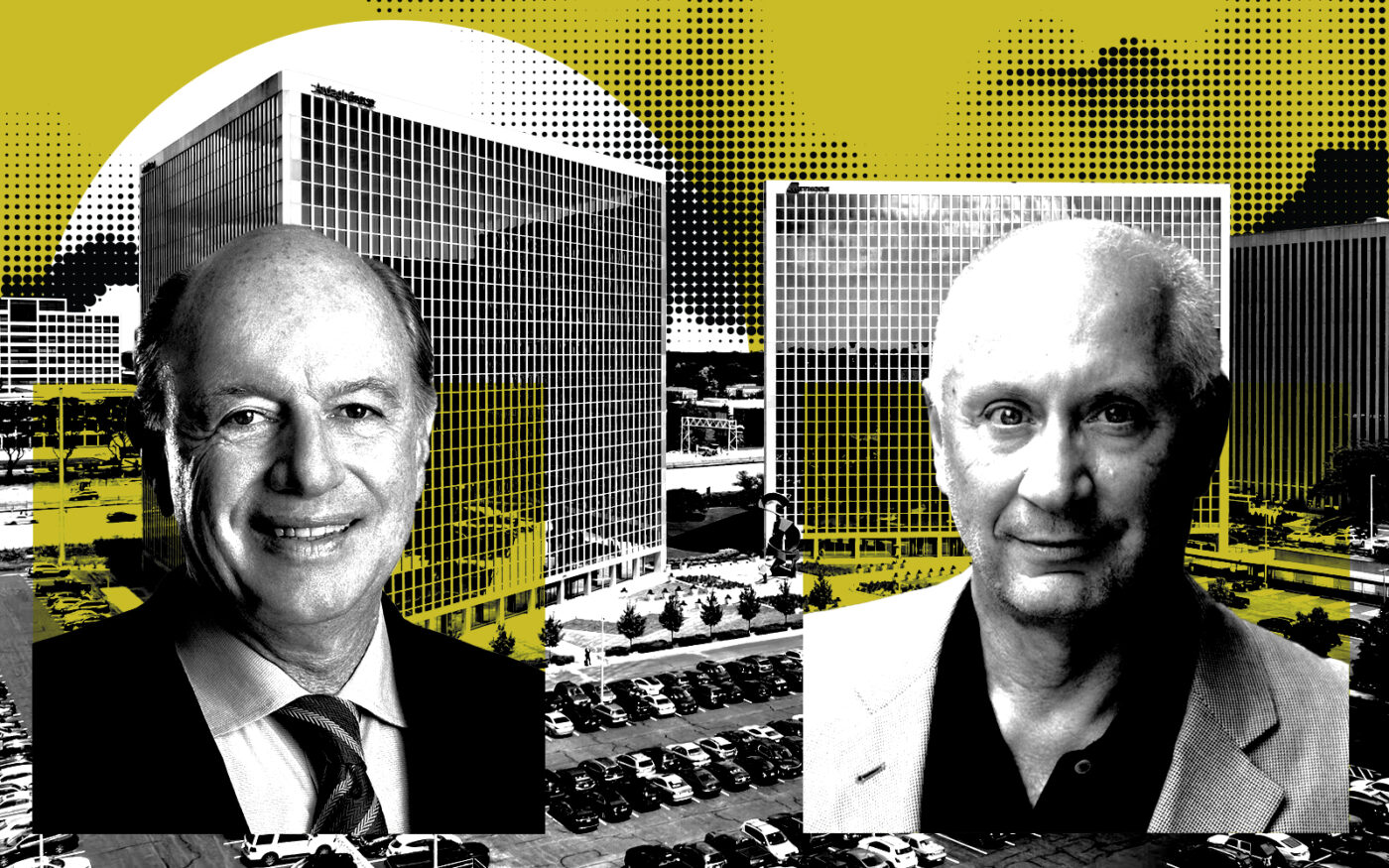

Varde Partners took over the Triangle Plaza, which includes two 14-story towers totalling 627,000 square feet at 8750 and 8770 West Bryn Mawr Avenue, from Pennsylvania-based landlord Alliance, CoStar reported. Minneapolis-based lender Varde appointed Chicago’s Glenstar Properties to manage the complex.

A number of distressed office properties in the Chicago-area have been surrendered via deed-in-lieu of foreclosure this year, but the Triangle Plaza stands apart from other such arrangements because the building is actually performing well.

The complex is 92 percent leased and houses tenants including Komatsu, Old National Bank, Combined Insurance, Power Construction, Ardagh Metal Packaging and Lawson Products. That’s far better than most office buildings in the Windy City, which saw its vacancy rate rise to a record high of 22.6 percent last quarter. Lingering remote-work trends, climbing interest rates, company layoffs, banking failures and a pessimistic outlook on Chicago real estate in general have contributed to the decline.

Properties given back to their lender typically have poor occupancy rates and are barely staying afloat. For instance, another big suburban landlord, Adventus, was hit with a $114 million foreclosure lawsuit last week over 870,000-square-foot Riverway office near O’Hare while it’s just 68 percent leased.

It’s possible that falling rents or problems with the original deal structure were reasons for Alliance’s giveback.

Alliance, managed by Clay Hamlin III and Richard Previdi and affiliated with Hawaiian businessman Jay Shidler, bought the Triangle Plaza for $141 million in September 2018, with the help of a $78 million loan from Varde.

But that only bought them control of the property’s leasehold — the building portion of the asset — because the deal involved a ground lease, meaning there is separate ownership of the land beneath the structure that gets rent from the leasehold owner. That put Alliance on the hook for land rent costs in addition to debt service on the towers.

The added costs can make things tough on property owners, especially if rents are falling, as other entities that have done ground lease deals with Shidler affiliates have recently discovered.

An affiliate of Alliance and Shidler, a ground lease specialist, continues to own the Triangle Plaza’s land, as do affiliates of theirs for the land beneath the historic downtown Chicago office properties known as the Burnham Center and 300 West Adams Street in the Loop.

Read more

The owner of the leasehold at the Adams Street asset fell into default on its loan early on in the pandemic, and it was scheduled to be sold via auction last month following a lender’s takeover but has since been listed for sale again by JLL.

The Burnham Center’s leasehold, meanwhile, is being shopped for sale by owner Golub & Co. in an offering expected to draw less than the property’s debt.

— Quinn Donoghue