A low-profile investor who gambled on an East Loop office tower with a complicated debt structure is struggling to replace DePaul University after the school left a big chunk of space in the building last year.

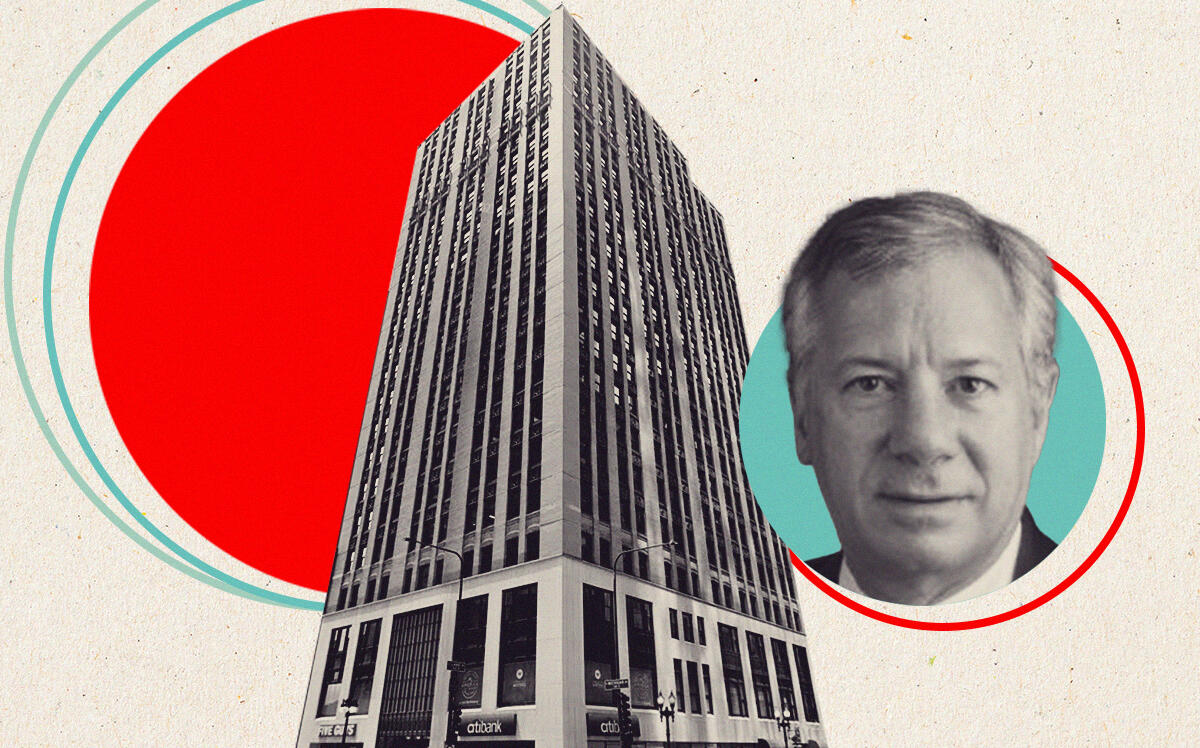

An LLC tied to the Firenze Group’s David Perlstein and an investor named Sung Moon in February has defaulted on a ground lease for the 22-story, 455,000-square-foot building at 55 East Jackson Boulevard. They bought the leasehold on the building in 2019 for $64 million from Marc Realty, one of Chicago’s most prominent commercial landlords.

The deal allowed Pearlstein and Moon to collect the revenue from the office tenant rents while paying a ground lease fee to Marc, which retained ownership of the land. While DePaul was in its 158,000-square-foot lease, it made for a steady profit, putting the property’s annual revenue stream at more than twice the total debt service, according to credit ratings agency DBRS Morningstar. DePaul late last year ended its lease and consolidated offices it had at 55 Jackson into buildings on its campus.

The $44 million loan that Perlstein and Moon obtained from lender Ready Capital Structured Finance to fund their Jackson Boulevard acquisition is set to mature in August. And this spring it was transferred to a special servicer, meaning the lender and borrower have to work out some problems, according to Morningstar. After the loan was issued, the debt was packaged with other commercial real estate loans and sold off to investors in securities markets, making some of the details about the property public.

This isn’t the only Chicago office property where a ground lease appears to be going wrong. At 300 South Riverside Plaza, well-known New York investor Rubin Schron is in a joint venture as the landlord in a ground lease that has building owners David Werner and Joseph Mizrachi struggling. The $167 million loan against the ground lease at that 23-story, 1.1-million-square-foot property was put on a watchlist by the lender earlier this year because Werner and Mizrachi defaulted on their separate $175 million loan against the West Loop building.

It’s unclear what caused the default on the East Loop ground lease by Perlstein and Moon — whether their entity failed to make a payment on the ground lease or fell into some other violation of terms. The ground lease included a 99-year term, according to Cook County records.

Perlstein didn’t respond to a request for comment, and Key Bank, the special servicer now overseeing the $44 million loan, declined to comment. Marc Realty didn’t return a request for comment.

This also isn’t the first time in recent months that Firenze Group has made headlines for a deal on the ropes. Early last year, Perlstein’s Virginia-based firm was rumored to have a deal to buy the 65-story tower at 311 South Wacker Drive for $310 million. But that transaction never closed, forcing the landlord, a joint venture of Chicago-based Zeller Realty Group and the Chinese firm Cindat, to hire a new brokerage and market the property again.

It still hasn’t traded, and it’s expected to fetch bids far less than what Firenze was reported to have agreed paying, with interest rate hikes further squeezing office valuations that were already under duress due to the pandemic and remote working trends.

And Marc Realty is facing foreclosure at a West Loop office building on Jackson Boulevard. The firm is alleged to have failed to pay back more than $14 million it owed on a $16.5 million loan against the 10-story, 198,000-square-foot building at 216 West Jackson Boulevard, where the landlord’s former largest tenant, Marex Spectron, vacated about 40,000 square feet in 2020. A lawsuit involving that asset was filed by the lender in January and is still moving through court, even as Marc is reportedly cooperating and considering a deed-in-lieu of foreclosure to ease the giveback process.

It’s unclear how the ground lease trouble with Firenze could end up impacting 55 East Jackson’s ownership. Firenze was reportedly in discussions with a nonprofit tenant to backfill DuPaul’s now-vacant space, but little new information about the potential lease has come forward recently, according to the March report by Morningstar.

If Marc finds a way to take back over the building portion of the East Loop property as a result of the ground lease default, the company would own its own offices again. It occupies Suite 500 of the building, according to its website.

Read more