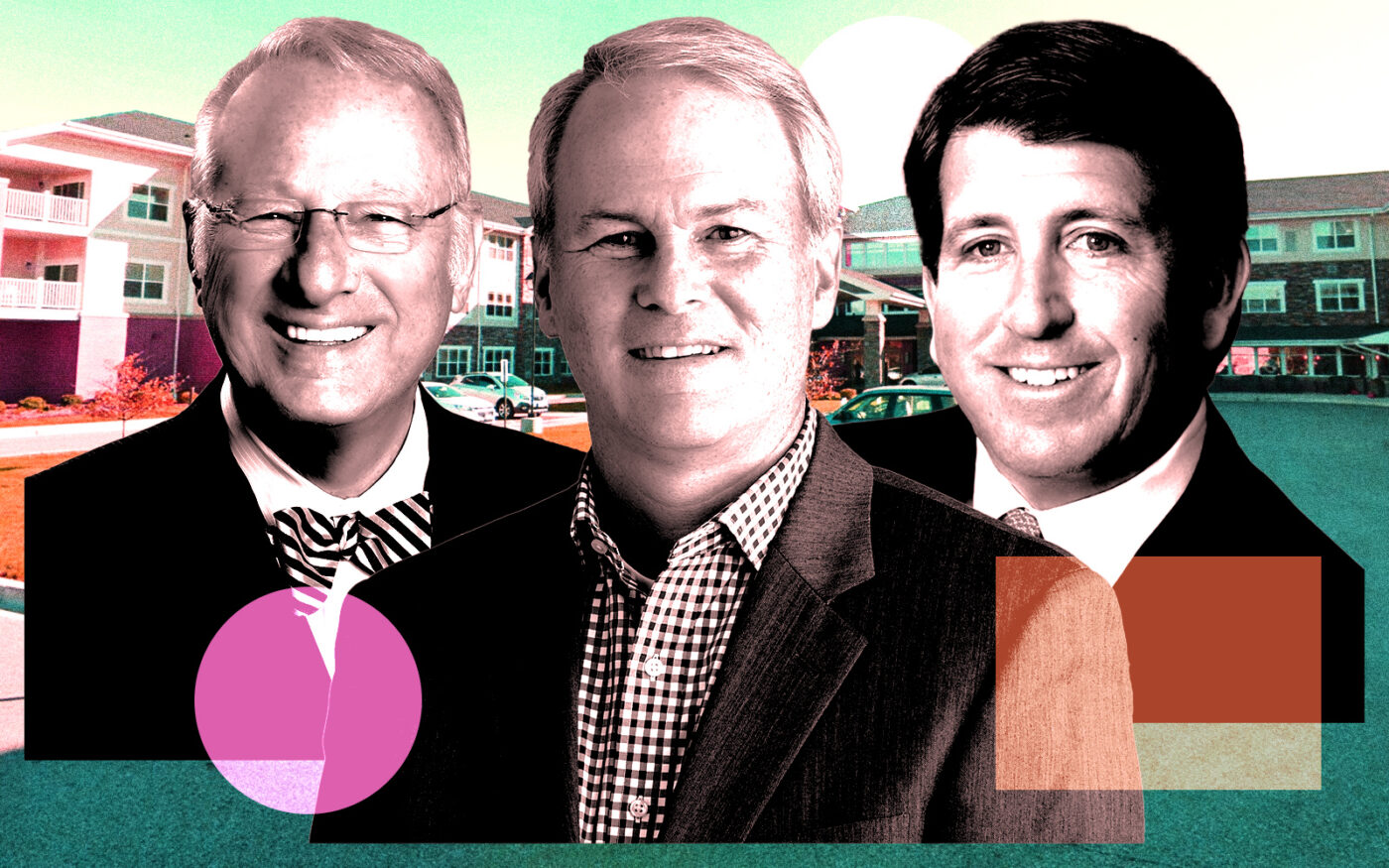

A joint venture of Harrison Street Real Estate Capital and Ryan Companies has cashed in on the sale of a senior living facility in Chicago’s northwest suburbs.

The investment and development firms sold Clarendale of Algonquin, a 186-unit property at 2001 West Algonquin Road, to Oak Brook-based Inland Real Estate Group’s acquisition arm. The price was $63 million, McHenry County records show.

The cost of the project, which was completed in 2017, was $40 million, according to previous reports. Harrison, whose CEO is Christopher Merrill, declined to comment. Ryan Companies and Inland Real Estate Group did not return requests for comment.

It’s at least the third time large Chicagoland senior living facilities traded hands in recent months. Bridge Investment Group sold River Glen of St. Charles to Citrine Investment Group for $19 million in February, and Standard Communities dipped into the senior housing asset class with its $110 million acquisition of Commonwealth Apartments in Chicago’s Lincoln Park neighborhood and Greenleaf Apartments in southwest suburban Bolingbrook.

Investors have been optimistic about senior housing communities as the sector recovers from the impacts of the pandemic. More than 80 percent of investors surveyed by CBRE expect the facilities to reach pre-pandemic residency levels by fall 2023, coupled with strong rent growth, according to a report the real estate services firm released last year.

Read more

Ryan Companies has also developed senior living facilities in Chicago’s Portage Park neighborhood at the Six Corners intersection and in the south suburb of Mokena, according to the Minneapolis-based firm’s website. The Algonquin complex has 76 independent living residences, 56 assisted living and 54 memory care suites.

The independent living residences include one and two-bedroom units ranging from about 720 to 1,285 square feet, and assisted and memory care living units include studio, one and two-bedroom apartments and range from approximately 310 to 835 square feet.