Draper & Kramer has put two high rise apartment towers on the market, one of them with an assumable mortgage loan which may strengthen its lure of potential buyers seeking to avoid the impact of rising interest rates.

The Chicago-based development firm is selling Eleven Thirty, a 656-unit building at 1130 South Michigan Avenue, and Aspire, a 275-unit building at 2111 South Wabash Avenue, Crain’s reported. Both apartments are in the city’s South Loop neighborhood.

Draper hired Berkadia to broker the 43-story Eleven Thirty, and CBRE to broker the 24-story Aspire.

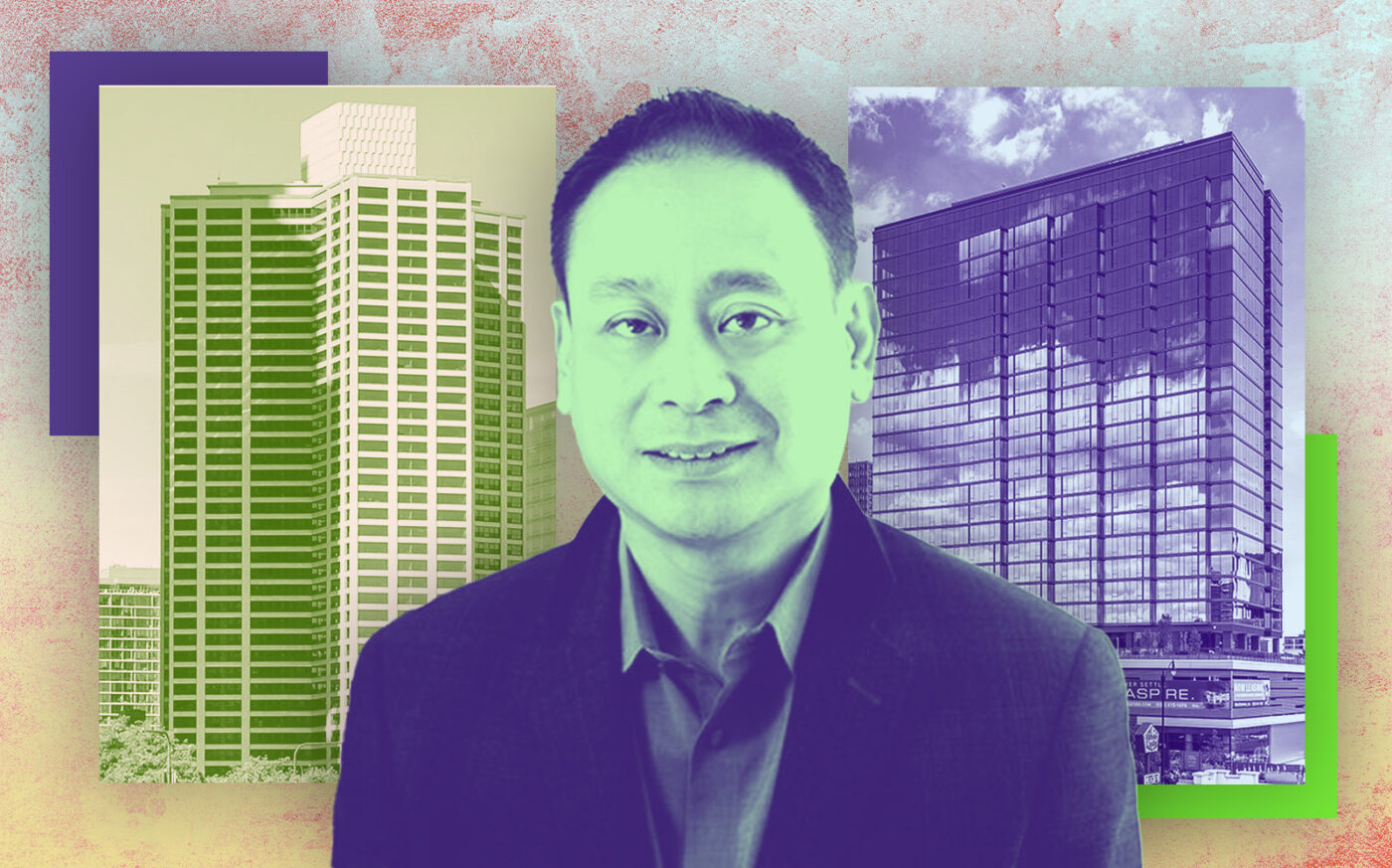

“While we typically invest in properties long term, as was the case with Eleven Thirty and other assets, we will always evaluate transactional opportunities that are in the best interests of our investors and in consideration of current market conditions,” the firm’s CIO Blas Puzon told the outlet.

It’s tough to estimate what each building will sell for given downtown Chicago’s apartment market achieving near record-high rents, while at the same time investors are struggling to overcome the increased cost to borrow money to make large commercial real estate purchases.

Plus, within the last 12 months, five downtown apartment buildings have sold for a total of more than $75 million, a slowdown from previous periods of strong rent growth such as the past two years. Rent increases are expected to temper this year nationwide.

However, Eleven Thirty, which was built in 1967, comes with an assumable loan, a trait that may attract a swarm of investors. This will allow buyers to inherit the existing loan and interest rates on the building, instead of having to take out a new mortgage. Thus, an investor could save a in the long run.

The property’s loan has a $89.3 million balance, a fixed interest rate of 3.8 percent and doesn’t mature until 2047. A new loan for the building would likely range from 5.5 to 6.25 percent, according to the outlet.

Eleven Thirty is 95 percent occupied, with an average rent of $2,315 per month, or $3.04 per square foot. Aspire also has about a 95 percent occupancy rate with a monthly rent average of $2,707, or $2.93 per square foot.

D&K financed Aspire with a $69 million construction loan, and the complex opened in 2020.

— Quinn Donoghue

Read more