UPDATED, June 1, 2023 5:00 p.m.

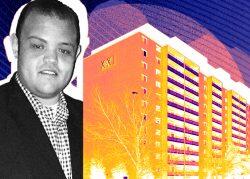

Chicago-based Lakeview Realty Partners closed on an $18.3 million condo deconversion on the city’s North Side, adding to the string of deals for mid-sized apartment buildings in the Lakeview neighborhood.

The Pine Grove Condominium Association was the seller of the 94-unit property at 3825 North Pine Grove Avenue. The buyer is an LLC controlled by area landlords William and Terezia Covaci, according to Illinois business records, and Andy Friedman and Jake Parker of brokerage Kiser Group were hired by the condo association to market the property last spring, and facilitated the sale.

“The condominium deconversion market remains very strong,” Friedman said, predicting more deconversion offerings to come in 2023. “The amount of buildings that were converted from apartments to condos in Chicago before 2008 provides a steady stream of deals.”

Though Friedman said multifamily properties of that size rarely trade hands in the Lakeview neighborhood, the deal is the latest in a string of recent condo deconversions in the Chicago area that include Michael Dobrov’s $63 million takeover of a 357-unit complex in Schaumburg last year, Beak Peak Capital’s $21.7 million July purchase of a 152-unit complex in Naperville and Ansonia Properties’ $46 million deconversion of of a 262-unit complex in Wheeling.

In Lakeview, North Park Ventures paid $32.3 million for the 115-unit Barry Quad in the 800 block of West Barry Street in April 2021, while in July last year, another investor cashed in on a neighborhood asset acquired through a 2019 deconversion. Investment firm MO2 Properties sold an 80-unit Lakeview property for $28 million to Bill Silverstein’s Beal Properties, after MO2 had acquired most of the units for about $17 million through a deconversion sale.

Condo deconversions require 85 percent of the building’s ownership to be on board with the sale and can be controversial. In this case, 90 percent of the units were investor-owned and being rented out while 10 percent were owner-occupied, Friedman said.

“As a result, individual unit sales were depressed, and this deconversion sale provided an excellent exit for owners,” he said, claiming per unit values through the deconversion deal exceeded market values.

The move also adds more rental units to one of Chicago’s most competitive rental submarkets. The Lincoln Park-Lakeview area had a vacancy rate of 3.1 percent in the third quarter of 2022, according to the latest multifamily report available from Marcus & MIllichap.

An earlier version of this story misidentified the buyers of the property. The buyers have been corrected to William and Terezia Covaci in this updated story.

Read more