Bayshore Properties can’t get enough of Chicago’s northwest suburbs.

The Indiana-based apartments investment firm dropped $131 million on an Arlington Heights complex, CoStar News reported, building its portfolio to more than $240 million across three purchases made within the last year.

Ohio-based Connor Group was the seller on Bayshore’s latest deal, adding the 586-unit Stonebridge Village Apartments at a price that comes to about $224,000 per unit. The property last traded in 2016 for $105 million, or $179,000 per unit, meaning last month’s sale marked about a 25 percent rise in property value.

It also played into a record 2022 for U.S. multifamily sales volume, as deals within the asset class last year reached $5.5 billion, the highest in at least a decade and just more than 2021’s $5.4 billion, CoStar reported. Multiple large apartment complexes in Chicago’s northwest suburbs contributed with nine-figure sales prices last year, including a Rolling Meadows property that FPA Multifamily sold to New York-based Beitel Group for $111 million, and the Bourbon Square property in Palatine that set a record overall price for the Chicago suburbs when Albion Residential bought it for $140 million, or $228,000 per unit.

While Bayshore sold a multifamily building in Chicago’s southern suburbs last year to San Francisco-based landlord Robert Imhoff for $38 million, it’s been focused on buying in the northwest suburbs. Last year it bought the 344-unit Mount Prospect Greens property for $50 million, and completed a condo deconversion that turned a 357-unit complex in Schaumburg into apartments for $63 million in a deal it closed in partnership with deconversion specialist Michael Doborov.

Greystone arranged financing for Bayshore on the Arlington Heights deal– the same firm that helped the buyer finance the Schaumburg condo deconversion.

As for Connor Group, it’s slimming down its Chicago-area holdings with the deal just weeks after entering Miami with its first purchase in that market, where it spent $138 million, or $372,000 per apartment, to buy adjacent complexes in the Miramar area that total 371 units.

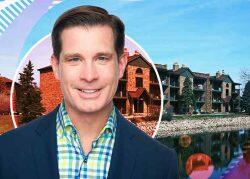

CBRE’s Steve LaMotte, John Jaeger, Justin Puppi, Ross Wettersten and Dan Wilson represented Connor Group in the Arlington Heights sale.

Read more

— Sam Lounsberry