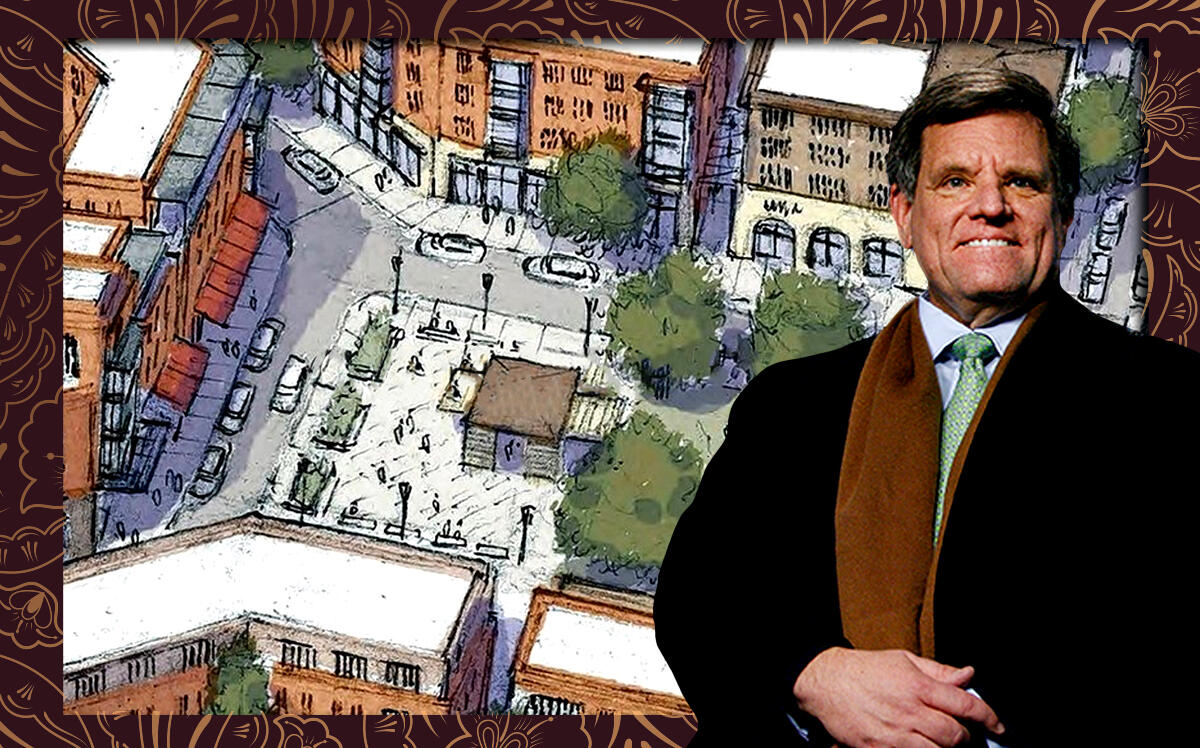

The Wirtz family’s plans to turn vacant land in Chicago’s northwest suburbs into a sprawling development will target multiple segments of housing consumers with 3,000 units ranging from apartments, townhomes, single-family and senior homes.

The family, which owns the NHL’s Chicago Blackhawks, is working to bring housing, shops and athletic fields to land the family owns on Mundelein’s northwest side, the Daily Herald reported.

So far, the plans are to build 1,200 single-family houses, 600 townhouses and 800 other multifamily units. There will also be 600 age-targeted residential units. The development will be built in stages, with the first units expected to be ready for residents in 2025.

Aside from the housing and retail elements, the project is also proposing pocket parks, community buildings, a village center and light industrial buildings for the property. Pedestrian-friendly roads and equestrian trails are envisioned, as well, plus the family is considering building a school on the 800-acre site. The family-owned Ivanhoe Nursery & Farms, which has been on the site for more than 160 years, will remain.

“This is a legacy project for the Wirtz family,” the family’s attorney Bruce Goldsmith told the outlet. “They’re not leaving the area. They’re not leaving the farm.”

The village board agreed to annex 740 acres into Mundelein and more land could soon be brought into village territory.

Mayor Steve Lentz said he is grateful the family is staying in town and heavily involved in the project, rather than selling the land to a homebuilding company.

The land that makes up Ivanhoe Farms is where Michael Wirtz — great-great grandfather of Blackhawks President Rocky Wirtz — settled after emigrating from Germany in the 1850s.

The Wirtz family’s holdings include the United Center which is shared with the Chicago Bulls ownership group, two banks, downtown office buildings, apartments on the North Side and the Breakthru Beverage Group alcohol wholesaler. The family is also in the process of selling its entire Evanston apartments portfolio for $35 million.

Read more

— Victoria Pruitt