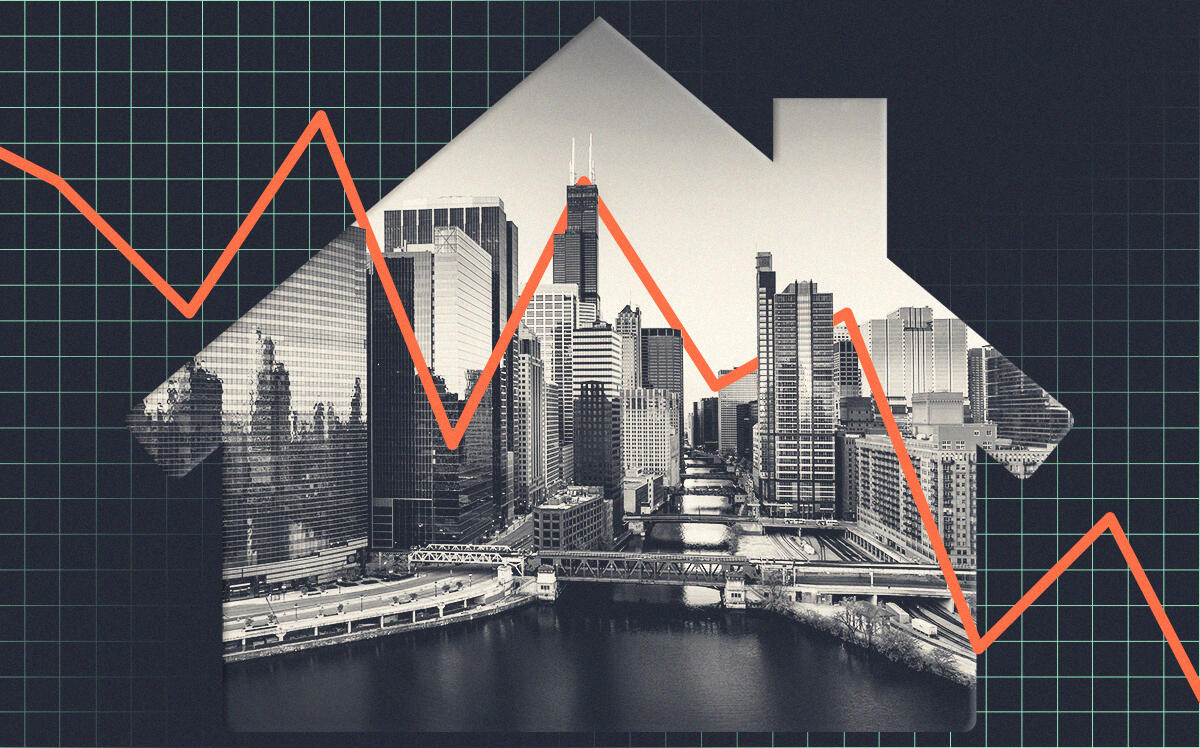

Mortgage interest rates are taking a toll on Chicago’s housing market.

In the Chicago metro area, home sales last month dropped 22 percent year-over-year, while prices continue to rise.

“The number of sales always drops this time of year in the Chicago area, but I think it’s quite a bit lower than last year,” said Daniel McMillen, head of the Stuart Handler Department of Real Estate at the University of Illinois at Chicago. “However, last year was a recovery year. The big thing is that interest rates are at 7% and that’s going to slow down the market.”

Rising interest rates not only limit buyers, but create a market where those who would normally sell their homes are hesitant to because they have locked in low mortgage rates. Inventory decreased 18 percent from this time last year, according to data provided by the Illinois Realtors Association.

“I think it’s kind of a rational thing right now to wait until spring to buy,” McMillen said. “I understand the delays. I think the Fed is pretty serious about ending this inflation.”

Despite the focus on home buyers, inflation and interest rates will also have a negative impact on renters, who are more subject to yearly increases in prices due to inflation, whereas buyers have their interest rate locked in, but can refinance when rates drop. Should the inflation continue for another year, renters are in for sticker shock on their monthly payments.

Beyond the limited inventory and fewer closed sales, the median sale price of homes increased from this time last year, with a jump from $290,000 to $305,000 throughout the Chicago metro.

Condominiums, however, continued to struggle more than single family homes in both categories. Condos alone have a median sale price of $245,000, compared to single-family homes that average nearly $100,000 more, at $340,000.

The slowing market comes after the pandemic-era boom on residential real estate nationwide, where low interest rates and high demand created a seller’s market that pushed prices up. That’s changed dramatically in the last six months, while interest rates have risen to 7 percent and would-be buyers are backing out of the market.

“There’s just so much uncertainty right now, and that slows down the market,” McMillen said.

Read more