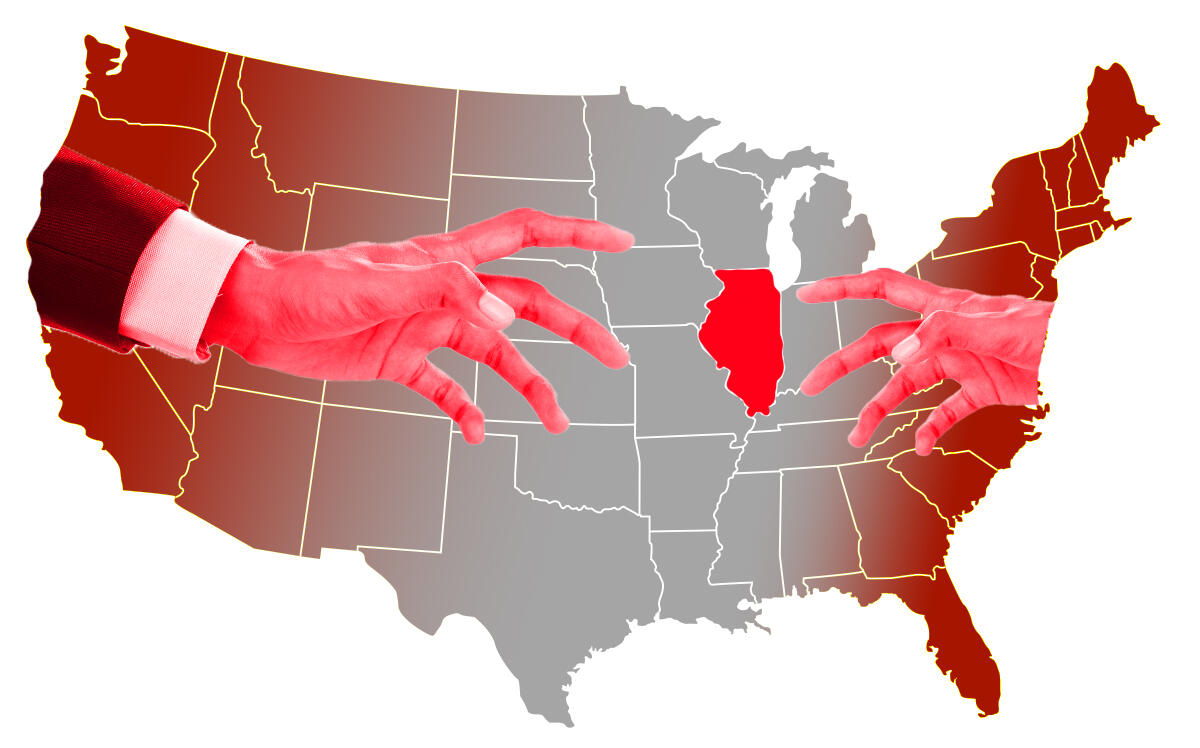

Bucktown stands out as a retail district among Chicago neighborhoods as buyers from New York and California increasingly reshape the North Side’s shopping and dining landscape.

Aside from Fulton Market’s standout performance, none of the city’s other 10 retail submarkets have drawn larger crowds of customers compared to pre-pandemic levels than Bucktown, a September study by Cushman & Wakefield found. Bucktown in July saw a 13.5 percent gain in foot traffic from its pre-pandemic peak, behind only Fulton Market’s 14.3 percent increase.

And Greenstone Partners broker Brewster Hague and his colleagues have been cashing in on the evolution of Bucktown and neighboring Wicker Park. He’s made mixed-use properties on the North Side his specialty, and has had to school some California multifamily investors on how to manage the retail spaces below the housing units they’ve been buying in the neighborhoods.

“We’ve found a little niche with a lot of owner-user buyers,” Hague said. “They’re coming in from out of state and they want to establish a hospitality platform in our neighborhoods here.”

Greenstone this year has brokered seven deals of at least $700,000 for retail or mixed-use with apartments and ground-floor retail on properties in Wicker Park and Bucktown, and 15 since 2020, with a combined value of more than $26 million, according to data the brokerage provided last month. No other brokers are making close to as many deals for such properties, according to CoStar data Greenstone shared.

“Returns on investment are much higher here than on the east coast and west coast for the same property, essentially,” Hague said.

While Chicago’s North Side neighborhood retail has fared well during the health crisis relative to battered Loop and Magnificent Mile properties, the top of the market is flattening out as values of spaces on less prominent neighborhood streets catch up.

Upscale retailers have made Bucktown a designer destination, and North Damen Avenue has emerged as its main drag. The neighborhood’s triple-net rents per square foot are $60, Cushman found, with Damen Avenue running higher, according to Joseph Dushey of New York-based Jenel Real Estate, which has a 3 million-square-foot portfolio across the nation that includes 18 buildings in Chicago, its website shows. For comparison, Fulton Market’s triple-net rents clocked in at $75 on the Cushman report while suburban rents are hovering at about $17.50.

Jenel has seven properties in the 1600 block of North Damen, one of three North Side stretches where pricing and occupancy took only a brief hit from the pandemic. The others were Armitage Avenue in Lincoln Park and Southport Avenue in Lakeview.

“In those three corridors coming out of the pandemic, within like 6 months, new leases were being signed at pre-pandemic levels,” Hague said. “That was great to see, because it further demonstrates the market to investors and sellers that location means everything.”

Yet there remains plenty of availability in Bucktown, with about 35 percent of its 533,000 square feet in retail supply available, the Cushman report said.

“Obviously, you can do better in the neighborhoods than $60 a foot, there’s no doubt about that, but there is definitely somewhere it’s going to top out,” JLL’s Walter Wahlfeldt said. “In Wicker Park, Bucktown and Southport, I don’t know that you’re going to see rents get that much higher.”

Pricing has also been complicated by uncertainty regarding tax assessments. Cook County Assessor Fritz Kaegi has started a new triennial round of assessments and so far indicated he’s prone to hike values of commercial properties more so than single-family homes, increasing retail tax liabilities.

The environment requires buyers to know their limits, and not overestimate the pace at which rent increases can take place without overburdening retail tenants.

“If you’re realistic about your rents you should be able to lease space,” Dushey said. “When you buy a building and you have a huge basis, and you’ve recently purchased a property in the height of the market, when things were a little exaggerated, that’s not good. It makes it very challenging.”

Plus, restaurant operators have been increasingly limited on how much more rent they can afford by the commissions paid to delivery services such as DoorDash and UberEats, said Cushman broker Greg Kirsch. “DoorDash is a double-edged sword,” he said.

Rising interest rates have also cut back buying opportunities to a smaller group of sellers, Dushey said. “People that don’t see the rents flying up that are motivated to sell, you can make a deal with those types,” he said.

Restaurant leases turning over on Wicker Park and Bucktown streets that aren’t quite as high-profile as Damen are also giving owners a chance to raise rents, Hague said. In pockets on the 1600, 1700 and 2000 blocks of Division Street, for instance, new leases are being signed at $50 to $60 per square foot, he said.

“A lot of other restaurants are paying $35 or $40,” Hague said. “When you can demonstrate that to investors, that adds a complete other level of comfort to them.”

Read more