Industrial developers have never been busier in Chicago.

With warehouse tenants’ demand for bigger buildings rising, massive new projects got underway in the third quarter, pushing the Chicago area to a new record number of construction starts in the third quarter, according to Colliers. The 17.2 million square feet of buildings across 48 projects that got underway is a new quarterly record, breaking the previous all-time-high of 13.1 million square feet set in the second quarter of 2020.

Competition to bring supply to market quickly is fierce enough between developers to spark litigation when plans don’t go smoothly.

In Joliet, a second lawsuit was filed by Oak Brook’s CenterPoint Properties against the city council in August over the local municipality’s denial of a plan to build a new industrial facility near the Interstate 55 and Interstate 80 interchange, according to the Herald-News.

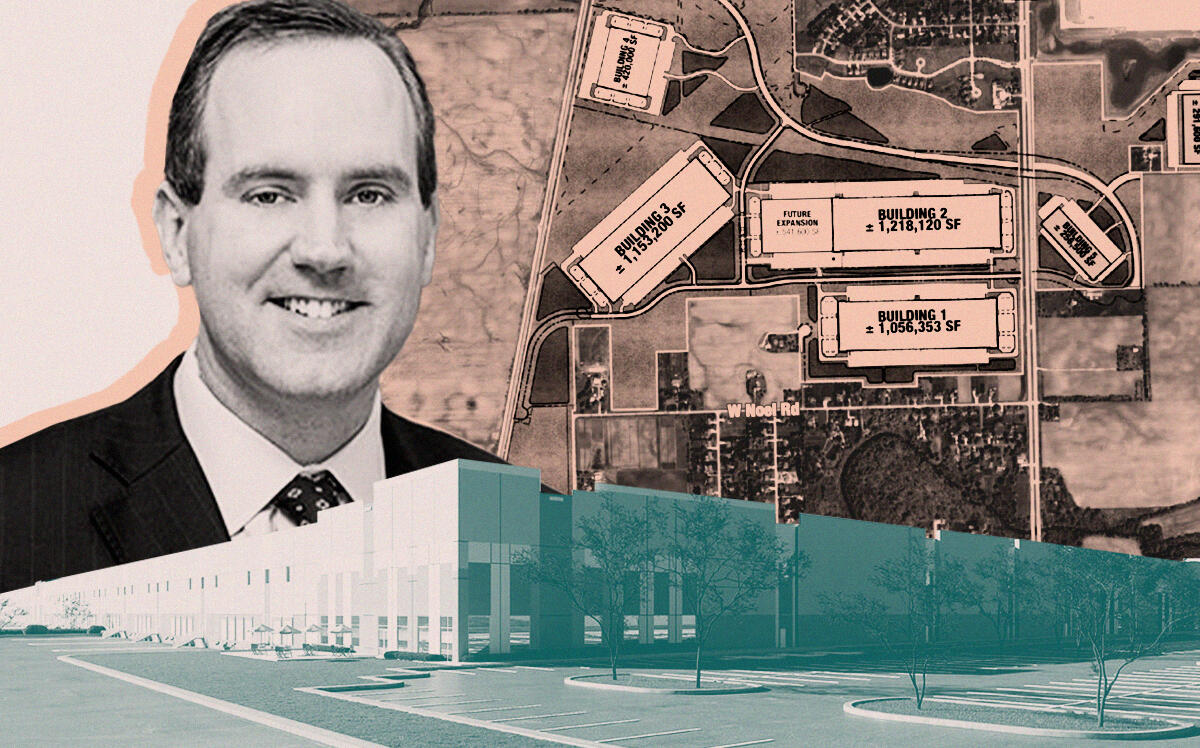

The quarter’s largest new construction project was Kansas City-based NorthPoint Development’s two-building plan that will total 2.2 million square feet, next door to the CenterPoint site. CenterPoint opposed the NorthPoint plan. The case is still moving through court.

Almost all of the new construction projects were started on speculation, demonstrating developers’ confidence that demand will support profitable returns.

“A lot of different tenant clients of mine are out of space, and need double the amount,” said Andrew Maletich of brokerage Cawley Chicago.

That’s especially true in the submarket surrounding O’Hare International Airport, where the vacancy rate hovers around 2 percent despite much of the buildings being smaller — less than 100,000 square feet — than the more modern, larger warehouses at least double that size many tenants prefer today.

Developers are assembling parcels in the O’Hare area as quickly as possible to update and enlarge smaller industrial spaces to between 50,000 and 70,000 square feet — much smaller than projects pursued in other submarkets.

“People will do things differently in O’Hare than they will in any other market. You won’t see them build that small,” Maletich said.

The dynamic has enabled some tenants that signed leases a few years ago to make money by vacating their space early, and subleasing it at a higher rate they were paying the direct landlords as they wait for availability in a larger building to open, he said. What’s more, landlords have had to add new clauses to their rental agreements to capture additional value on the secondhand market through subleases.

Read more