Chicago office tenants continue to cut back on space, even as more people are returning to the workplace.

Marketing software firm ActiveCampaign is the latest company following this trend by shedding a massive amount of space for the sublease market.

The company’s 101,000-square-foot offering at One North Dearborn Street is among the largest recent additions to Chicago’s secondary market, which reached a historic high of 6.4 million square feet available in the central business district as of this month, according to brokerage MBRE. Sublease options have nearly doubled since the first quarter of 2020, when the pandemic began.

The city’s previous all-time-high for available space was 6 million square feet, a mark set earlier this year.

That number could nearly double as tenants keep reassessing their post-pandemic real estate needs, Cushman & Wakefield broker Ari Klein said.

“I bet you’re going to see another 5 million square feet come onto the sublease market,” he said. “Raw space isn’t going to move unless it’s in a super Class A trophy tower.”

“No one wants to contend with the highest construction costs we’ve ever seen, even with landlords offering triple-digit tenant improvement allowances.”

In fact, the record amount of available sublease space is already an undercount of what’s actually available.

“It’s unquantified,” Klein said of the secondhand market.

One of his clients in a Wacker Drive tower recently decided to expand by about 30,000 square feet, and needed it in the same elevator bank as its existing space.

Nothing was available to lease directly from the landlord, and none of the building’s other tenants that used that elevator were actively marketing subleases. So Klein made calls to see if he could strike a deal with one of them anyway, and multiple offered up their spaces. He implied he’s close to making it happen.

ActiveCampaign’s decision to scale back comes just a few years after making a substantial expansion. In 2019, it tacked on 50,000 square feet to its lease, according to published reports. But the company’s sublease offering illustrates the rapid pace Chicago’s office tenants are backpedaling on their need for real estate.

“What we’ve learned over the course of the past few years is that our team works really well in a hybrid environment,” ActiveCampaign founder and CEO Jason VandeBoom said through a spokeswoman. “We remain a Chicago-based company and will continue hiring great talent in the city. We are simply iterating upon the type of space and what hybrid means for the future of work at ActiveCampaign.”

A spokeswoman for ActiveCampaign said the company is keeping its options open and may decide to keep some of the space or could consider a move to another property in a smaller office.

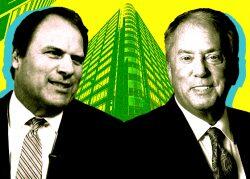

The Central Loop from State to Wells streets, an area that includes ActiveCampaign’s Dearborn building jointly owned by Boston-based Beacon Capital Partners, MetLife and the New York State Common Retirement Fund, accounts for more than 1.1 million square feet of the central business district’s sublease stock.

The West Loop, from Wells to Halsted streets, contains the most within the district at more than 2.7 million square feet, according to MBRE. The Central Loop secondary market has by far the oldest listings, as they average nearly three years on the market, meaning some of the listings predate the pandemic.

“It’s affecting the market,” said MBRE broker Andrew Davidson. “Landlords are having to compete with good sublease space. Especially for deals where people are looking for good as-is conditions that are ready to go and they don’t necessarily have to commit long-term, sublease space is ideal for that. It allows tenants flexibility and to get into a better building than they normally would at a lower cost.”

As reverberations of a broader economic downturn grow louder, businesses considering subleasing must be cautious about what spaces they agree to take over.

A subtenant’s deal could be cut short in the event the primary tenant becomes distressed to the point it can’t afford to pay the gap between its more expensive direct rental rate and the less expensive rate paid by its subtenant.

“Occupiers also have to feel comfortable with the credit that’s underneath, that the [sublandlord] they are subleasing from is going to survive,” Davidson said. “Otherwise their sublease means nothing.”

Read more