Chicago office investor Ameritus, turning its attention to the booming multifamily market, is set to spend $50 million to gobble up a suburban Wheeling development.

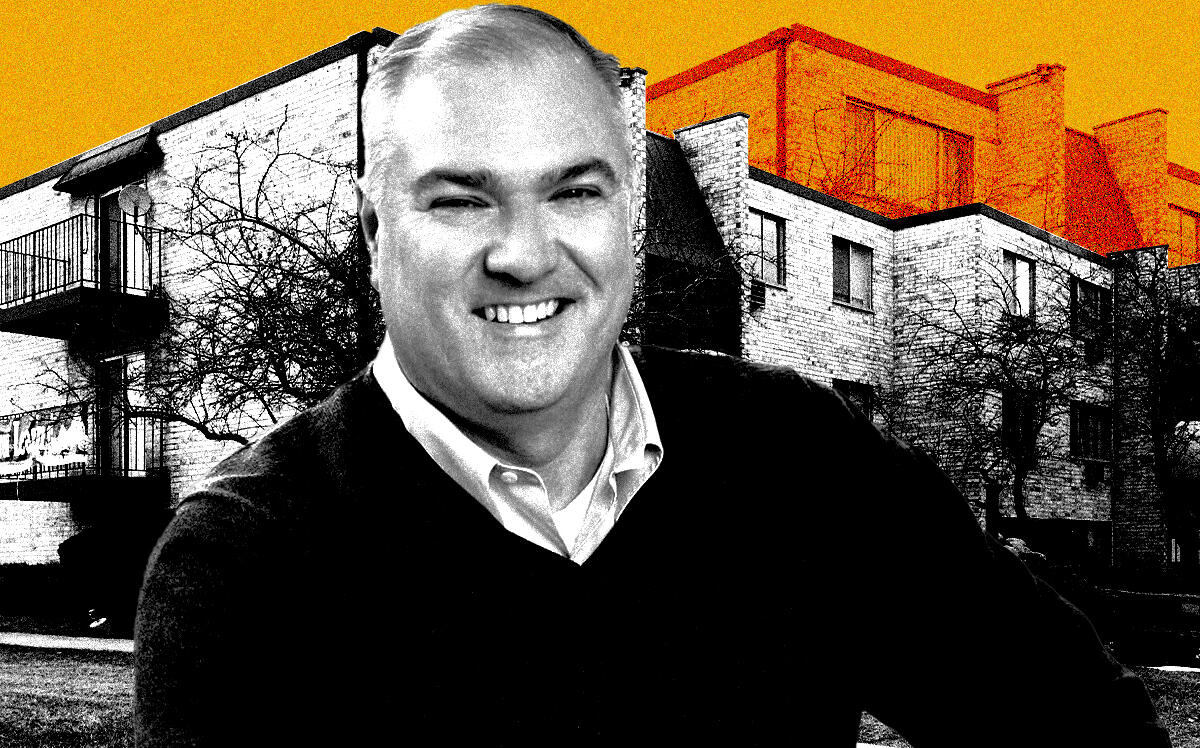

Ameritus, led by Benjamin Nummy, Jeb Scherb and Bob Buddington, has so far shelled out $30 million for 75 percent of the Hunt Club, made up of 74 six-unit buildings, public records show. It just snagged a $50 million loan from California’s CoreVest American Finance to buy the rest of the units, all of which were owned by individual investors, and start renovating, according to Nummy.

“It’s a unique asset,” Nummy said in an interview. “Not too many people would really want to spend a year cobbling together and negotiating these contracts for $600,000 purchases to get to where they need to be.”

The Hunt Club buildings, some 23 miles northwest of downtown Chicago, need a facelift to make them uniform in appearance. Each was managed separately and are in various states of disrepair after being developed and sold by Inland Real Estate in the 1980s. Some have been fixed with additions that are at stylistic odds with the neighboring buildings.

“There’s no consistency of improvements out there, no consistency among the other owners in wanting to address deferred maintenance issues,” Nummy said.

Ameritus now wields enough clout with the owners to pass special assessments and collect fees to fund projects. Holdouts could lose out, because building values decline after an assessment is in place.

“Once we start rolling out the capital plan, a lot of the holdouts will acquiesce,” Nummy said.

Ameritus is also eyeing other housing complexes whose values could rise with upgrades. Its Chicago office assets include 121 West Wacker Drive in the Loop bought for $119 million in 2018, as well as the buildings at 205 and 211 West Wacker. The company also owns the 248-unit Fox Pointe Apartments in suburban Aurora, bought for $25.2 million from Inland in 2020, according to public records.

“Because office and retail and hotels are not on anyone’s radar right now, the multifamily sector and industrial sector have been overbid for the last year or two,” Nummy said. “It’s tougher to find apartment assets that make sense to upgrade.”