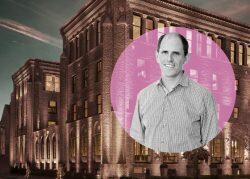

A venture backed by Brookfield Asset Management bought a restaurant and nightclub in a historic building in River North that was transformed by Chicago developer Sterling Bay.

Phoenix-based Fundamental Income paid about $30 million for the 34,000-square-foot building at 632 North Dearborn Street, Crain’s reported, citing people familiar with the deal. The property is a 130-year-old Romanesque Revival building that’s been home to Tao Group’s Chicago outpost since 2018.

It was the second purchase of an historic building by Fundamental, a two-year-old firm focused on buying properties leased to single tenants on long-term deals. That’s a business model threatened by accelerating inflation, because some rents may not rise at the same pace over the course of a lease.

In October, Fundamental paid $45 million for the historic Three Arts Building in the Gold Coast. It’s leased on a long-term basis to Restoration Hardware.

The move also shows how the retail market is changing, with experience-based assets such as restaurants, clubs and entertainment facilities fetching higher valuations than before the pandemic, while storefronts face challenges from the rise of e-commerce and muted downtown foot traffic amid the health crisis.

“Obviously there have been Covid impacts on restaurants and entertainment as a whole, but in a post-COVID world, operators like Tao and experiential assets like this are going to thrive,” Fundamental CIO Alexi Panagiotakopoulos told Crain’s.

For Sterling Bay, the deal marks the completion of a cashout delayed in April 2020, when a deal to sell the property fell through as the pandemic struck. The developer bought the property for $11.5 million in 2014, and it was kept vacant while a joint venture of Sterling Bay’s hospitality arm Four Corners and Tao Group spent $25 million to transform the property ahead of its 2018 reopening.

Tao inked a 20-year lease at the time, and the rent rises 6 percent every three years as part of the deal, though the base price is unclear.

Since its start in 2020, Fundamental Income says it’s spent more than $600 million on real estate.

Read more

CORRECTION, May 25, 2022, 2:15 p.m.: The final paragraph of this story has been corrected to show that Fundamental says it has spent more than $600 million on real estate.

CORRECTION, May 27, 2022, 1:45p.m.: The sixth paragraph of this story has been corrected to show that Panagiotakopoulos is the CIO.