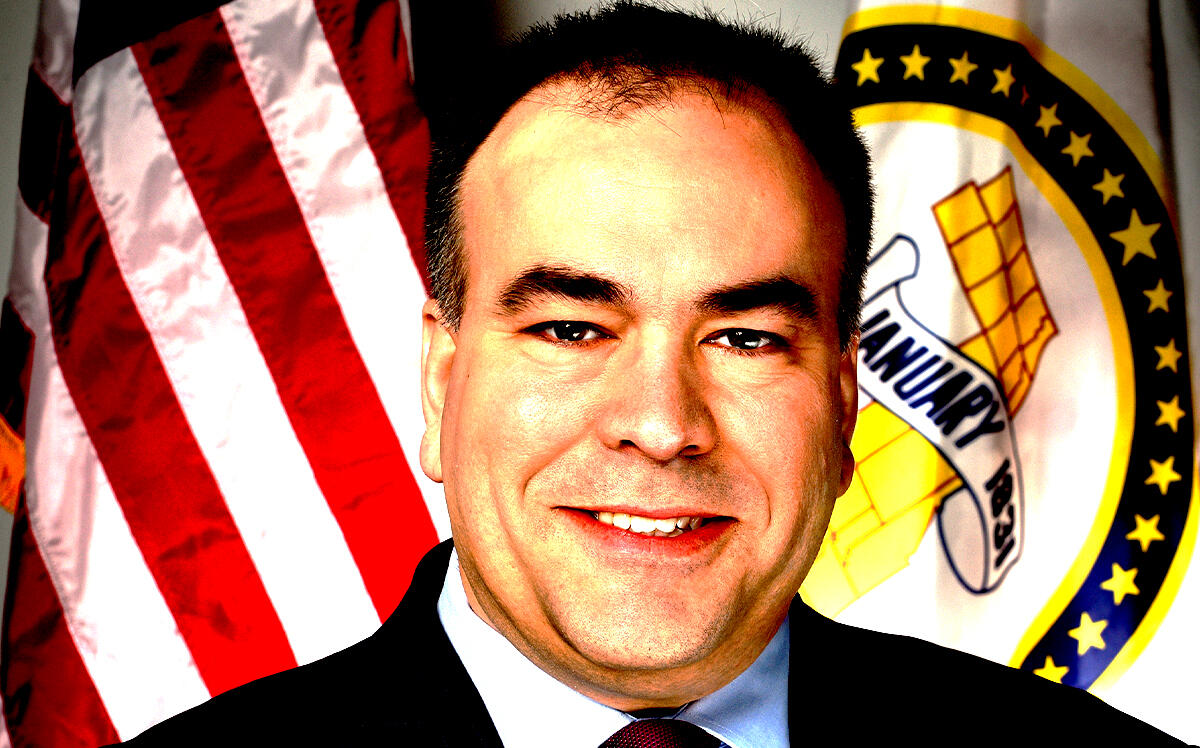

UPDATED Jan. 28, 2022, 3:45 p.m.: Cook County assessor Fritz Kaegi is under fire again.

Wrong assumptions about the way the pandemic would hit workers and home prices led to some tax breaks for wealthy neighborhoods such as Logan Square, and increases in less affluent ones, including Greater Grand Crossing, according to the Chicago Sun-Times. About 5,000 homeowners in the city and the north suburbs didn’t get a Covid-related break, even though they seem to have qualified for one.

While Kaegi’s own assessment increased, it fell for notable politicians such as Mayor Lori Lightfoot. Kaegi disputed the report’s conclusions.

While the Assessor’s Office had never before undertaken unemployment projections before the pandemic, Kaegi decided to take action within weeks of the March 2020 shutdown, when it became clear that home values in Chicago were falling, the newspaper reported.

That spring, Kaegi and his staff recalculated the values placed of all 1.5 million homes in Cook County, cutting them by a median of 10 percent.

That decision resulted in lower tax bills for some homeowners, higher ones for others, and higher tax bills for most commercial buildings even though businesses were hard-hit by the pandemic, too, according to the Sun-Times.

A few large commercial properties did get breaks, including Wrigley Field, Arlington International Racecourse and many hotels. Others, including Willis Tower, had big increases.

In a statement on Friday, Kaegi said reducing property taxes was the right thing to do, given that commercial and residential properties hit historic lows in March 2020.

“We provided Cook County homeowners and commercial property owners with urgently needed Covid-related changes across the board. It was the right thing to do morally in that emergency, and it was the right thing to do to create more accurate property values,” Kaegi said. “It is no coincidence that those griping about Covid relief are property tax attorneys and large commercial property owners who benefited from the rigged system of the past.”

He said wealthy commercial property owners weren’t treated differently than any of the other 1.5 million residential and commercial properties that received a Covid adjustment. “We don’t give special treatment to the politically connected or very wealthy – and we never will,” Kaegi said.

What Kaegi didn’t foresee, according to the Sun-Times, was that the housing market would rebound so quickly, even before homeowners got their tax bills in 2021, as people rushed to buy homes in the more sparsely populated suburbs. But the cuts were already locked in.

“They took a gamble, and the gamble didn’t turn out as they expected,” Laurence Msall, president of the Civic Federation, which monitors government finances, told the Sun-Times. “A lot of the relief they gave was uneven and not where it was needed.”

Kaegi’s office came up with a new formula for projecting unemployment neighborhood by neighborhood, instead of relying on home prices, as assessors in Illinois typically do. The formula, based on data from the U.S. Census Bureau and the Federal Reserve, was meant to calculate how the unemployment rate would affect the value of homes, condos and small apartment buildings in the neighborhood.

They estimated the unemployment rate in every neighborhood would double to 16 percent. Kaegi’s office then cut assessments on most residential properties by 7.5 percent to 15.4 percent.

It’s unclear how much Covid relief each homeowner got from Kaegi. The changes weren’t documented on tax bills that were paid last October, nor were they listed on county tax websites. The Cook County treasurer’s office, the body that mails the bills, says it doesn’t know how much each bill was affected, the Sun-Times reported. Lawyers who handle property tax appeals say they can’t figure out how the reductions were calculated.

Robert Ross, the former data chief for Kaegi, who quit last year, told the Sun-Times taxes were reduced for homeowners if their home’s assessment fell by 10 percent or more. Otherwise, a lower assessment meant the property tax would be higher than the year before.

“We guessed it wrong, which means some people won and some people lost,” Ross said to the Sun-Times. Ross has been discussing the breaks with Kari Steele, who is opposing Kargi in the June Democratic primary.

Kaegi said in Friday’s statement that his office has “operated transparently, publishing an extensive, public explanation of our Covid adjustment’s on the Assessor’s website in May 2020.”

Kaegi also said any residential property owner can review a map to see what the adjustment was in their neighborhood, which was reflected in the individual assessment.

The breaks are being rolled back for homeowners in Chicago because Kaegi was required by law to reassess every property in the city in 2021, The Sun-Times said.

But north suburban homeowners north of Oak Park are keeping their breaks for a second year. Homeowners South of Oak Park get to keep their breaks until their communities are reassessed in 2023.

Kaegi said his office can’t reassess the entire county in one year and that by law he can’t increase assessments for homeowners except as part of a broader reassessment.