A KKR fund bought a three-building logistics property in Chicago as part of a purchase of 1.9 million square feet of warehouses.

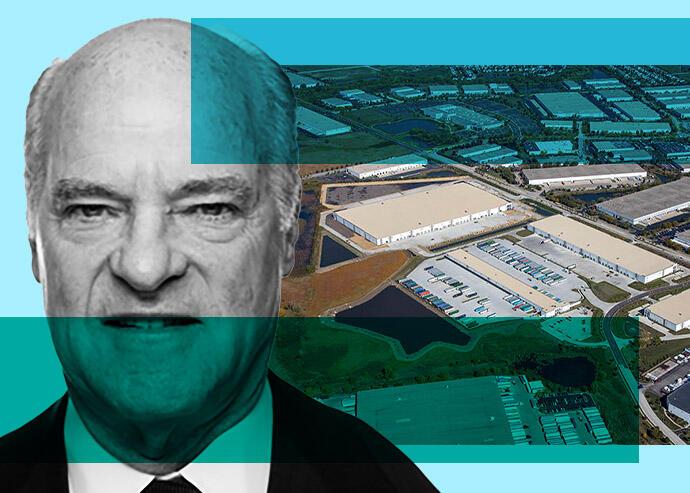

KKR Real Estate Select Trust paid developer Crow Holdings Industrial $155 million for a fully leased 923,000-square-foot property in suburban Bolingbrook, Commercial Property Executive reported. The property, comprising a truck terminal, cross-dock and rear-load warehouse, is occupied by four tenants on a long-term basis.

Distribution centers located close to “major population centers and key transportation hubs will have significant staying power and are a great match for KREST’s long-term capital,” said Ben Brudney, director in the real estate group at KKR.

The Chicago region is one of the country’s largest logistics markets and is a hub for food and beverage and consumer product distribution, according to the company’s website. The industrial park is about 30 miles from Chicago’s central business district and 25 miles from Midway International Airport.

It was a banner year for Chicago industrial real estate. Demand for last-mile warehouses to serve online retail pushed asking rents to an all-time high of $5.90 per square foot in the fourth quarter of 2021. Active leasing drove down vacancy rates to 8 percent during the same period, below the pre-pandemic level of 8.6 percent.

As part of the recent deal, KKR also bought a newly constructed, one million-square-foot, cross-dock industrial warehouse for $109 million in Charleston, South Carolina. The Charleston market, driven by private and public sector employment, showed consistent growth over the past decades, according to KREST.

KKR, which spent three years acquiring the 14.5 million square feet of warehouses through 50 transactions in 12 major markets across the country, launched KREST in May. The trust allows individual retail investors to put their money into the company’s least risky assets.