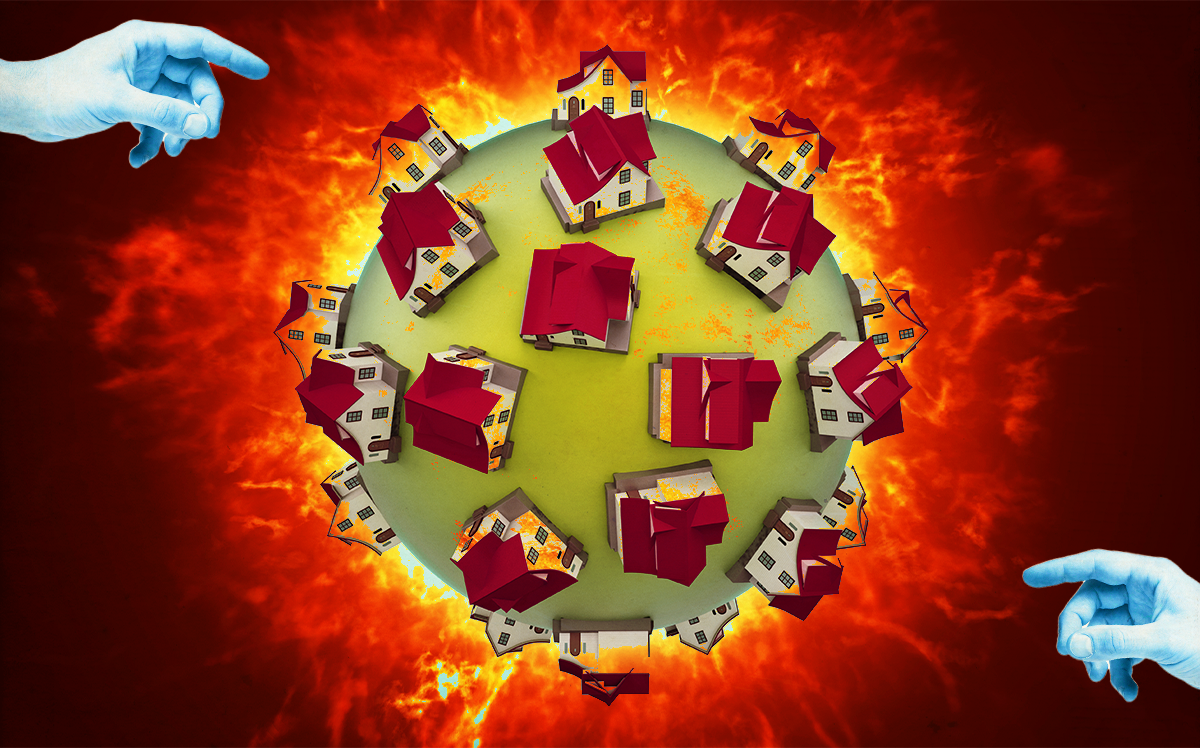

Chicago’s housing market is hotter than ever but the soaring home prices are keeping out first-time buyers.

The effect of these home seekers being priced out could impact the rental market and the accessible city neighborhoods and suburbs, the Chicago Tribune reported, citing a report from the Joint Center for Housing Studies at Harvard University.

Chicago had 120,000 fewer affordable housing units even before home prices skyrocketed this year due to a shortage of inventory, high construction and labor costs.

The report found that a buyer earning between 50 and 80 percent of the area’s median income could afford a house priced at $196,450 in June 2020. But one year later, a home that was 80 percent of the median price sold for $220,562, making it less accessible for low-income buyers.

The booming housing market has pushed medium-income buyers to less expensive areas including Garfield Park and Humboldt Park, where they would make offers over asking price. Residents of those neighborhoods lose bidding wars, and are likely to stay in rentals, ultimately driving up rent prices, the Tribune reported.

“It’s like this vicious loop,” said John LeTourneau, president of the suburban Mainstreet Organization of Realtors.

Changing zoning regulations to allow more high-density housing in some Chicago neighborhoods and offering a rehab loan for buyers of properties that need work are suggestions from real estate professionals.

But it comes down to investing in more affordable housing and programs that offer down payment assistance, Raheem Hanifa, Harvard research analyst, told the Tribune.

Measures to preserve affordable housing have to come quickly as there will be fewer places left for low-income buyers, she said. “And it’s creeping to middle income and folks that are higher in the future.”

Low-income families could afford a home in just 20 of the country’s 100 largest metro areas this year, down about 50 percent from 2020.

[Chicago Tribune] – Connie Kim