It would have been the biggest condo deconversion in Chicago history.

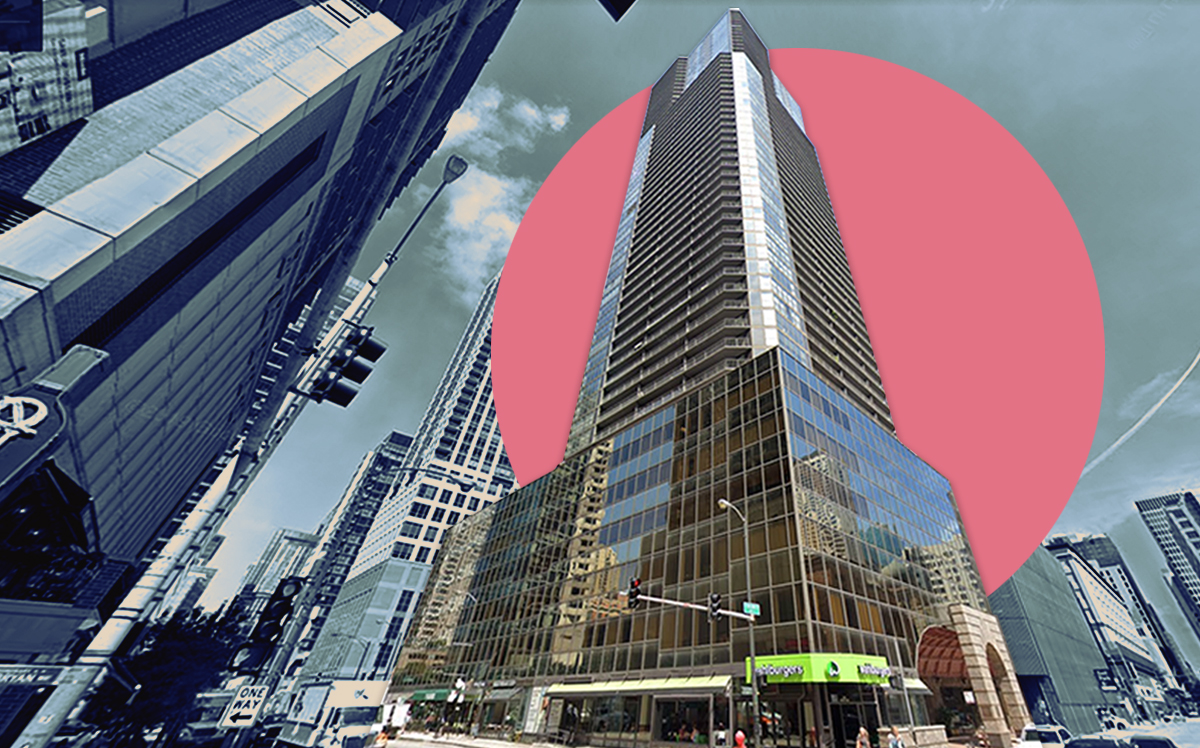

But in the end, enough owners of the 467-unit River North tower balked at the planned $188 million bulk sale, and it was rejected in a Tuesday night vote, according to Crain’s. That followed an appellate court decision earlier in the day, which refused a request from condo owners of the 10 E. Ontario St. complex who opposed the sale to block the planned vote.

Strategic Properties of North America hoped to continue its string of deconversion-focused acquisitions, seizing on a still-popular — though increasingly difficult — move in Chicago. In March, the company bought a 309-unit condo tower in Streeterville. And in 2018, it paid $78 million for a 268-unit tower in Lincoln Park, making it at the time the most expensive condo deconversion in city history.

But deconversions in Chicago have become tougher after the city passed a rule that requires 85 percent of a building’s condo owners to approve a bulk sale, up from 75 percent. After that, the suburbs saw a modest uptick in deconversions and interest from investors.

For the latest deal-that-wasn’t, about 73 percent of owners of the 51-story Ontario Place complex approved the sale, according to Crain’s. About 22 percent rejected it and the rest didn’t vote. New Jersey-based Strategic Properties could put in a higher bid or throw in the towel, according to the report.

The most expensive deconversion in Chicago history remains ESG Kullen’s $107 million purchase of the 391-unit building at 1400 North Lake Shore Drive. The controversial deal — condo owners voted to move forward in 2018 but several rounds of setbacks — closed in late January. [Crain’s] — Alexi Friedman