Before Crate & Barrel vacated its flagship store on the Magnificent Mile, the landlord and leasing team considered a piecemeal strategy for the five-story, glass-ensconced building: chopping up the space to house multiple tenants.

Starbucks’ roastery at 646 Michigan Avenue (Credit: Starbucks)

Instead, it landed a retail whale. In fact, Starbucks’ commitment to take all 46,000 square feet for an experimental roastery and cocktail bar is an absolute outlier in the market – it’s easily the biggest flagship lease deal to take place on the Mag Mile in recent years, dwarfing Apple’s deal for 20,000 square feet at 401 N. Michigan Avenue in 2017. Brokers in Chicago told The Real Deal they couldn’t think of a comparable deal in the last decade.

CBRE broker Todd Siegel

The leasing team considers itself “extremely” lucky to find a single company that had the vision and ambition to occupy the entire building at 646 N. Michigan Avenue, said CBRE broker Todd Siegel, who was tapped by the landlord, Crate & Barrel founder Gordon Segal.

“But in this business, you only need one and we were fortunate enough that we were partnering with a world-class brand,” said Siegel.

For virtually every other landlord on the Mag Mile, trying to find a well-capitalized tenant with the financial means and interest in a massive block of retail space is a fool’s errand. Due to a confluence of larger market forces, landlords can no longer rely on a department store or global retailer who believes the brand value of a flagship store is worth the enormous costs — often over $1 million per year in rent.

Instead, most landlords on North Michigan Avenue are demising their blocks of space, pursuing tenants who they believe are better positioned to weather market pressures created by e-commerce and shifting consumer habits.

Solving a retail puzzle

The process of shrinking large, contiguous blocks of space for a smattering of tenants is expensive, time-consuming and challenging, but it’s still better than letting good space sit empty.

“It’s like solving a vertical jigsaw puzzle,” Siegel said.

I think that [large block vacancies] is being driven by the sheer occupancy costs that come with being a 40,000- to 50,000-square-foot tenant on a street like Madison, Fifth, Michigan, Rodeo, etc, — CBRE broker Todd Siegel

His biggest challenge is quickly finding tenants for the cheaper space above or below ground level, minimizing the landlord’s exposure while they wait for a top-dollar tenant.

“We don’t necessarily want to lease the filet of the asset before we’ve solved for those other pieces of the greater space,” Siegel said.

CBRE is currently working with Golub & Company and CIM on the Tribune Tower redevelopment by repositioning about 50,000 square feet of ground-floor retail space into 1,000- to 2,000-square-foot components.

Even with rents on storefront spaces in the Mag Mile dropping from roughly $550 a square foot in 2017 to about $350 a square foot in 2019, finding a single tenant to scoop up a large block of space is rare.

Most tenants are looking at under 5,000 square feet, or between 10,000 and 15,000 square feet, said Siegel.

“I think that a lot of that is being driven by the sheer occupancy costs that come with being a 40,000- to 50,000-square-foot tenant on a street like Madison, Fifth, Michigan, Rodeo, etc,” he said.

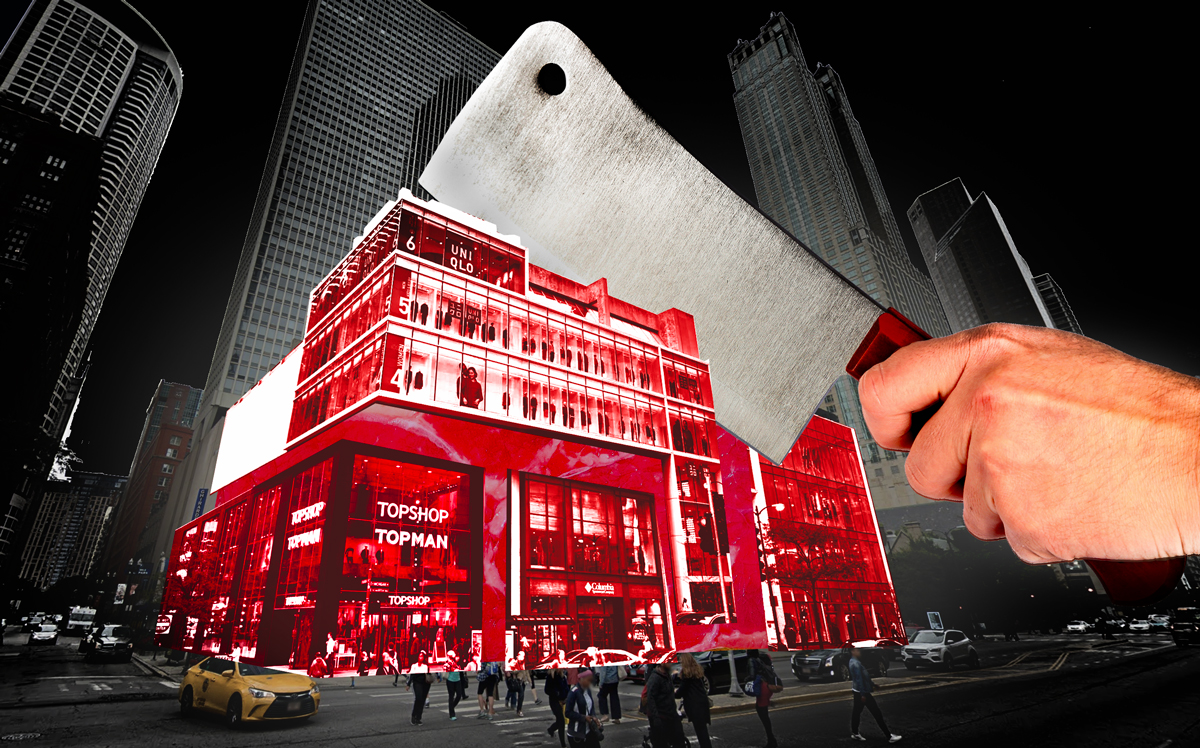

Landlords with multi-tenancy plans for vacant storefronts include: Acadia Realty Trust in the old Saks Fifth Avenue men’s store at 717 N. Michigan Avenue, Macerich in the old Forever 21 store at 540 N. Michigan Avenue, and Brookfield Properties in the old Topshop store at 830 N. Michigan Avenue.

Variety pack

Nike at 669 Michigan Avenue (Credit: Google Maps)

The space breakup along North Michigan Avenue has provided opportunity for retailers that in another lifetime would have never considered a storefront on the strip. It’s also led to a game of musical chairs among existing tenants.

“We see a lot of bustle around potential relocations of existing tenants that are on the avenue today, that are having success, that have no aspirations of leaving the street, but maybe moving within the street to rightsize and to take advantage of what is a favorable tenant market today,” Siegel said.

There’s been a shift away from apparel and high fashion, with the concentration leaving the Mag Mile and moving to the Oak Street, Rush Street and Walton Street areas, and more cell phone retailers taking prominent locations on the strip, said Newmark Knight Frank’s James Schutter, who specializes in Chicago retail.

A Roots storefront (Credit: Wikipedia)

“The change in tenants is a great example of how retail is changing and what is successful in today’s environment,” he said.

About a year ago, two significant apparel retailers — Forever 21 and Tommy Bahama — moved out of 540 North Michigan Avenue and 664 North Michigan Avenue, respectively.

Stone Real Estate retail broker John Vance

But in late May, Roots moved into a two-story space across the street, which was significant because it involved an out-of-country apparel brand leasing 11,000 square feet in a longtime vacancy, said Stone Real Estate retail broker John Vance, who served as the tenants’ broker.

A new flagship experience

With a lease about to expire, Best Buy in late 2019 elected to shutter its biggest store in Chicago, a two-level space at Hearns’ 875 North Michigan Avenue, formerly known as the John Hancock Center. In defending the closure, the consumer electronics retailer said the rent was higher than many of its stores in Manhattan.

875 North Michigan Avenue (Credit: Wikipedia)

Even when factoring store revenue, the numbers just didn’t pencil out. And that’s true of a lot of retailers who are banking on e-commerce to make up for in-store sales.

“What I think we’re seeing is that retail is reinventing what the flagship experience looks like,” Siegel said. “So, if 20 years ago, the only method with which to sell one’s goods was through a single brick-and-mortar store, the retailer recognized that store had to be of a certain size to hold product. Today, that retailer that has figured out how to utilize both a brick-and-mortar presence and an omnichannel presence can shrink the footprint of that store and change the type of offering in that store, so they can create a really immersive experience.”

The Best Buy closure added another 35,000 square feet of space to the overall vacancy on the Mag Mile, which already included 30,000 square feet of vacant space in the former Apple flagship store at 679 North Michigan Avenue.

Earlier in 2019, there was approximately 3.3 million square feet of retail space on the Mag Mile, including 2.2 million square feet of specialty stores and about 1.1 million square feet of department stores. It’s likely grown since then. Of the 2.2 million square feet of specialty stores, almost 248,000 square feet, or 11 percent, was vacant at the end of July, up from 9.9 percent in 2017, according to CBRE.

Mozzarella Store Pizza & Caffe at 822 North Michigan Avenue (Credit: Facebook)

A new type of tenant is starting to fill the void: eateries. Lou Malnati’s recently opened a new location inside the Wrigley Building at 410 North Michigan Avenue and the Mozzarella Store Pizza & Caffe opened this summer in the bilevel space formerly occupied by Hershey’s Chocolate World at 822 North Michigan Avenue.

Vance said experiential offerings like Starbucks’ roastery help to build brand loyalty and attract and retain customers.

“You need those hospitality, tourist-driven attractions,” Vance said. “It’s very important for this town. Tourism is important to Chicago.”