Operators of the state’s largest data centers will see major tax breaks under a statewide measure to boost Illinois’ tech infrastructure.

The incentives, which were slipped last-minute into the state’s $45 billion capital spending plan over the weekend, cross off a wish list item for business groups who say the state has been losing out on new data center capacity to other parts of the country with heavier benefits.

Unlike most other industrial projects, data centers need massive amounts of electricity to power the servers that store their client companies’ data, plus refrigeration systems to keep them from overheating. The new measure exempts data center owners and their tenants from paying sales taxes on all kinds of equipment, from servers and computer processors to cooling racks and plumbing supplies.

“Sales tax is everything for data centers, because of how often they need to refresh,” said Tyler Diers, a lobbyist for the Illinois Chamber of Commerce who advocated for the measure. “Just like you and I update our phone every two years, they’re updating their equipment constantly.”

The Chicago region is home to the country’s third-largest network of data centers behind Dallas/Fort Worth and Northern Virginia, and its growth hasn’t let up. More than 42,000 square feet of new data centers were under construction earlier this year, set to bring the state’s total capacity to nearly 600 Megawatts, according to a recent report from JLL.

But business groups have argued a nudge from Springfield would make the local industry grow even faster. The chamber issued a 42-page report last year pointing to major data center campuses under construction in Iowa and Indiana, which are among the 30 states that have created their own tax incentives.

In 2017, Illinois’ data center industry accounted for some 31,500 jobs and raised about $878 million in tax revenue, according to the chamber.

“There’s no reason we reason we should be losing out on this business to rural Iowa,” Diers said. “Rural Illinois has been left out of the tech economy, and now it’s going to get a shot at participating.”

The Illinois State Senate approved the sales tax break bill May 1, but the measure was “bottled up” in the House, Diers said.

But Friday evening, hours before the scheduled end of the legislative session, Republican leaders included the tax sweetener on a list of pro-business items they demanded in exchange for corralling their caucus behind a proposed state budget. Democrats in the supermajority agreed, slipping the measure into the $4.3 billion capital spending plan for state facilities like hospitals and prisons. The bill now heads to Gov. J.B. Pritzker for his signature.

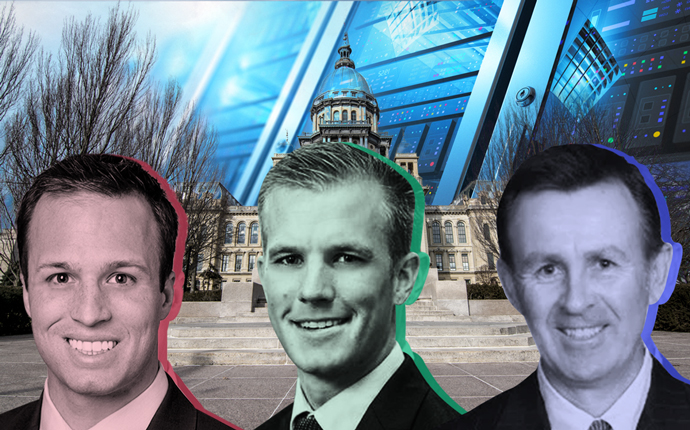

Out-of-state data center developers noticed right away, according to Andy Cvengros, who oversees Midwest data center services for JLL. Cvengros started getting phone calls over the weekend, “basically saying, ‘Show me all your available properties,’” he said.

“Chicago has always been an attractive data center location, but over the last couple years we’ve seen businesses choose other markets because of the incentives that are in place,” Cvengros said. “So we’re excited to be on a level playing field again.”

In order to qualify for the tax breaks, data center owners and tenants must show they’ve collectively tallied at least $250 million in capital expenses within a five-year period. They also have to employ 20 or more full-time unionized workers, and pay them at least 125 percent of the median income in whichever county the data center operates.

Finally, each data center would need proof that it meets a “green building standard” like LEED or Energy Star.

An extra measure, added at the urging of state Rep. Elgie Sims (D-Chicago), would give a 20 percent income tax break to developers who build new data centers in high-poverty parts of the state.

The suite of incentives is scheduled to sunset after 10 years, but the General Assembly will have the option to renew it.

The sweeteners will be a boon to companies like California-based ServerFarm, which is working on adding capacity inside its 134,000-square-foot data center at 840 South Canal Street in Chicago. Tax breaks will allow the company to speed up the expansion, according to A.J. Matel, the company’s vice president of sales.

“Every budget has a fixed budget on how much capital they can outlay for expenses,” Matel said. “So if I can suddenly spend more in Illinois, why wouldn’t I?”