Fritz Kaegi’s win in the Democratic primary for Cook County assessor this spring over incumbent Joe Berrios not only surprised party leadership but has also gotten the attention of owners of large properties.

In the leadup to the March election, Berrios was criticized over how he assessed — or rather, undervalued — some large commercial properties. A Crain’s report pointed out the Willis Tower, for instance, sold for more than $1 billion yet Berrios’ office valued it at $580 million. The Aon Center sold for $712 million, yet Berrios valued it at $356 million.

With Berrios on the way out and Kaegi the presumptive replacement at this point (though Republicans can still put someone on the ballot), changes would appear to be coming. It’s just a matter of when.

Cook County properties are reassessed every three years depending on what region of the county they’re in. This year it’s Chicago’s, meaning city property owners will get one last assessment under Berrios.

Berrios spokesperson Tom Shaer said no changes are in store for the system of assessing commercial properties, which was criticized before the election for focusing more on a buildings’ income instead of recent sales prices.

Next year, properties in the northern townships will be reassessed under a new administration, with the southern townships to follow in 2020. It won’t be until 2021 that the city of Chicago sees its property assessed under a new assessor.

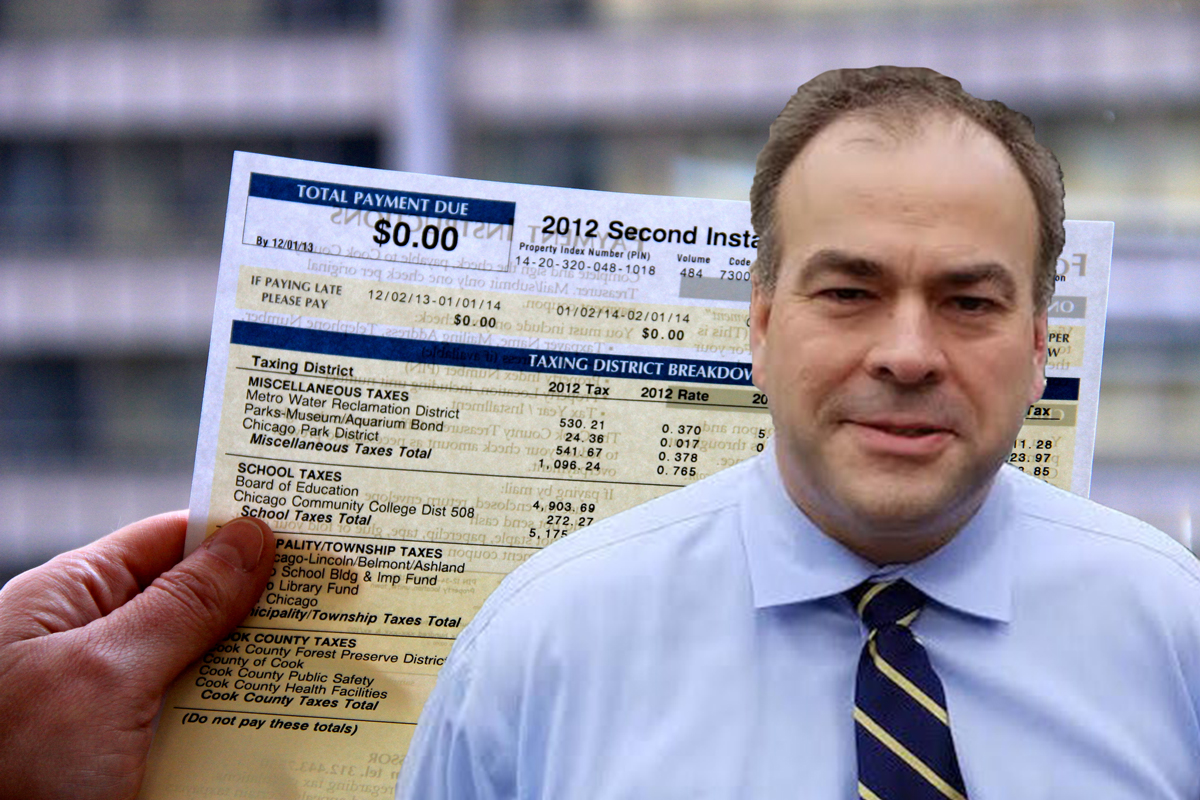

In 2016, large office buildings in Chicago had a median property tax bill of $2.9 million, according to a study commissioned by the Building Owners and Managers Association of Chicago (BOMA). That’s already an increase of more than $500,000 per building compared to 2012.

Higher assessments buildings are unlikely to be phased in.

The assessor’s office has no mechanism to phase in changes, said UIC political science professor and former Chicago alderman Dick Simpson. So any change in an assessment system would have an immediate effect on that year’s valuations.

Additionally, implementing a new assessment system is relatively easy, one consultant said.

“We shouldn’t imagine it’s going to take years to fix. It’s not that complicated,” said Robert Weissbourd, president of RW Ventures, a consulting firm that has worked with Berrios and former assessor James Houlihan.

“I don’t want to say there’s no data obstacle,” Weissbourd said. “If you want to get the commercial [assessments] perfect you’d need more staff and you’d need to spend more time, particularly the first time around. But you could do much better than you’re doing now without a significant amount of work, because there’s a lot of publicly available, simple data.”

But fine-tuning might take a while, according to Larry Clark, director of strategic initiatives for the International Association of Assessing Officers. Cook County is an especially large jurisdiction and the resources needed to collect detailed data would be substantial.

Another wildcard is the political situation.

In the primary, Kaegi did not receive support from many major Democratic political players. Cook County Board president Toni Preckwinkle, Illinois Speaker of the House Mike Madigan, eventual gubernatorial nominee J.B. Pritzker and Chicago Mayor Rahm Emanuel all supported Berrios.

Should he prevail in the general election, Kaegi would have complete control in overhauling the assessment process, Simpson said. But he will have no control over possible legislative changes related to assessments, nor over the decisions made by the Cook County Board of Review. It is an additional, independent office to which property owners — commercial, industrial and residential — can appeal their taxes.

Kaegi, who did not respond to multiple requests for interviews, ran on promises of openness and transparency.

“One of the first things that can be done is making clear how [the assessor’s office] is assessing the properties so people can more clearly engage in making it fair. Transparency is easy and it doesn’t take a lot of time,” Weissbourd said.

Transparent assessment valuations may save building owners money by reducing the need for (and therefore cost of) appeals. Currently, more than 70 percent of commercial and industrial assessments are appealed with the assessor’s office, according to a ProPublica/Chicago Tribune study. That far exceeds industry standards and spurs its own legal industry.

Between 2011 and 2016, the 10 legal firms with the most activity with the assessor appealed $42.1 billion in assessed value, receiving a total reduction of assessed value of about $9.2 billion for their clients, according to the ProPublica-Tribune study. Illinois Speaker Mike Madigan’s firm, Madigan & Getzendanner, appealed $8.6 billion in assessed value alone.

Clarity and transparency would make assessments less subject to changes upon appeal, barring extraordinary circumstances, Weissbourd said.

“This has been a system that’s hugely opaque and that has not served anyone, including [building] owners and developers,” he said.